- India

- /

- Healthcare Services

- /

- NSEI:YATHARTH

Yatharth Hospital & Trauma Care Services Limited's (NSE:YATHARTH) 25% Price Boost Is Out Of Tune With Earnings

Yatharth Hospital & Trauma Care Services Limited (NSE:YATHARTH) shareholders have had their patience rewarded with a 25% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 48%.

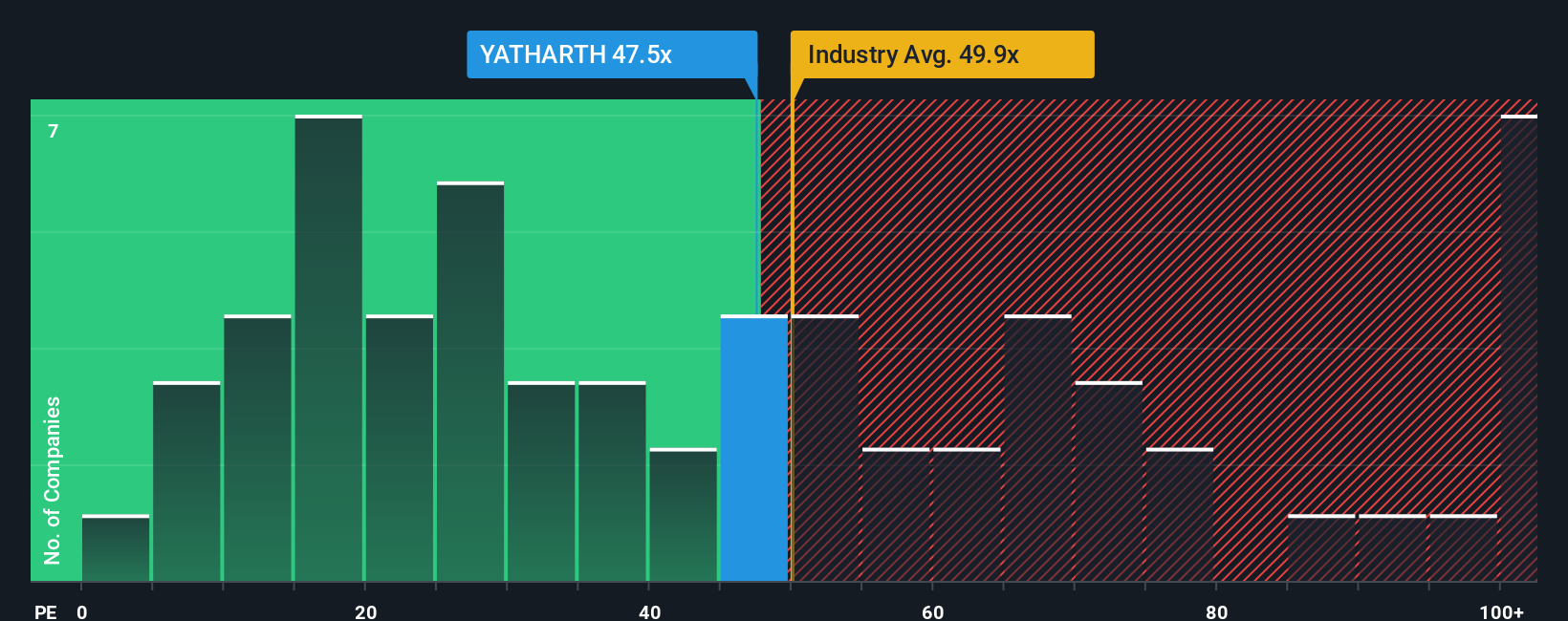

After such a large jump in price, Yatharth Hospital & Trauma Care Services' price-to-earnings (or "P/E") ratio of 47.5x might make it look like a strong sell right now compared to the market in India, where around half of the companies have P/E ratios below 30x and even P/E's below 16x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's inferior to most other companies of late, Yatharth Hospital & Trauma Care Services has been relatively sluggish. One possibility is that the P/E is high because investors think this lacklustre earnings performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

Check out our latest analysis for Yatharth Hospital & Trauma Care Services

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Yatharth Hospital & Trauma Care Services would need to produce outstanding growth well in excess of the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. Still, the latest three year period has seen an excellent 101% overall rise in EPS, in spite of its uninspiring short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 24% over the next year. That's shaping up to be similar to the 24% growth forecast for the broader market.

With this information, we find it interesting that Yatharth Hospital & Trauma Care Services is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Bottom Line On Yatharth Hospital & Trauma Care Services' P/E

The strong share price surge has got Yatharth Hospital & Trauma Care Services' P/E rushing to great heights as well. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Yatharth Hospital & Trauma Care Services currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Plus, you should also learn about this 1 warning sign we've spotted with Yatharth Hospital & Trauma Care Services.

If you're unsure about the strength of Yatharth Hospital & Trauma Care Services' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:YATHARTH

Yatharth Hospital & Trauma Care Services

Owns and operates super-specialty hospitals in Delhi and Madhya Pradesh.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives