- India

- /

- Healthcare Services

- /

- NSEI:VIJAYA

Vijaya Diagnostic Centre Limited's (NSE:VIJAYA) Shares May Have Run Too Fast Too Soon

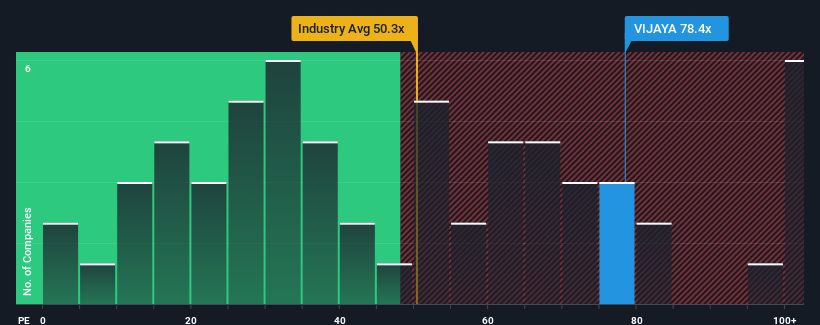

With a price-to-earnings (or "P/E") ratio of 78.4x Vijaya Diagnostic Centre Limited (NSE:VIJAYA) may be sending very bearish signals at the moment, given that almost half of all companies in India have P/E ratios under 34x and even P/E's lower than 19x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Vijaya Diagnostic Centre certainly has been doing a good job lately as it's been growing earnings more than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Vijaya Diagnostic Centre

How Is Vijaya Diagnostic Centre's Growth Trending?

In order to justify its P/E ratio, Vijaya Diagnostic Centre would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered an exceptional 32% gain to the company's bottom line. The latest three year period has also seen a 20% overall rise in EPS, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 22% each year over the next three years. With the market predicted to deliver 20% growth per year, the company is positioned for a comparable earnings result.

With this information, we find it interesting that Vijaya Diagnostic Centre is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

What We Can Learn From Vijaya Diagnostic Centre's P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Vijaya Diagnostic Centre currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Vijaya Diagnostic Centre with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Vijaya Diagnostic Centre's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:VIJAYA

Vijaya Diagnostic Centre

Provides diagnostic services for patients in India.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.