- India

- /

- Healthcare Services

- /

- NSEI:THYROCARE

Why It Might Not Make Sense To Buy Thyrocare Technologies Limited (NSE:THYROCARE) For Its Upcoming Dividend

Readers hoping to buy Thyrocare Technologies Limited (NSE:THYROCARE) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. The ex-dividend date is usually set to be two business days before the record date, which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. Accordingly, Thyrocare Technologies investors that purchase the stock on or after the 25th of July will not receive the dividend, which will be paid on the 30th of August.

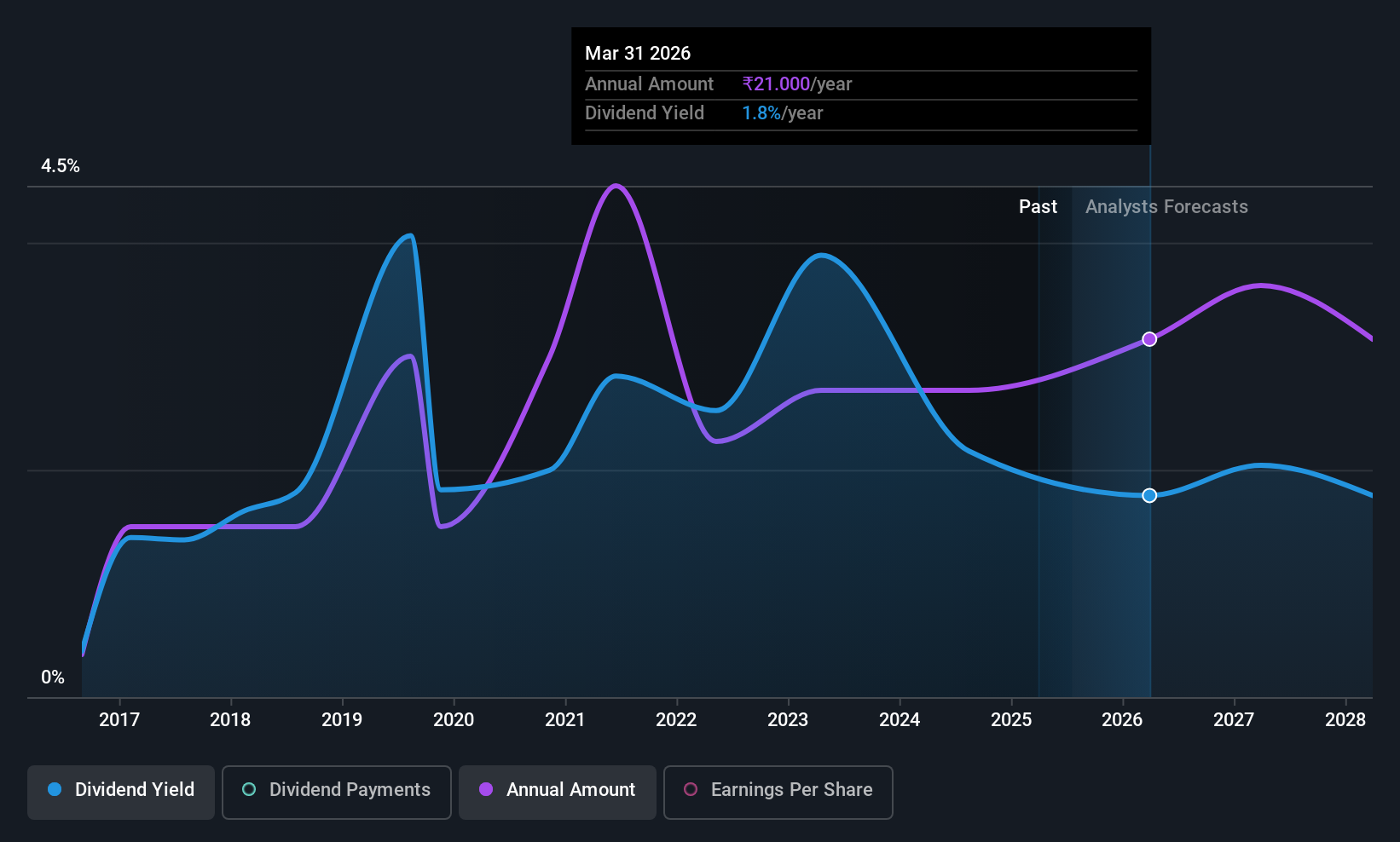

The company's next dividend payment will be ₹21.00 per share, and in the last 12 months, the company paid a total of ₹21.00 per share. Last year's total dividend payments show that Thyrocare Technologies has a trailing yield of 1.8% on the current share price of ₹1184.35. If you buy this business for its dividend, you should have an idea of whether Thyrocare Technologies's dividend is reliable and sustainable. So we need to investigate whether Thyrocare Technologies can afford its dividend, and if the dividend could grow.

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Thyrocare Technologies paid out 122% of profit in the past year, which we think is typically not sustainable unless there are mitigating characteristics such as unusually strong cash flow or a large cash balance. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. It paid out more than half (65%) of its free cash flow in the past year, which is within an average range for most companies.

It's good to see that while Thyrocare Technologies's dividends were not covered by profits, at least they are affordable from a cash perspective. If executives were to continue paying more in dividends than the company reported in profits, we'd view this as a warning sign. Very few companies are able to sustainably pay dividends larger than their reported earnings.

Check out our latest analysis for Thyrocare Technologies

Click here to see how much of its profit Thyrocare Technologies paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies that aren't growing their earnings can still be valuable, but it is even more important to assess the sustainability of the dividend if it looks like the company will struggle to grow. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. That explains why we're not overly excited about Thyrocare Technologies's flat earnings over the past five years. It's better than seeing them drop, certainly, but over the long term, all of the best dividend stocks are able to meaningfully grow their earnings per share.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In the past nine years, Thyrocare Technologies has increased its dividend at approximately 27% a year on average.

Final Takeaway

Has Thyrocare Technologies got what it takes to maintain its dividend payments? Flat earnings per share and a high payout ratio are not what we like to see, although at least it paid out a lower percentage of its free cash flow. Bottom line: Thyrocare Technologies has some unfortunate characteristics that we think could lead to sub-optimal outcomes for dividend investors.

With that being said, if you're still considering Thyrocare Technologies as an investment, you'll find it beneficial to know what risks this stock is facing. Be aware that Thyrocare Technologies is showing 2 warning signs in our investment analysis, and 1 of those shouldn't be ignored...

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Thyrocare Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:THYROCARE

Thyrocare Technologies

Provides diagnostic testing services to patients, laboratories, and hospitals in India.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion