- India

- /

- Healthcare Services

- /

- NSEI:METROPOLIS

3 Growth Stocks With High Insider Ownership To Watch

Reviewed by Simply Wall St

In a week marked by a flurry of earnings reports and mixed economic signals, global markets have shown some volatility, with major U.S. indexes like the Nasdaq Composite and S&P MidCap 400 reaching record highs before retreating. Amidst this backdrop, growth stocks have generally underperformed compared to value shares, highlighting the importance of identifying companies with strong fundamentals and high insider ownership as potential indicators of confidence in future performance.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 33% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's uncover some gems from our specialized screener.

Mrs. Bectors Food Specialities (NSEI:BECTORFOOD)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mrs. Bectors Food Specialities Limited manufactures and distributes various food products in India, with a market cap of ₹110.75 billion.

Operations: The company generates revenue of ₹16.89 billion from its food products segment in India.

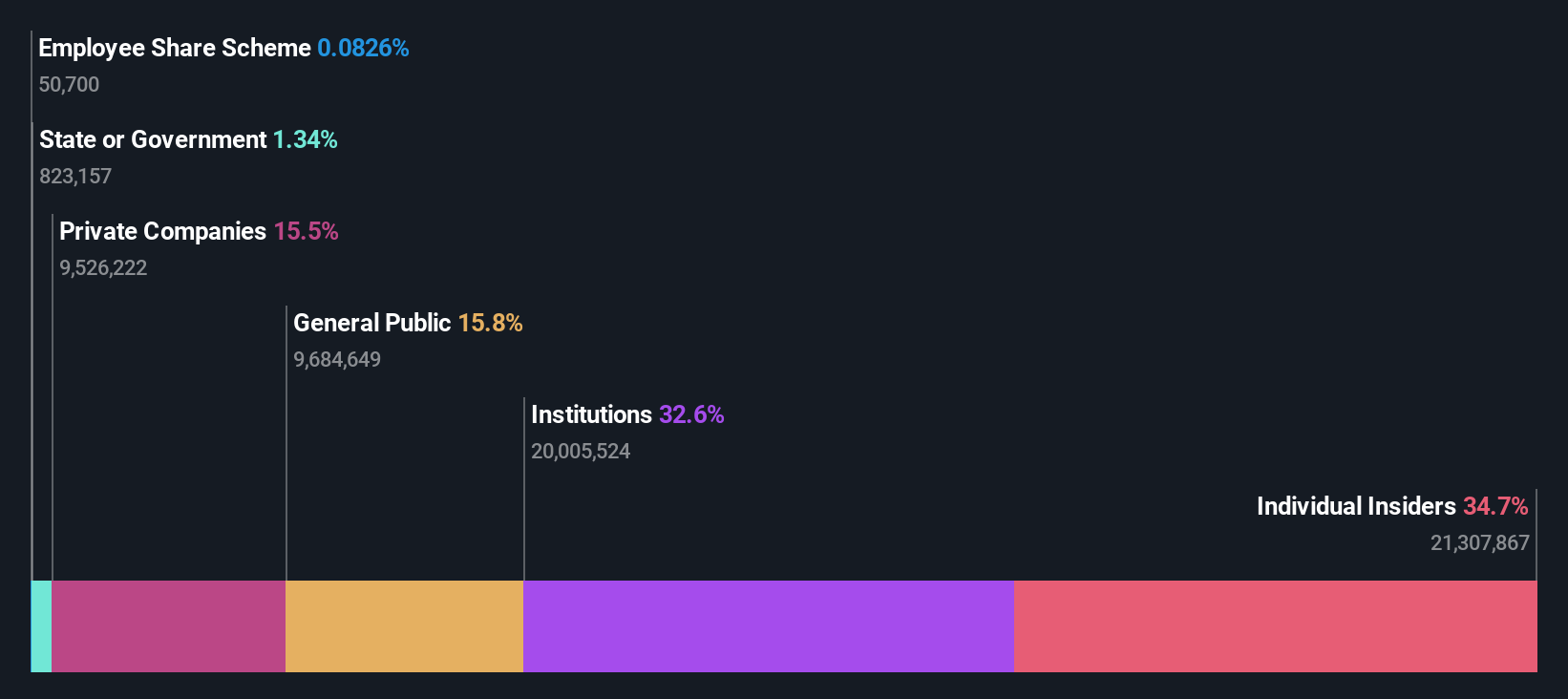

Insider Ownership: 34.7%

Mrs. Bectors Food Specialities shows potential as a growth company with high insider ownership, despite recent shareholder dilution through a follow-on equity offering of INR 4 billion. The company's earnings are expected to grow significantly at over 20% annually, outpacing the Indian market's average. While insider buying has surpassed selling in recent months, substantial non-cash earnings and changes in auditors may require careful monitoring by investors seeking long-term growth opportunities.

- Navigate through the intricacies of Mrs. Bectors Food Specialities with our comprehensive analyst estimates report here.

- The analysis detailed in our Mrs. Bectors Food Specialities valuation report hints at an inflated share price compared to its estimated value.

Metropolis Healthcare (NSEI:METROPOLIS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Metropolis Healthcare Limited offers diagnostic services both in India and internationally, with a market cap of ₹110.18 billion.

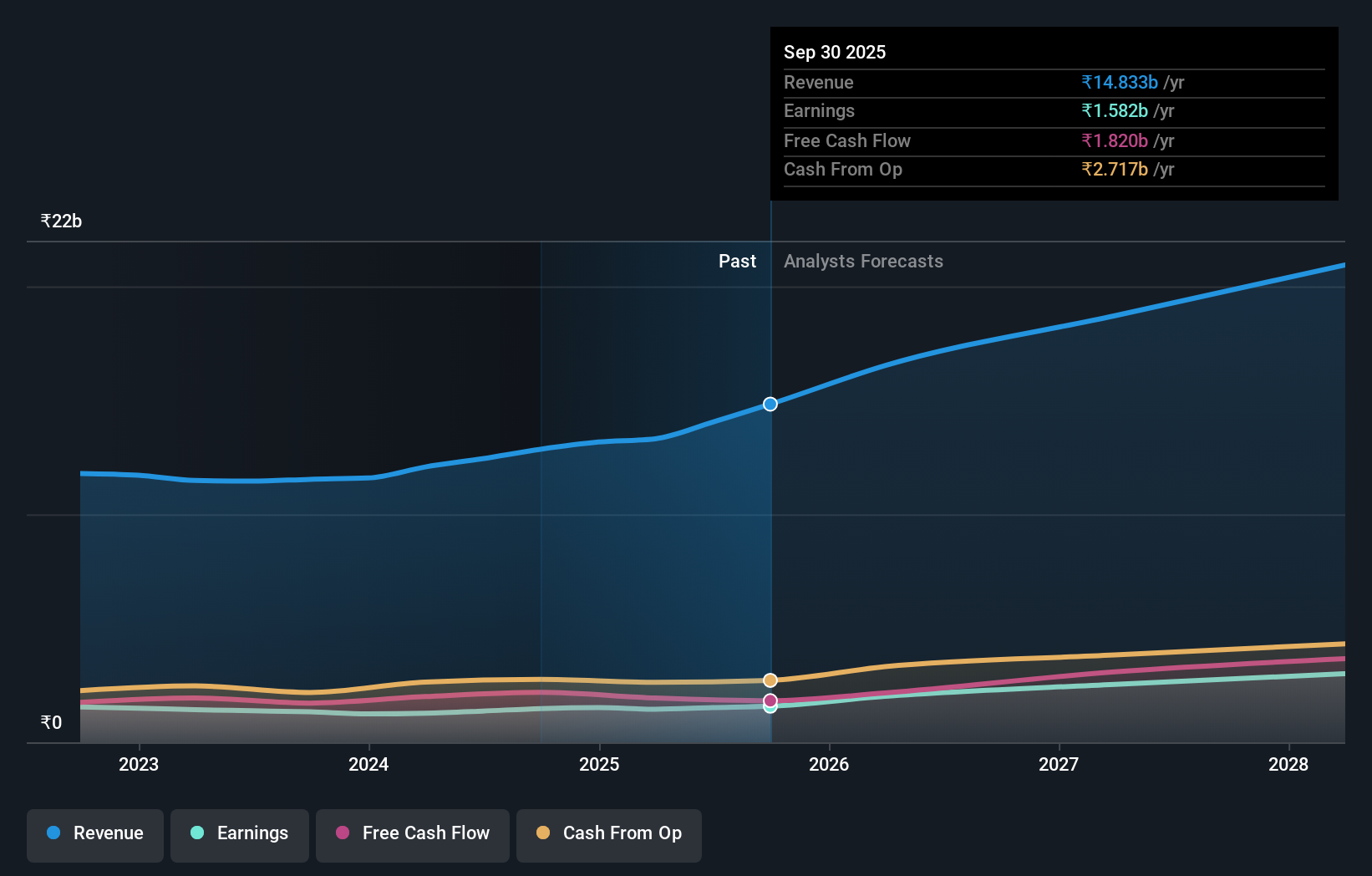

Operations: The company's revenue is primarily derived from its Pathology Service segment, which generated ₹12.44 billion.

Insider Ownership: 18.8%

Metropolis Healthcare's earnings are forecast to grow significantly at 23.1% annually, surpassing the Indian market average. However, notable insider selling has occurred recently without substantial insider buying, which might concern some investors. Recent executive changes include a new Chief Information Officer and the resignation of the CFO. The company aims for 13-15% revenue growth in 2025, driven by volume increases and product mix enhancements to boost revenue per patient.

- Delve into the full analysis future growth report here for a deeper understanding of Metropolis Healthcare.

- In light of our recent valuation report, it seems possible that Metropolis Healthcare is trading beyond its estimated value.

R Systems International (NSEI:RSYSTEMS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: R Systems International Limited is a digital product engineering company that designs and builds chip-to-cloud software products and platforms, with a market cap of ₹59.41 billion.

Operations: The company generates revenue from Information Technology Services amounting to ₹15.53 billion and Business Process Outsourcing Services totaling ₹1.76 billion.

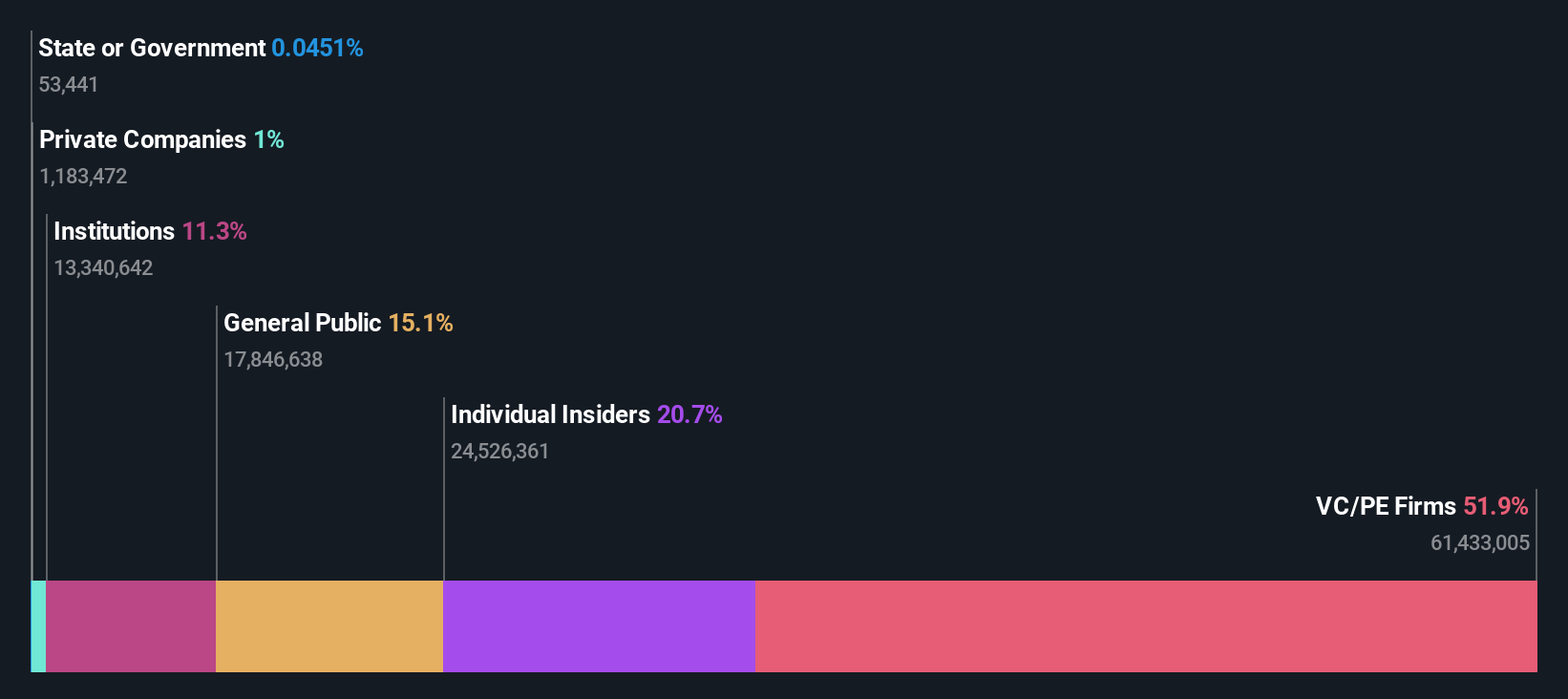

Insider Ownership: 20.6%

R Systems International is experiencing steady growth, with earnings forecasted to rise 19.1% annually, outpacing the Indian market. Recent executive appointments in technology and HR aim to bolster strategic capabilities. The launch of OptimaAI Suite underscores its commitment to digital transformation and innovation across industries. Despite a less stable dividend history, R Systems' revenue is projected to grow 12% per year, faster than the broader market's 10.3%. No significant insider trading activity has been reported recently.

- Dive into the specifics of R Systems International here with our thorough growth forecast report.

- According our valuation report, there's an indication that R Systems International's share price might be on the expensive side.

Turning Ideas Into Actions

- Click here to access our complete index of 1528 Fast Growing Companies With High Insider Ownership.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:METROPOLIS

Metropolis Healthcare

Provides pathology and related healthcare services in India, Africa, South Asia, the Middle East, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives