- India

- /

- Healthcare Services

- /

- NSEI:HCG

Pinning Down HealthCare Global Enterprises Limited's (NSE:HCG) P/S Is Difficult Right Now

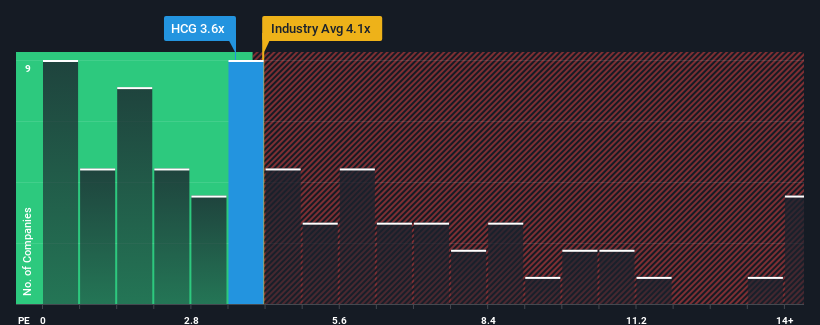

There wouldn't be many who think HealthCare Global Enterprises Limited's (NSE:HCG) price-to-sales (or "P/S") ratio of 3.6x is worth a mention when the median P/S for the Healthcare industry in India is similar at about 4.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for HealthCare Global Enterprises

How Has HealthCare Global Enterprises Performed Recently?

Recent revenue growth for HealthCare Global Enterprises has been in line with the industry. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. Those who are bullish on HealthCare Global Enterprises will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

Want the full picture on analyst estimates for the company? Then our free report on HealthCare Global Enterprises will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, HealthCare Global Enterprises would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. Pleasingly, revenue has also lifted 64% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 18% during the coming year according to the nine analysts following the company. With the industry predicted to deliver 27% growth, the company is positioned for a weaker revenue result.

In light of this, it's curious that HealthCare Global Enterprises' P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Given that HealthCare Global Enterprises' revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

You should always think about risks. Case in point, we've spotted 1 warning sign for HealthCare Global Enterprises you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if HealthCare Global Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HCG

HealthCare Global Enterprises

Provides medical and healthcare services focusing on cancer and fertility in India and internationally.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives