- India

- /

- Healthcare Services

- /

- NSEI:GPTHEALTH

Why Investors Shouldn't Be Surprised By GPT Healthcare Limited's (NSE:GPTHEALTH) 26% Share Price Surge

GPT Healthcare Limited (NSE:GPTHEALTH) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

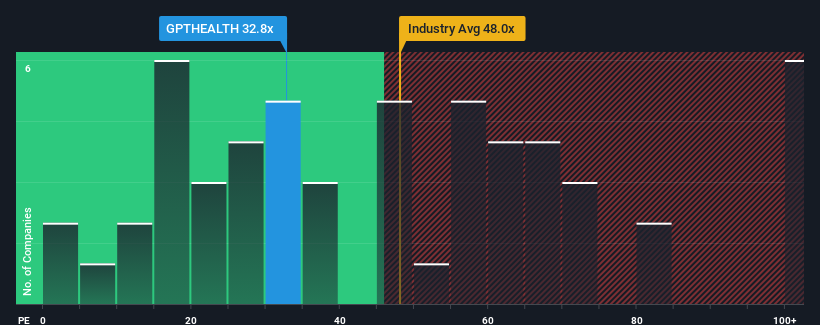

Even after such a large jump in price, there still wouldn't be many who think GPT Healthcare's price-to-earnings (or "P/E") ratio of 32.8x is worth a mention when the median P/E in India is similar at about 35x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

There hasn't been much to differentiate GPT Healthcare's and the market's earnings growth lately. It seems that many are expecting the mediocre earnings performance to persist, which has held the P/E back. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

See our latest analysis for GPT Healthcare

Is There Some Growth For GPT Healthcare?

There's an inherent assumption that a company should be matching the market for P/E ratios like GPT Healthcare's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 22% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 121% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 20% each year during the coming three years according to the only analyst following the company. That's shaping up to be similar to the 21% per year growth forecast for the broader market.

With this information, we can see why GPT Healthcare is trading at a fairly similar P/E to the market. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

GPT Healthcare appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of GPT Healthcare's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

It is also worth noting that we have found 1 warning sign for GPT Healthcare that you need to take into consideration.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:GPTHEALTH

GPT Healthcare

Owns and operates a chain of multispecialty hospitals under the ILS Hospitals brand name in India.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives