- India

- /

- Healthcare Services

- /

- NSEI:ASTERDM

Did You Manage To Avoid Aster DM Healthcare's (NSE:ASTERDM) 26% Share Price Drop?

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Unfortunately the Aster DM Healthcare Limited (NSE:ASTERDM) share price slid 26% over twelve months. That's well bellow the market return of 2.6%. Aster DM Healthcare may have better days ahead, of course; we've only looked at a one year period. It's down 1.7% in the last seven days.

View our latest analysis for Aster DM Healthcare

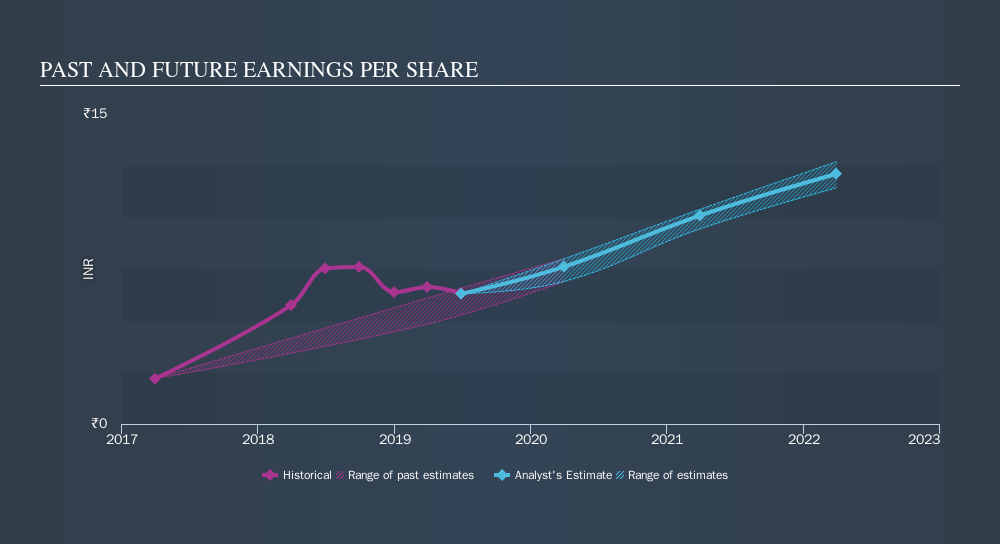

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Unhappily, Aster DM Healthcare had to report a 16% decline in EPS over the last year. The share price decline of 26% is actually more than the EPS drop. So it seems the market was too confident about the business, a year ago.

The company's earnings per share (over time) are depicted in the image below.

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

While Aster DM Healthcare shareholders are down 26% for the year, the market itself is up 2.6%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. With the stock down 3.8% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Aster DM Healthcare by clicking this link.

Aster DM Healthcare is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:ASTERDM

Aster DM Healthcare

Provides healthcare and allied services in India, the United Arab Emirates, Qatar, Oman, Kingdom of Saudi Arabia, Jordan, Kuwait and Bahrain, and Republic of Mauritius.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives