- India

- /

- Healthcare Services

- /

- NSEI:APOLLOHOSP

Is Apollo Hospitals Enterprise (NSE:APOLLOHOSP) Using Too Much Debt?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Apollo Hospitals Enterprise Limited (NSE:APOLLOHOSP) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Apollo Hospitals Enterprise

How Much Debt Does Apollo Hospitals Enterprise Carry?

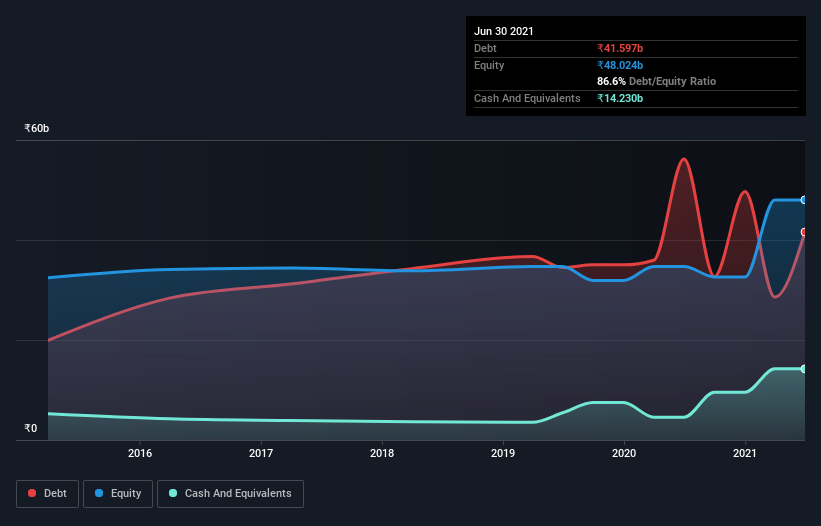

The image below, which you can click on for greater detail, shows that Apollo Hospitals Enterprise had debt of ₹41.6b at the end of March 2021, a reduction from ₹56.2b over a year. On the flip side, it has ₹14.2b in cash leading to net debt of about ₹27.4b.

How Strong Is Apollo Hospitals Enterprise's Balance Sheet?

According to the last reported balance sheet, Apollo Hospitals Enterprise had liabilities of ₹20.4b due within 12 months, and liabilities of ₹45.8b due beyond 12 months. Offsetting these obligations, it had cash of ₹14.2b as well as receivables valued at ₹14.9b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₹37.0b.

Given Apollo Hospitals Enterprise has a market capitalization of ₹718.3b, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Apollo Hospitals Enterprise has net debt worth 1.8 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 3.0 times the interest expense. While that doesn't worry us too much, it does suggest the interest payments are somewhat of a burden. Importantly, Apollo Hospitals Enterprise grew its EBIT by 71% over the last twelve months, and that growth will make it easier to handle its debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Apollo Hospitals Enterprise can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the most recent three years, Apollo Hospitals Enterprise recorded free cash flow worth 78% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

Happily, Apollo Hospitals Enterprise's impressive EBIT growth rate implies it has the upper hand on its debt. But we must concede we find its interest cover has the opposite effect. It's also worth noting that Apollo Hospitals Enterprise is in the Healthcare industry, which is often considered to be quite defensive. Zooming out, Apollo Hospitals Enterprise seems to use debt quite reasonably; and that gets the nod from us. While debt does bring risk, when used wisely it can also bring a higher return on equity. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example - Apollo Hospitals Enterprise has 4 warning signs we think you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading Apollo Hospitals Enterprise or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:APOLLOHOSP

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.