Tata Consumer Products Limited Beat Analyst Estimates: See What The Consensus Is Forecasting For This Year

Tata Consumer Products Limited (NSE:TATACONSUM) just released its second-quarter report and things are looking bullish. The company beat both earnings and revenue forecasts, with revenue of ₹28b, some 2.3% above estimates, and statutory earnings per share (EPS) coming in at ₹2.79, 21% ahead of expectations. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

Check out our latest analysis for Tata Consumer Products

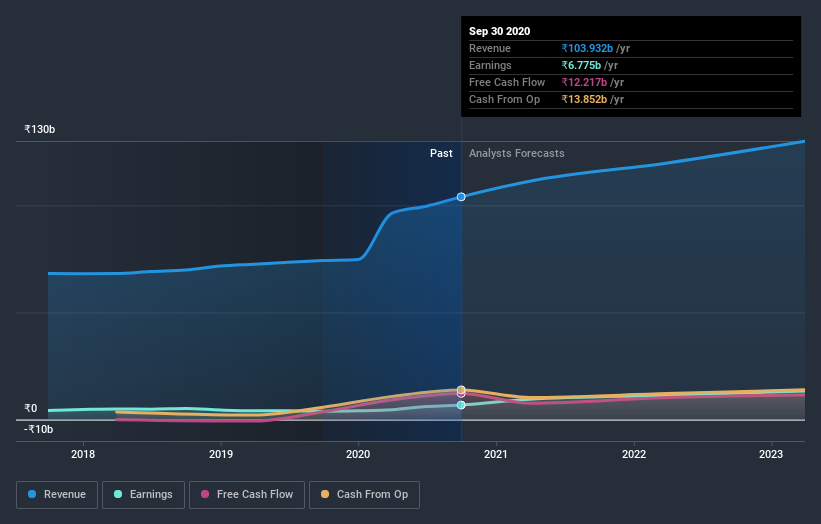

Taking into account the latest results, the most recent consensus for Tata Consumer Products from eleven analysts is for revenues of ₹111.2b in 2021 which, if met, would be an okay 7.0% increase on its sales over the past 12 months. Statutory earnings per share are predicted to leap 36% to ₹10.01. Yet prior to the latest earnings, the analysts had been anticipated revenues of ₹108.1b and earnings per share (EPS) of ₹9.08 in 2021. There's been a pretty noticeable increase in sentiment, with the analysts upgrading revenues and making a solid gain to earnings per share in particular.

It will come as no surprise to learn that the analysts have increased their price target for Tata Consumer Products 5.7% to ₹542on the back of these upgrades. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. The most optimistic Tata Consumer Products analyst has a price target of ₹640 per share, while the most pessimistic values it at ₹400. This shows there is still a bit of diversity in estimates, but analysts don't appear to be totally split on the stock as though it might be a success or failure situation.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Tata Consumer Products' past performance and to peers in the same industry. It's clear from the latest estimates that Tata Consumer Products' rate of growth is expected to accelerate meaningfully, with the forecast 7.0% revenue growth noticeably faster than its historical growth of 5.5%p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 9.1% per year. So it's clear that despite the acceleration in growth, Tata Consumer Products is expected to grow meaningfully slower than the industry average.

The Bottom Line

The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around Tata Consumer Products' earnings potential next year. Fortunately, they also upgraded their revenue estimates, although our data indicates sales are expected to perform worse than the wider industry. We note an upgrade to the price target, suggesting that the analysts believes the intrinsic value of the business is likely to improve over time.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have forecasts for Tata Consumer Products going out to 2023, and you can see them free on our platform here.

You still need to take note of risks, for example - Tata Consumer Products has 1 warning sign we think you should be aware of.

If you decide to trade Tata Consumer Products, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tata Consumer Products might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:TATACONSUM

Tata Consumer Products

Produces, distributes, and trades in food products in India, the United States, the United Kingdom, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives