We Think Some Shareholders May Hesitate To Increase Som Distilleries & Breweries Limited's (NSE:SDBL) CEO Compensation

Key Insights

- Som Distilleries & Breweries will host its Annual General Meeting on 27th of September

- Total pay for CEO Jagdish Arora includes ₹13.9m salary

- The overall pay is 62% above the industry average

- Som Distilleries & Breweries' total shareholder return over the past three years was 1,122% while its EPS grew by 108% over the past three years

Under the guidance of CEO Jagdish Arora, Som Distilleries & Breweries Limited (NSE:SDBL) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 27th of September. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

Check out our latest analysis for Som Distilleries & Breweries

Comparing Som Distilleries & Breweries Limited's CEO Compensation With The Industry

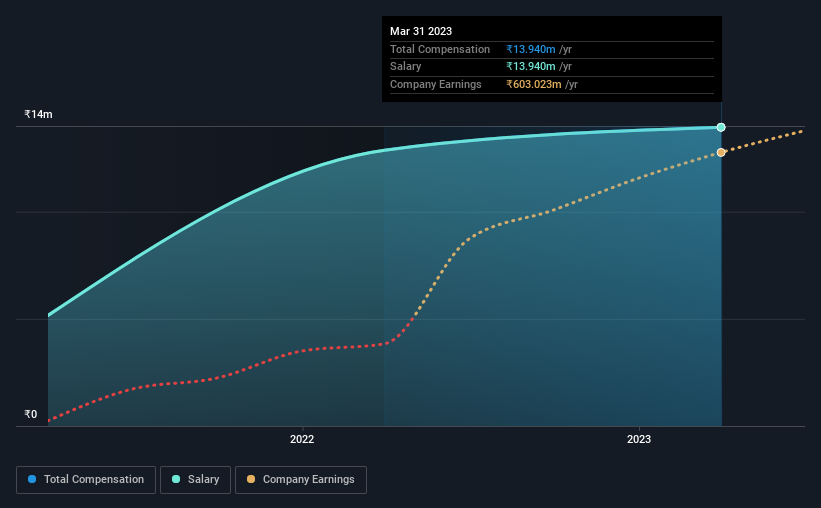

According to our data, Som Distilleries & Breweries Limited has a market capitalization of ₹25b, and paid its CEO total annual compensation worth ₹14m over the year to March 2023. We note that's an increase of 8.3% above last year. Notably, the salary of ₹14m is the entirety of the CEO compensation.

On comparing similar companies from the Indian Beverage industry with market caps ranging from ₹8.3b to ₹33b, we found that the median CEO total compensation was ₹8.6m. This suggests that Jagdish Arora is paid more than the median for the industry. Moreover, Jagdish Arora also holds ₹4.9b worth of Som Distilleries & Breweries stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | ₹14m | ₹13m | 100% |

| Other | - | - | - |

| Total Compensation | ₹14m | ₹13m | 100% |

On an industry level, roughly 83% of total compensation represents salary and 17% is other remuneration. On a company level, Som Distilleries & Breweries prefers to reward its CEO through a salary, opting not to pay Jagdish Arora through non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Som Distilleries & Breweries Limited's Growth Numbers

Over the past three years, Som Distilleries & Breweries Limited has seen its earnings per share (EPS) grow by 108% per year. Its revenue is up 64% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Som Distilleries & Breweries Limited Been A Good Investment?

Most shareholders would probably be pleased with Som Distilleries & Breweries Limited for providing a total return of 1,122% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Som Distilleries & Breweries pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 2 warning signs for Som Distilleries & Breweries you should be aware of, and 1 of them makes us a bit uncomfortable.

Switching gears from Som Distilleries & Breweries, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you're looking to trade Som Distilleries & Breweries, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SDBL

Som Distilleries & Breweries

Engages in the manufacture and sale of beer and Indian made foreign liquor in India.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives