Market Cool On Sarveshwar Foods Limited's (NSE:SARVESHWAR) Revenues Pushing Shares 30% Lower

Sarveshwar Foods Limited (NSE:SARVESHWAR) shares have had a horrible month, losing 30% after a relatively good period beforehand. Longer-term, the stock has been solid despite a difficult 30 days, gaining 12% in the last year.

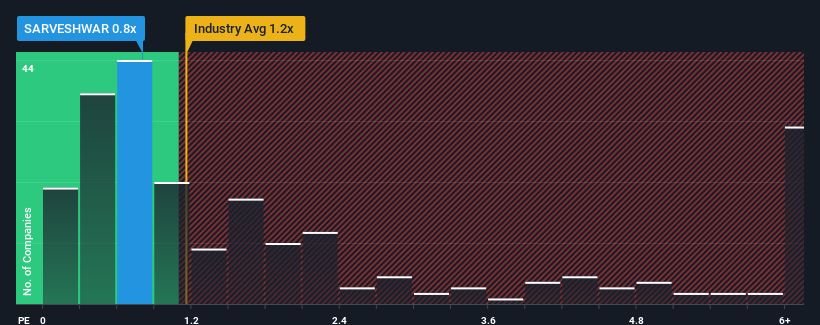

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Sarveshwar Foods' P/S ratio of 0.8x, since the median price-to-sales (or "P/S") ratio for the Food industry in India is also close to 1.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Sarveshwar Foods

What Does Sarveshwar Foods' P/S Mean For Shareholders?

Sarveshwar Foods certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. Those who are bullish on Sarveshwar Foods will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Sarveshwar Foods, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

Sarveshwar Foods' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 39% last year. The latest three year period has also seen an excellent 82% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 12% shows it's noticeably more attractive.

In light of this, it's curious that Sarveshwar Foods' P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

What Does Sarveshwar Foods' P/S Mean For Investors?

Following Sarveshwar Foods' share price tumble, its P/S is just clinging on to the industry median P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Sarveshwar Foods currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You always need to take note of risks, for example - Sarveshwar Foods has 3 warning signs we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SARVESHWAR

Sarveshwar Foods

Manufactures and sells of basmati and non basmati rice in India.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives