I Ran A Stock Scan For Earnings Growth And Radico Khaitan (NSE:RADICO) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Radico Khaitan (NSE:RADICO). While profit is not necessarily a social good, it's easy to admire a business than can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Radico Khaitan

How Quickly Is Radico Khaitan Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that Radico Khaitan has managed to grow EPS by 35% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

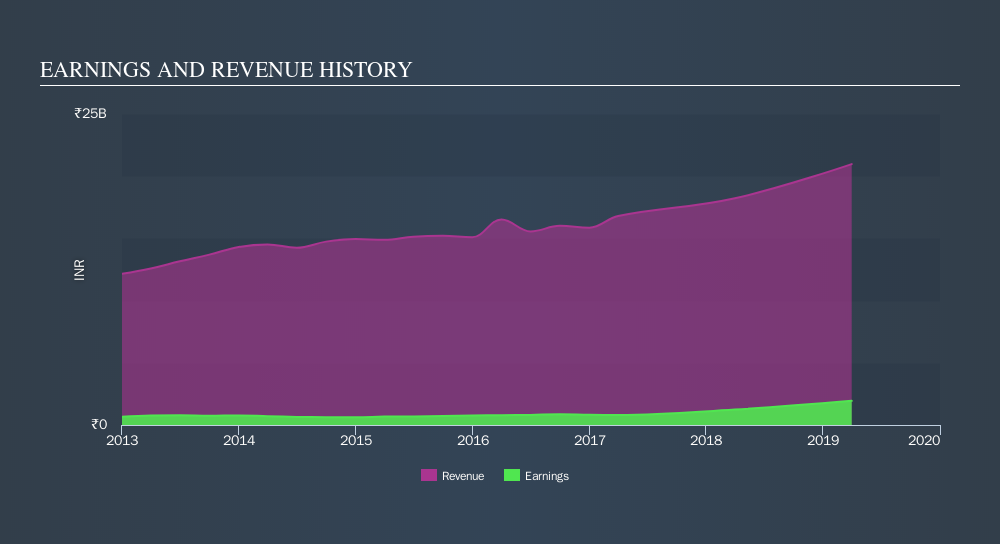

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Radico Khaitan is growing revenues, and EBIT margins improved by 2.4 percentage points to 15%, over the last year. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail check this interactive graph.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Radico Khaitan.

Are Radico Khaitan Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Radico Khaitan insiders have a significant amount of capital invested in the stock. To be specific, they have ₹1.7b worth of shares. That's a lot of money, and no small incentive to work hard. Even though that's only about 4.0% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Should You Add Radico Khaitan To Your Watchlist?

For growth investors like me, Radico Khaitan's raw rate of earnings growth is a beacon in the night. Further, the high level of insider buying impresses me, and suggests that I'm not the only one who appreciates the EPS growth. Fast growth and confident insiders should be enough to warrant further research. So the answer is that I do think this is a good stock to follow along with. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Radico Khaitan is trading on a high P/E or a low P/E, relative to its industry.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:RADICO

Radico Khaitan

Engages in the manufacture and trading of Indian made foreign liquor (IMFL) and country liquor in India, the United States, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives