Will The ROCE Trend At Ponni Sugars (Erode) (NSE:PONNIERODE) Continue?

There are a few key trends to look for if we want to identify the next multi-bagger. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. With that in mind, we've noticed some promising trends at Ponni Sugars (Erode) (NSE:PONNIERODE) so let's look a bit deeper.

Return On Capital Employed (ROCE): What is it?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Ponni Sugars (Erode), this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

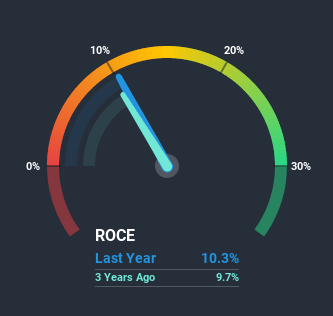

0.10 = ₹306m ÷ (₹3.4b - ₹417m) (Based on the trailing twelve months to September 2020).

So, Ponni Sugars (Erode) has an ROCE of 10%. In absolute terms, that's a pretty normal return, and it's somewhat close to the Food industry average of 12%.

See our latest analysis for Ponni Sugars (Erode)

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings, revenue and cash flow of Ponni Sugars (Erode), check out these free graphs here.

What The Trend Of ROCE Can Tell Us

The fact that Ponni Sugars (Erode) is now generating some pre-tax profits from its prior investments is very encouraging. Shareholders would no doubt be pleased with this because the business was loss-making five years ago but is is now generating 10% on its capital. Not only that, but the company is utilizing 93% more capital than before, but that's to be expected from a company trying to break into profitability. We like this trend, because it tells us the company has profitable reinvestment opportunities available to it, and if it continues going forward that can lead to a multi-bagger performance.

On a related note, the company's ratio of current liabilities to total assets has decreased to 12%, which basically reduces it's funding from the likes of short-term creditors or suppliers. So shareholders would be pleased that the growth in returns has mostly come from underlying business performance.Our Take On Ponni Sugars (Erode)'s ROCE

Long story short, we're delighted to see that Ponni Sugars (Erode)'s reinvestment activities have paid off and the company is now profitable. Since the stock has only returned 8.0% to shareholders over the last five years, the promising fundamentals may not be recognized yet by investors. So with that in mind, we think the stock deserves further research.

If you want to continue researching Ponni Sugars (Erode), you might be interested to know about the 2 warning signs that our analysis has discovered.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

If you decide to trade Ponni Sugars (Erode), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:PONNIERODE

Ponni Sugars (Erode)

Engages in the manufacture and sale of sugar in India.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives