It's Down 28% But ShreeOswal Seeds and Chemicals Limited (NSE:OSWALSEEDS) Could Be Riskier Than It Looks

Unfortunately for some shareholders, the ShreeOswal Seeds and Chemicals Limited (NSE:OSWALSEEDS) share price has dived 28% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 55% share price decline.

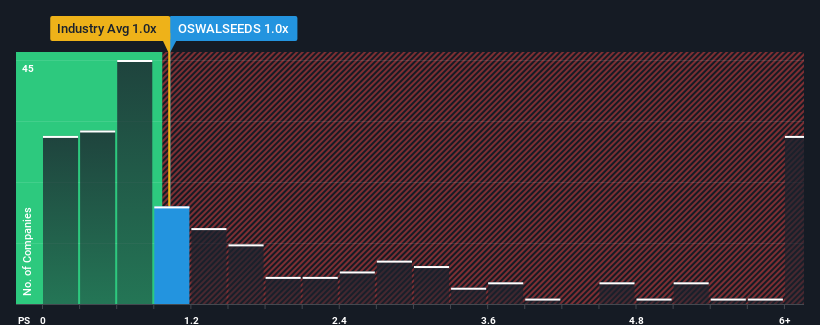

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about ShreeOswal Seeds and Chemicals' P/S ratio of 1x, since the median price-to-sales (or "P/S") ratio for the Food industry in India is about the same. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for ShreeOswal Seeds and Chemicals

How Has ShreeOswal Seeds and Chemicals Performed Recently?

For instance, ShreeOswal Seeds and Chemicals' receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on ShreeOswal Seeds and Chemicals will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, ShreeOswal Seeds and Chemicals would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 15%. Even so, admirably revenue has lifted 58% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 11% shows it's noticeably more attractive.

With this information, we find it interesting that ShreeOswal Seeds and Chemicals is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From ShreeOswal Seeds and Chemicals' P/S?

With its share price dropping off a cliff, the P/S for ShreeOswal Seeds and Chemicals looks to be in line with the rest of the Food industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that ShreeOswal Seeds and Chemicals currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 3 warning signs for ShreeOswal Seeds and Chemicals (of which 2 can't be ignored!) you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:OSWALSEEDS

ShreeOswal Seeds and Chemicals

Produces, processes, trades, and sells various agricultural seeds in India.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives