Nakoda Group of Industries Limited (NSE:NGIL) Shares Slammed 32% But Getting In Cheap Might Be Difficult Regardless

Nakoda Group of Industries Limited (NSE:NGIL) shareholders that were waiting for something to happen have been dealt a blow with a 32% share price drop in the last month. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

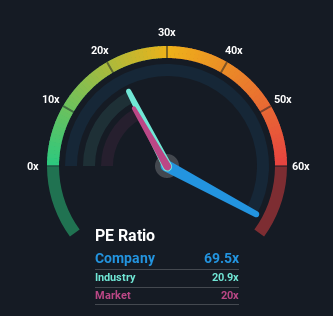

Although its price has dipped substantially, Nakoda Group of Industries' price-to-earnings (or "P/E") ratio of 69.5x might still make it look like a strong sell right now compared to the market in India, where around half of the companies have P/E ratios below 20x and even P/E's below 10x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Nakoda Group of Industries certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Nakoda Group of Industries

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Nakoda Group of Industries' to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 455% last year. Pleasingly, EPS has also lifted 149% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 22% shows it's noticeably more attractive on an annualised basis.

With this information, we can see why Nakoda Group of Industries is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Final Word

Even after such a strong price drop, Nakoda Group of Industries' P/E still exceeds the rest of the market significantly. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Nakoda Group of Industries revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 3 warning signs for Nakoda Group of Industries (1 makes us a bit uncomfortable!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20x).

If you're looking to trade Nakoda Group of Industries, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nakoda Group of Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NGIL

Nakoda Group of Industries

Engages in the manufacture and trading of tutty fruity and other agriculture commodities in India.

Slight with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives