Investors Appear Satisfied With Manorama Industries Limited's (NSE:MANORAMA) Prospects As Shares Rocket 25%

Manorama Industries Limited (NSE:MANORAMA) shares have continued their recent momentum with a 25% gain in the last month alone. The annual gain comes to 130% following the latest surge, making investors sit up and take notice.

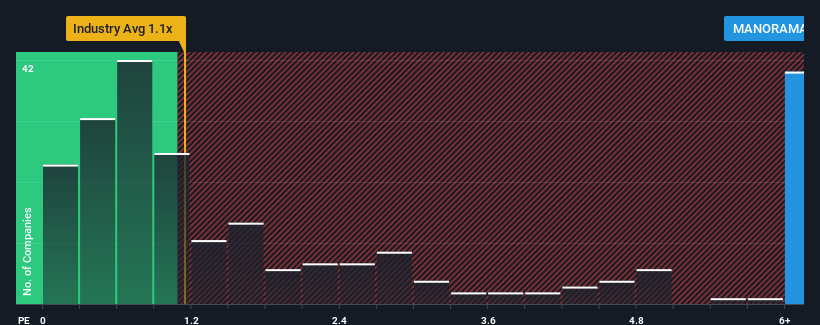

After such a large jump in price, you could be forgiven for thinking Manorama Industries is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 9x, considering almost half the companies in India's Food industry have P/S ratios below 1.1x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Manorama Industries

How Has Manorama Industries Performed Recently?

With revenue growth that's exceedingly strong of late, Manorama Industries has been doing very well. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Manorama Industries, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Manorama Industries would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 30% gain to the company's top line. Pleasingly, revenue has also lifted 126% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 11%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's understandable that Manorama Industries' P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Final Word

Shares in Manorama Industries have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's no surprise that Manorama Industries can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

Before you settle on your opinion, we've discovered 3 warning signs for Manorama Industries (2 are significant!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:MANORAMA

Manorama Industries

Manufactures, processes, and supplies specialty fats and butters from tree-borne, and plant-based seeds worldwide.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives