Kothari Sugars and Chemicals (NSE:KOTARISUG) Has A Rock Solid Balance Sheet

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Kothari Sugars and Chemicals Limited (NSE:KOTARISUG) does carry debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Kothari Sugars and Chemicals

How Much Debt Does Kothari Sugars and Chemicals Carry?

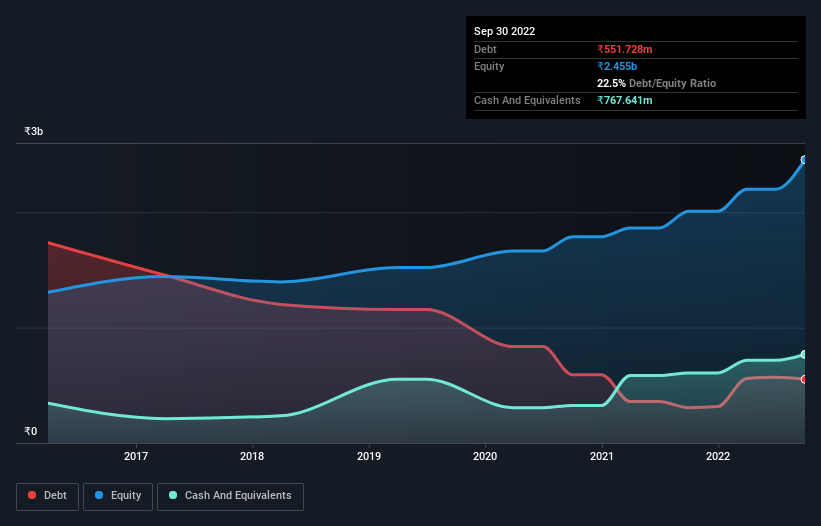

The image below, which you can click on for greater detail, shows that at September 2022 Kothari Sugars and Chemicals had debt of ₹551.7m, up from ₹306.2m in one year. However, its balance sheet shows it holds ₹767.6m in cash, so it actually has ₹215.9m net cash.

How Strong Is Kothari Sugars and Chemicals' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Kothari Sugars and Chemicals had liabilities of ₹1.21b due within 12 months and liabilities of ₹311.4m due beyond that. Offsetting this, it had ₹767.6m in cash and ₹249.9m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₹506.9m.

Since publicly traded Kothari Sugars and Chemicals shares are worth a total of ₹4.20b, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. While it does have liabilities worth noting, Kothari Sugars and Chemicals also has more cash than debt, so we're pretty confident it can manage its debt safely.

Even more impressive was the fact that Kothari Sugars and Chemicals grew its EBIT by 213% over twelve months. If maintained that growth will make the debt even more manageable in the years ahead. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Kothari Sugars and Chemicals will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While Kothari Sugars and Chemicals has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the most recent three years, Kothari Sugars and Chemicals recorded free cash flow worth 74% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Summing Up

Although Kothari Sugars and Chemicals's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of ₹215.9m. And we liked the look of last year's 213% year-on-year EBIT growth. So is Kothari Sugars and Chemicals's debt a risk? It doesn't seem so to us. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 3 warning signs for Kothari Sugars and Chemicals (1 is significant!) that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Kothari Sugars and Chemicals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KOTARISUG

Kothari Sugars and Chemicals

Manufactures and sells sugar and its by-products in India and internationally.

Adequate balance sheet with very low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026