Here's Why I Think K.M. Sugar Mills (NSE:KMSUGAR) Is An Interesting Stock

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like K.M. Sugar Mills (NSE:KMSUGAR). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for K.M. Sugar Mills

How Quickly Is K.M. Sugar Mills Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years K.M. Sugar Mills grew its EPS by 9.2% per year. That's a pretty good rate, if the company can sustain it.

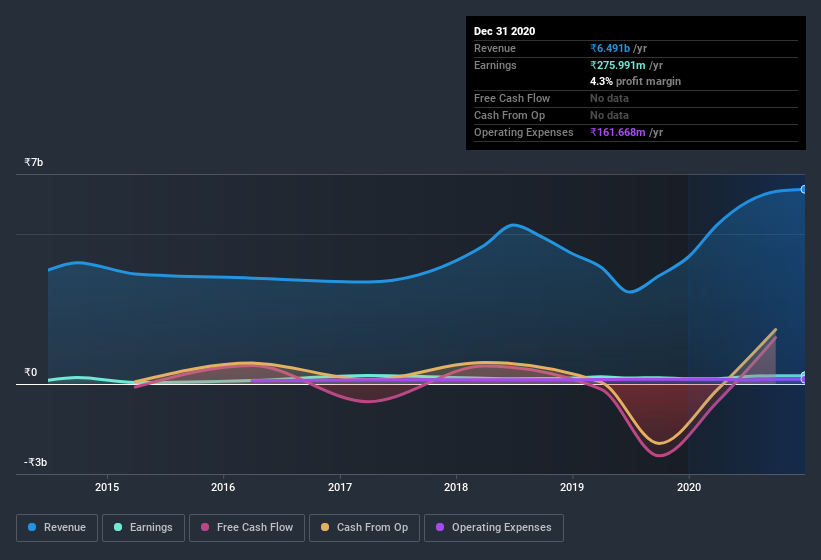

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. K.M. Sugar Mills maintained stable EBIT margins over the last year, all while growing revenue 53% to ₹6.5b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since K.M. Sugar Mills is no giant, with a market capitalization of ₹1.2b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are K.M. Sugar Mills Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So we're pleased to report that K.M. Sugar Mills insiders own a meaningful share of the business. Indeed, with a collective holding of 51%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. Of course, K.M. Sugar Mills is a very small company, with a market cap of only ₹1.2b. So despite a large proportional holding, insiders only have ₹590m worth of stock. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Is K.M. Sugar Mills Worth Keeping An Eye On?

One important encouraging feature of K.M. Sugar Mills is that it is growing profits. Just as polish makes silverware pop, the high level of insider ownership enhances my enthusiasm for this growth. That combination appeals to me, for one. So yes, I do think the stock is worth keeping an eye on. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with K.M. Sugar Mills , and understanding this should be part of your investment process.

Although K.M. Sugar Mills certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade K.M. Sugar Mills, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if K.M. Sugar Mills might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:KMSUGAR

K.M. Sugar Mills

Engages in manufacturing and sells sugar and industrial alcohol in India.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives