Auditors Are Concerned About Jay Shree Tea & Industries (NSE:JAYSREETEA)

When Jay Shree Tea & Industries Limited (NSE:JAYSREETEA) reported its results to June 2021 its auditors, S.R. Batliboi & Co - S R B C & Co could not be sure that it would be able to continue as a going concern in the next year. It is therefore fair to assume that, based on those financials, the company should strengthen its balance sheet in the short term, perhaps by issuing shares. Worse still, the auditor has given a qualified opinion, which is a red flag for many investors, and lenders.

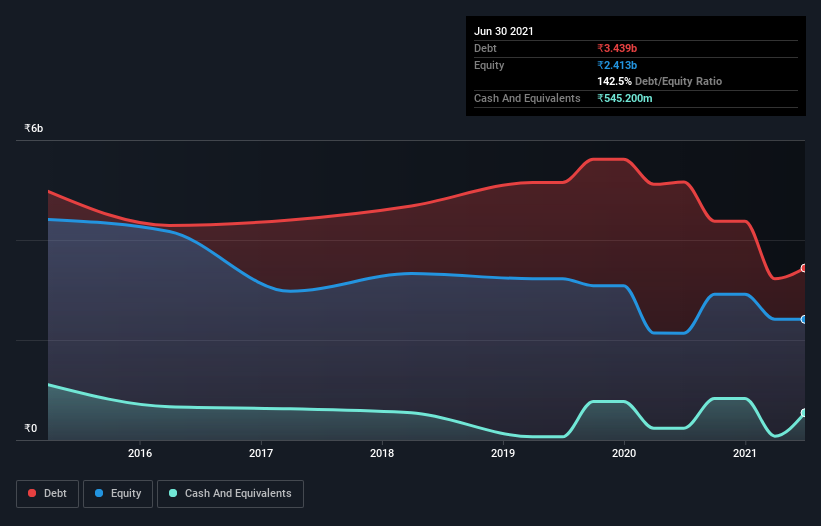

If the company does have to issue more shares, potential investors will be sure to consider how desperate it is for capital. So shareholders should absolutely be taking a close look at how risky the balance sheet is. The biggest concern we would have is the company's debt, since its lenders might force the company into administration if it cannot repay them.

View our latest analysis for Jay Shree Tea & Industries

How Much Debt Does Jay Shree Tea & Industries Carry?

As you can see below, Jay Shree Tea & Industries had ₹3.44b of debt at March 2021, down from ₹5.16b a year prior. On the flip side, it has ₹545.2m in cash leading to net debt of about ₹2.89b.

How Strong Is Jay Shree Tea & Industries' Balance Sheet?

The latest balance sheet data shows that Jay Shree Tea & Industries had liabilities of ₹5.58b due within a year, and liabilities of ₹1.45b falling due after that. Offsetting this, it had ₹545.2m in cash and ₹863.6m in receivables that were due within 12 months. So it has liabilities totalling ₹5.63b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the ₹2.51b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Jay Shree Tea & Industries would probably need a major re-capitalization if its creditors were to demand repayment.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While Jay Shree Tea & Industries's debt to EBITDA ratio (4.0) suggests that it uses some debt, its interest cover is very weak, at 1.0, suggesting high leverage. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. One redeeming factor for Jay Shree Tea & Industries is that it turned last year's EBIT loss into a gain of ₹458m, over the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But it is Jay Shree Tea & Industries's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Happily for any shareholders, Jay Shree Tea & Industries actually produced more free cash flow than EBIT over the last year. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

To be frank both Jay Shree Tea & Industries's interest cover and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. Overall, we think it's fair to say that Jay Shree Tea & Industries has enough debt that there are some real risks around the balance sheet. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. While some investors may specialize in these sort of situations, it's simply too risky and complicated for us to want to invest in a company after an auditor has expressed doubts about its ability to continue as a going concern. Our preference is to invest in companies that always make sure the auditor has confidence that the company will continue as a going concern. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Jay Shree Tea & Industries is showing 3 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you decide to trade Jay Shree Tea & Industries, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:JAYSREETEA

Jay Shree Tea & Industries

Engages in the manufacture and sale of tea in India and internationally.

Proven track record slight.

Market Insights

Community Narratives