Investor Optimism Abounds Hatsun Agro Product Limited (NSE:HATSUN) But Growth Is Lacking

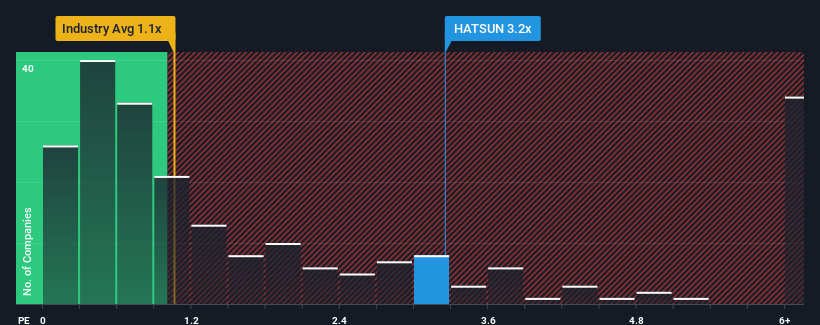

When close to half the companies in the Food industry in India have price-to-sales ratios (or "P/S") below 1.1x, you may consider Hatsun Agro Product Limited (NSE:HATSUN) as a stock to avoid entirely with its 3.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Hatsun Agro Product

How Has Hatsun Agro Product Performed Recently?

Recent revenue growth for Hatsun Agro Product has been in line with the industry. Perhaps the market is expecting future revenue performance to improve, justifying the currently elevated P/S. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hatsun Agro Product.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Hatsun Agro Product's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a decent 9.2% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 47% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 13% over the next year. Meanwhile, the rest of the industry is forecast to expand by 13%, which is not materially different.

In light of this, it's curious that Hatsun Agro Product's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What We Can Learn From Hatsun Agro Product's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Given Hatsun Agro Product's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 2 warning signs for Hatsun Agro Product (1 can't be ignored!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hatsun Agro Product might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HATSUN

Hatsun Agro Product

Engages in manufacturing and marketing of milk, milk products, and cattle feed in India and internationally.

High growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives