Here's Why I Think Globus Spirits (NSE:GLOBUSSPR) Might Deserve Your Attention Today

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Globus Spirits (NSE:GLOBUSSPR), which has not only revenues, but also profits. Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Globus Spirits

How Fast Is Globus Spirits Growing Its Earnings Per Share?

Over the last three years, Globus Spirits has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like the last firework on New Year's Eve accelerating into the sky, Globus Spirits's EPS shot from ₹15.31 to ₹38.06, over the last year. You don't see 149% year-on-year growth like that, very often.

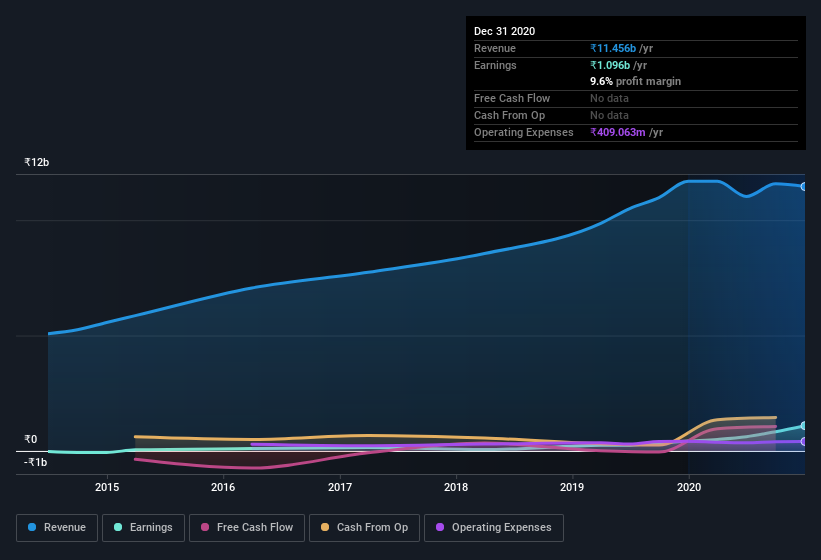

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. This approach makes Globus Spirits look pretty good, on balance; although revenue is flattish, EBIT margins improved from 6.7% to 14% in the last year. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Globus Spirits isn't a huge company, given its market capitalization of ₹9.2b. That makes it extra important to check on its balance sheet strength.

Are Globus Spirits Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news for Globus Spirits shareholders is that no insiders reported selling shares in the last year. So it's definitely nice that Joint MD & Executive Director Shekhar Swarup bought ₹3.5m worth of shares at an average price of around ₹183.

Along with the insider buying, another encouraging sign for Globus Spirits is that insiders, as a group, have a considerable shareholding. To be specific, they have ₹1.3b worth of shares. That's a lot of money, and no small incentive to work hard. That amounts to 14% of the company, demonstrating a degree of high-level alignment with shareholders.

Is Globus Spirits Worth Keeping An Eye On?

Globus Spirits's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The cherry on top is that insiders own a bunch of shares, and one has been buying more. Because of the potential that it has reached an inflection point, I'd suggest Globus Spirits belongs on the top of your watchlist. What about risks? Every company has them, and we've spotted 1 warning sign for Globus Spirits you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Globus Spirits, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Globus Spirits, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:GLOBUSSPR

Globus Spirits

Manufactures and sells bulk alcohol and alcoholic products in India and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success