- India

- /

- Metals and Mining

- /

- NSEI:VENUSPIPES

Dodla Dairy And Two More Stocks Seemingly Priced Below Indian Market Value Estimates

Reviewed by Simply Wall St

The Indian market has shown robust growth, climbing by 2.3% over the past week and an impressive 45% in the last year, with earnings expected to grow by 16% annually. In such a thriving market, identifying stocks that are seemingly undervalued could present potential opportunities for investors keen on finding value amidst prevailing market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| HEG (NSEI:HEG) | ₹2113.65 | ₹3300.48 | 36% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹413.75 | ₹636.71 | 35% |

| Updater Services (NSEI:UDS) | ₹319.60 | ₹536.82 | 40.5% |

| Venus Pipes and Tubes (NSEI:VENUSPIPES) | ₹2273.30 | ₹3588.90 | 36.7% |

| Vedanta (NSEI:VEDL) | ₹444.50 | ₹720.23 | 38.3% |

| Rajesh Exports (NSEI:RAJESHEXPO) | ₹313.55 | ₹507.92 | 38.3% |

| Mahindra Logistics (NSEI:MAHLOG) | ₹535.15 | ₹856.01 | 37.5% |

| Strides Pharma Science (NSEI:STAR) | ₹1021.60 | ₹1664.05 | 38.6% |

| Delhivery (NSEI:DELHIVERY) | ₹397.00 | ₹750.48 | 47.1% |

| Godrej Properties (NSEI:GODREJPROP) | ₹3128.70 | ₹5531.59 | 43.4% |

Let's dive into some prime choices out of the screener.

Dodla Dairy (NSEI:DODLA)

Overview: Dodla Dairy Limited operates in the production and sale of milk and dairy products both within India and internationally, with a market capitalization of approximately ₹71.04 billion.

Operations: The company generates ₹32.14 billion from the sale of milk and dairy products.

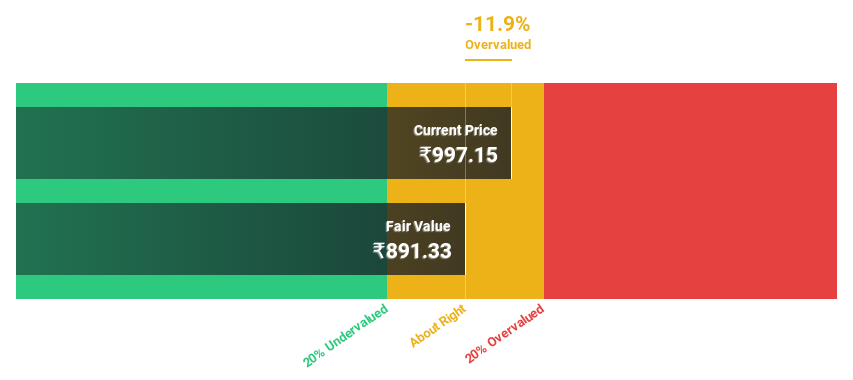

Estimated Discount To Fair Value: 13.9%

Dodla Dairy Limited, with a trading price of ₹1177.6 against a fair value estimate of ₹1368.21, appears undervalued based on discounted cash flows. The company recently reported substantial year-over-year earnings growth and is expected to continue this trend with forecasted annual profit growth outpacing the Indian market average. Despite significant insider selling in the past three months, Dodla's revenue and earnings projections suggest robust future performance, potentially making it an attractive option for those looking at cash flow-based valuations in the Indian market.

- In light of our recent growth report, it seems possible that Dodla Dairy's financial performance will exceed current levels.

- Navigate through the intricacies of Dodla Dairy with our comprehensive financial health report here.

Updater Services (NSEI:UDS)

Overview: Updater Services Limited operates an integrated business services platform in India, with a market capitalization of ₹21.40 billion.

Operations: The company generates revenue primarily through two segments: Business Support Services at ₹8.09 billion and Integrated Facility Management Services at ₹16.74 billion.

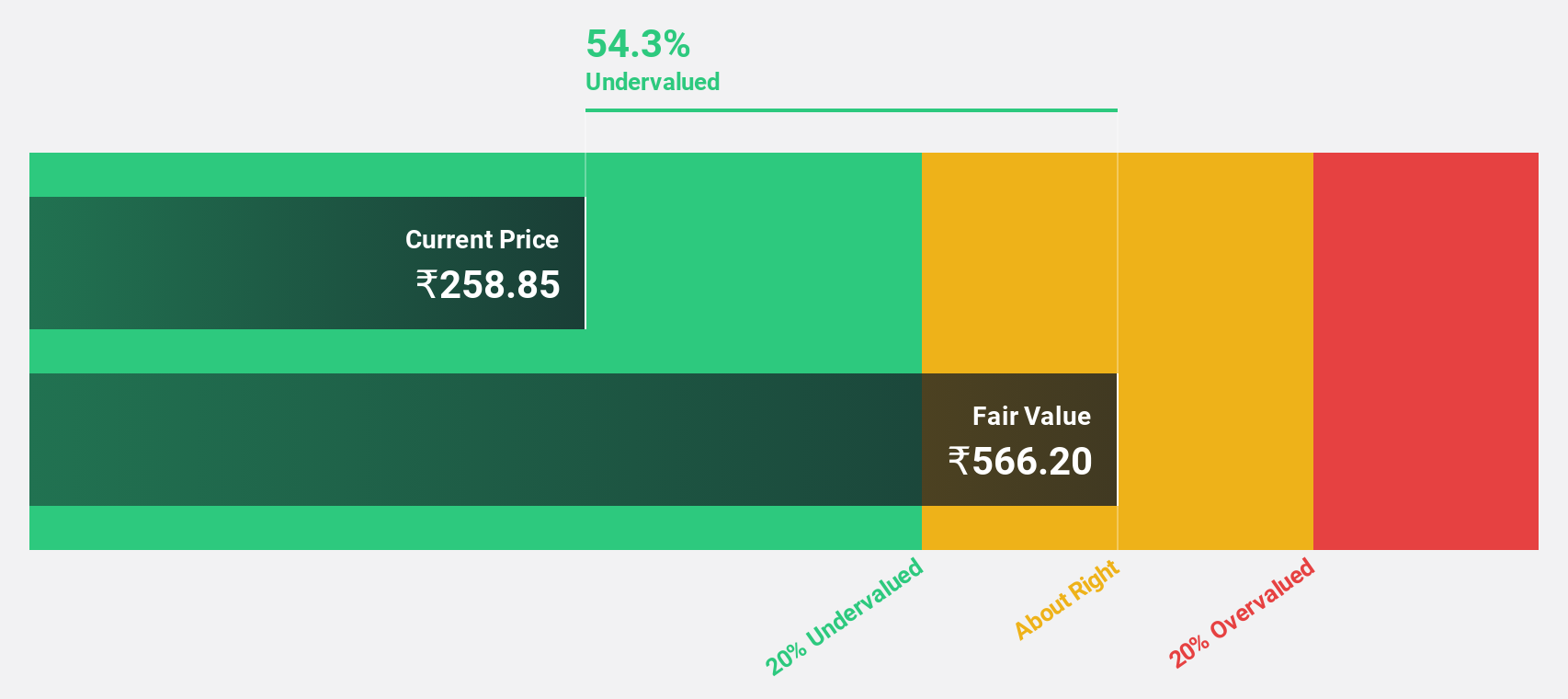

Estimated Discount To Fair Value: 40.5%

Updater Services, priced at ₹319.6, trades significantly below its estimated fair value of ₹536.82, suggesting undervaluation based on cash flows. The company's revenue and earnings are expected to grow at 15.1% and 34.45% per year respectively, outpacing the broader Indian market averages. Despite recent regulatory challenges with minimal financial implications, Updater Services' strong growth forecasts and current market position indicate potential for increased valuation.

- According our earnings growth report, there's an indication that Updater Services might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Updater Services.

Venus Pipes and Tubes (NSEI:VENUSPIPES)

Overview: Venus Pipes and Tubes Limited is engaged in the manufacturing and international sale of stainless steel pipes and tubes, with a market capitalization of approximately ₹46.14 billion.

Operations: The company generates revenue primarily from the manufacturing and trading of pipes, tubes, and steel, totaling ₹8.63 billion.

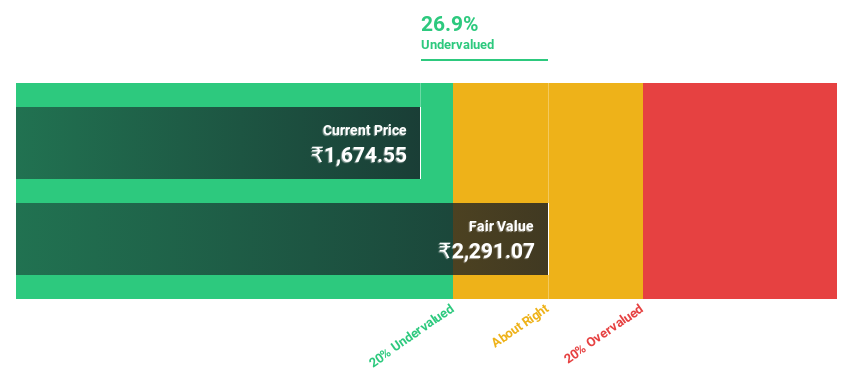

Estimated Discount To Fair Value: 36.7%

Venus Pipes and Tubes, with a current trading price of ₹2273.3, appears undervalued against a DCF-based fair value estimate of ₹3588.9, reflecting a substantial discount. The company's robust recent earnings growth (83.1% year-over-year) complements forecasts predicting revenue and earnings to expand by 23% and 29.27% annually, respectively—rates well above market averages. This financial trajectory, supported by strong quarterly performance including significant increases in sales and net income, positions it as an attractive prospect for cash flow-based valuation enhancement.

- Upon reviewing our latest growth report, Venus Pipes and Tubes' projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Venus Pipes and Tubes stock in this financial health report.

Seize The Opportunity

- Take a closer look at our Undervalued Indian Stocks Based On Cash Flows list of 18 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:VENUSPIPES

Venus Pipes and Tubes

Manufactures and sells stainless-steel pipes and tubes worldwide.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives