Balrampur Chini Mills Limited's (NSE:BALRAMCHIN) Shares Climb 26% But Its Business Is Yet to Catch Up

Balrampur Chini Mills Limited (NSE:BALRAMCHIN) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 48% in the last year.

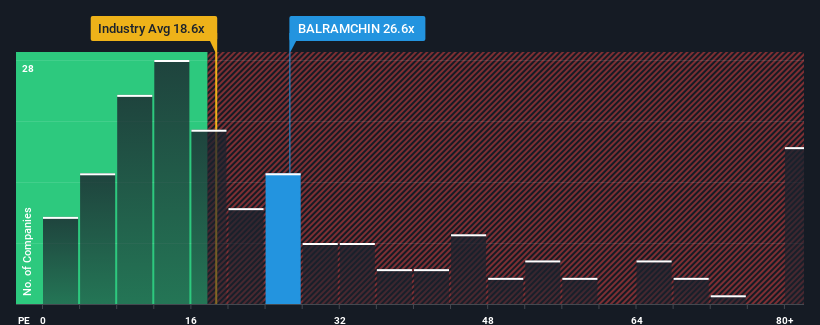

In spite of the firm bounce in price, it's still not a stretch to say that Balrampur Chini Mills' price-to-earnings (or "P/E") ratio of 26.6x right now seems quite "middle-of-the-road" compared to the market in India, where the median P/E ratio is around 25x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Balrampur Chini Mills hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Balrampur Chini Mills

Is There Some Growth For Balrampur Chini Mills?

There's an inherent assumption that a company should be matching the market for P/E ratios like Balrampur Chini Mills' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 29% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 7.7% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 22% as estimated by the seven analysts watching the company. That's shaping up to be materially lower than the 25% growth forecast for the broader market.

In light of this, it's curious that Balrampur Chini Mills' P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Balrampur Chini Mills' P/E

Balrampur Chini Mills appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Balrampur Chini Mills' analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Having said that, be aware Balrampur Chini Mills is showing 2 warning signs in our investment analysis, and 1 of those is concerning.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Balrampur Chini Mills might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BALRAMCHIN

Balrampur Chini Mills

Engages in the manufacture and sale of sugar in India.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives