Volatility 101: Should Ajooni Biotech (NSE:AJOONI) Shares Have Dropped 29%?

Ajooni Biotech Limited (NSE:AJOONI) shareholders will doubtless be very grateful to see the share price up 86% in the last quarter. But that is minimal compensation for the share price under-performance over the last year. After all, the share price is down 29% in the last year, significantly under-performing the market.

Check out our latest analysis for Ajooni Biotech

While Ajooni Biotech made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, companies that are not judged on their (small) profits should be growing revenue quickly. The main reason for this is that fast revenue growth can be readily extrapolated into a profitable future, but stagnant revenue cannot.

In the last year Ajooni Biotech saw its revenue grow by 49%. That's well above most other pre-profit companies. Given the revenue growth, the share price drop of 29% seems quite harsh. Our sympathies to shareholders who are now underwater. Prima facie, revenue growth like that should be a good thing, so it's worth checking whether losses have stabilized. Our monkey brains haven't evolved to think exponentially, so humans do tend to underestimate companies that have exponential growth.

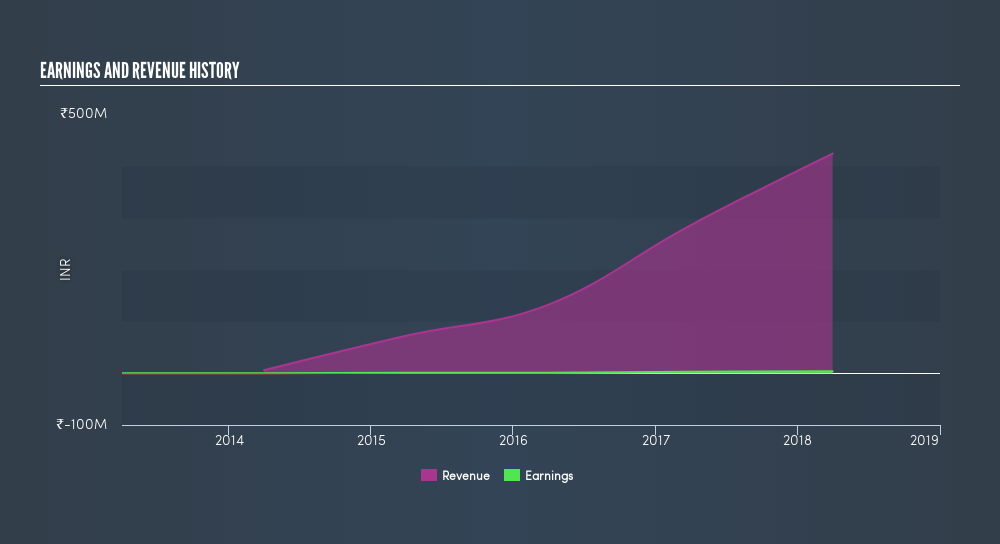

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

Balance sheet strength is crucual. It might be well worthwhile taking a look at our freereport on how its financial position has changed over time.

A Different Perspective

While Ajooni Biotech shareholders are down 29% for the year, the market itself is up 0.5%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Putting aside the last twelve months, it's good to see the share price has rebounded by 86%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). Is Ajooni Biotech cheap compared to other companies? These 3 valuation measures might help you decide.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this freelist of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:AJOONI

Excellent balance sheet with proven track record.

Market Insights

Community Narratives