- India

- /

- Oil and Gas

- /

- NSEI:SELAN

Sentiment Still Eluding Selan Exploration Technology Limited (NSE:SELAN)

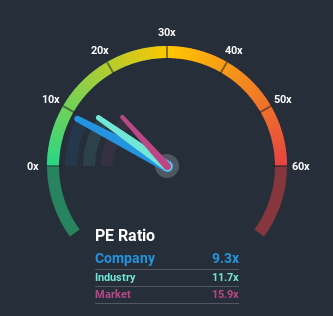

When close to half the companies in India have price-to-earnings ratios (or "P/E's") above 16x, you may consider Selan Exploration Technology Limited (NSE:SELAN) as an attractive investment with its 9.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

For instance, Selan Exploration Technology's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Selan Exploration Technology

Does Growth Match The Low P/E?

Selan Exploration Technology's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 54%. Still, the latest three year period has seen an excellent 172% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 9.8% shows it's noticeably more attractive on an annualised basis.

With this information, we find it odd that Selan Exploration Technology is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Selan Exploration Technology's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Selan Exploration Technology revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

Before you take the next step, you should know about the 4 warning signs for Selan Exploration Technology that we have uncovered.

If these risks are making you reconsider your opinion on Selan Exploration Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

When trading Selan Exploration Technology or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:SELAN

Selan Exploration Technology

Explores for and produces crude oil and natural gas in India.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives