- India

- /

- Oil and Gas

- /

- NSEI:HINDPETRO

Hindustan Petroleum Corporation Limited (NSE:HINDPETRO) Stock Catapults 28% Though Its Price And Business Still Lag The Industry

Hindustan Petroleum Corporation Limited (NSE:HINDPETRO) shares have continued their recent momentum with a 28% gain in the last month alone. The last month tops off a massive increase of 131% in the last year.

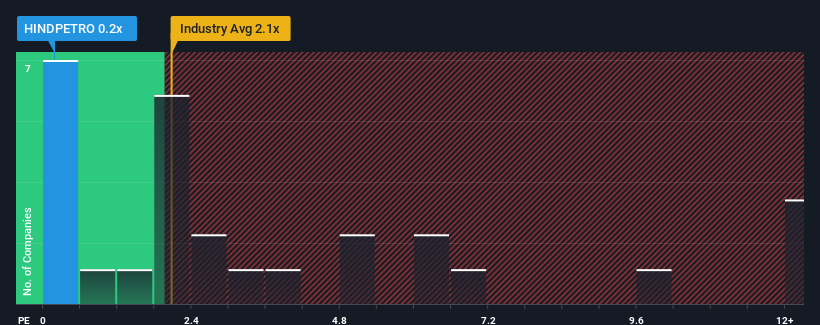

Although its price has surged higher, Hindustan Petroleum's price-to-sales (or "P/S") ratio of 0.2x might still make it look like a buy right now compared to the Oil and Gas industry in India, where around half of the companies have P/S ratios above 2.1x and even P/S above 6x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Hindustan Petroleum

What Does Hindustan Petroleum's P/S Mean For Shareholders?

Hindustan Petroleum hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Hindustan Petroleum's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Hindustan Petroleum's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period has seen an excellent 90% overall rise in revenue, in spite of its uninspiring short-term performance. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 6.4% as estimated by the analysts watching the company. That's not great when the rest of the industry is expected to grow by 7.6%.

In light of this, it's understandable that Hindustan Petroleum's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does Hindustan Petroleum's P/S Mean For Investors?

The latest share price surge wasn't enough to lift Hindustan Petroleum's P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Hindustan Petroleum's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Hindustan Petroleum (1 is a bit unpleasant) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hindustan Petroleum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HINDPETRO

Hindustan Petroleum

Engages in the refining and marketing of petroleum products in India and internationally.

Average dividend payer with moderate growth potential.