- India

- /

- Oil and Gas

- /

- NSEI:HINDOILEXP

Do Hindustan Oil Exploration's (NSE:HINDOILEXP) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Hindustan Oil Exploration (NSE:HINDOILEXP). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Hindustan Oil Exploration

Hindustan Oil Exploration's Improving Profits

In the last three years Hindustan Oil Exploration's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. Hindustan Oil Exploration boosted its trailing twelve month EPS from ₹14.67 to ₹17.12, in the last year. There's little doubt shareholders would be happy with that 17% gain.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. On the one hand, Hindustan Oil Exploration's EBIT margins fell over the last year, but on the other hand, revenue grew. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

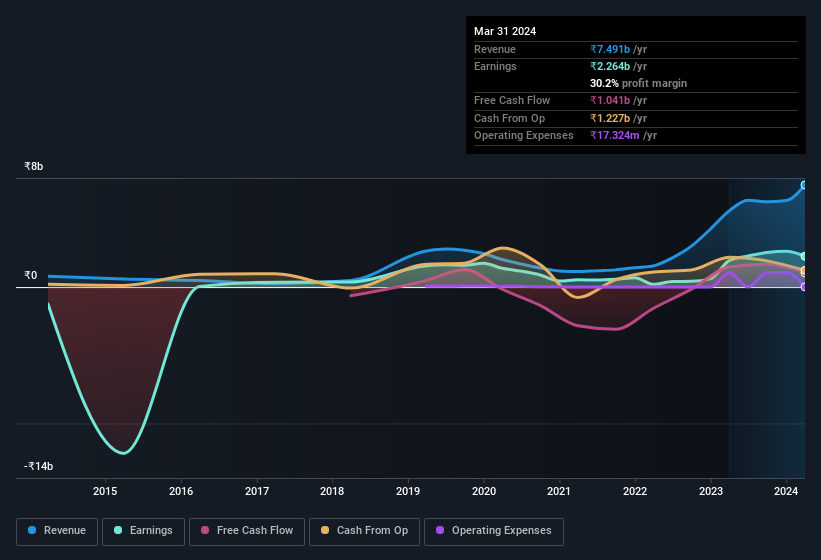

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Hindustan Oil Exploration's balance sheet strength, before getting too excited.

Are Hindustan Oil Exploration Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. So it is good to see that Hindustan Oil Exploration insiders have a significant amount of capital invested in the stock. Indeed, they have a considerable amount of wealth invested in it, currently valued at ₹9.6b. That equates to 27% of the company, making insiders powerful and aligned with other shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Well, based on the CEO pay, you'd argue that they are indeed. The median total compensation for CEOs of companies similar in size to Hindustan Oil Exploration, with market caps between ₹17b and ₹67b, is around ₹22m.

Hindustan Oil Exploration offered total compensation worth ₹14m to its CEO in the year to March 2023. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is Hindustan Oil Exploration Worth Keeping An Eye On?

As previously touched on, Hindustan Oil Exploration is a growing business, which is encouraging. Earnings growth might be the main attraction for Hindustan Oil Exploration, but the fun does not stop there. Boasting both modest CEO pay and considerable insider ownership, you'd argue this one is worthy of the watchlist, at least. Now, you could try to make up your mind on Hindustan Oil Exploration by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Indian companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hindustan Oil Exploration might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:HINDOILEXP

Hindustan Oil Exploration

Engages in the exploration, development, and production of onshore and offshore crude oil and natural gas in India.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives