- India

- /

- Capital Markets

- /

- NSEI:VLSFINANCE

Benign Growth For VLS Finance Limited (NSE:VLSFINANCE) Underpins Stock's 26% Plummet

To the annoyance of some shareholders, VLS Finance Limited (NSE:VLSFINANCE) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 26% in that time.

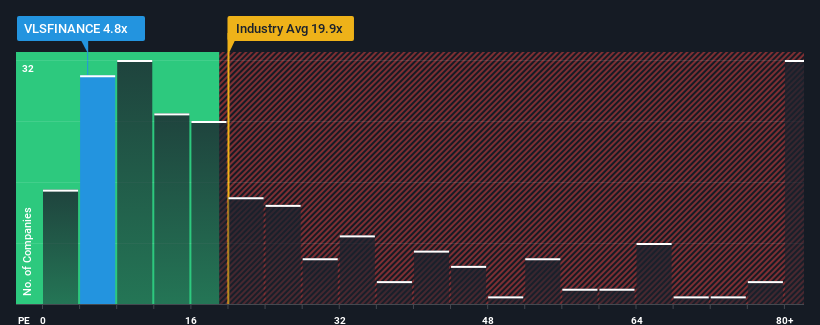

After such a large drop in price, VLS Finance's price-to-earnings (or "P/E") ratio of 4.8x might make it look like a strong buy right now compared to the market in India, where around half of the companies have P/E ratios above 27x and even P/E's above 51x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

For instance, VLS Finance's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for VLS Finance

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as VLS Finance's is when the company's growth is on track to lag the market decidedly.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 29%. This means it has also seen a slide in earnings over the longer-term as EPS is down 33% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 26% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's understandable that VLS Finance's P/E would sit below the majority of other companies. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Key Takeaway

Having almost fallen off a cliff, VLS Finance's share price has pulled its P/E way down as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that VLS Finance maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Before you settle on your opinion, we've discovered 1 warning sign for VLS Finance that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:VLSFINANCE

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026