- India

- /

- Capital Markets

- /

- NSEI:SMCGLOBAL

Even With A 27% Surge, Cautious Investors Are Not Rewarding SMC Global Securities Limited's (NSE:SMCGLOBAL) Performance Completely

SMC Global Securities Limited (NSE:SMCGLOBAL) shares have continued their recent momentum with a 27% gain in the last month alone. The last month tops off a massive increase of 103% in the last year.

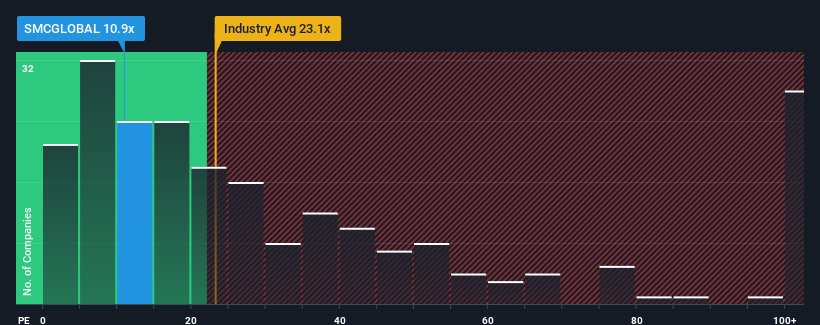

Although its price has surged higher, SMC Global Securities' price-to-earnings (or "P/E") ratio of 10.9x might still make it look like a strong buy right now compared to the market in India, where around half of the companies have P/E ratios above 32x and even P/E's above 58x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

SMC Global Securities has been doing a decent job lately as it's been growing earnings at a reasonable pace. One possibility is that the P/E is low because investors think this good earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for SMC Global Securities

How Is SMC Global Securities' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as SMC Global Securities' is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings growth, the company posted a worthy increase of 4.6%. Pleasingly, EPS has also lifted 115% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 24% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that SMC Global Securities' P/E sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Shares in SMC Global Securities are going to need a lot more upward momentum to get the company's P/E out of its slump. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of SMC Global Securities revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 2 warning signs for SMC Global Securities that you should be aware of.

If you're unsure about the strength of SMC Global Securities' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SMCGLOBAL

SMC Global Securities

Engages in the provision of various financial services in India and internationally.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026