- Saudi Arabia

- /

- Hospitality

- /

- SASE:6017

November 2024's Top Insider-Owned Growth Companies

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, with major indices like the S&P 500 and Nasdaq Composite reaching record highs, investors are optimistic about potential regulatory changes and tax cuts that could spur economic growth. In this environment, companies with strong insider ownership often attract attention as they may indicate confidence from those closest to the business; such alignment can be particularly appealing for growth-focused investors seeking opportunities in a rapidly evolving market landscape.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 36.6% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 42.1% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.9% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 49.1% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's uncover some gems from our specialized screener.

Info Edge (India) (NSEI:NAUKRI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Info Edge (India) Limited is an online classifieds company providing services in recruitment, matrimony, real estate, and education both in India and internationally, with a market cap of ₹1.03 trillion.

Operations: The company's revenue segments include Recruitment Solutions generating ₹19.52 billion and 99acres for Real Estate contributing ₹3.82 billion.

Insider Ownership: 37.7%

Info Edge (India) demonstrates characteristics of a growth company with high insider ownership, despite facing recent earnings pressure. Its revenue for the second quarter was INR 914.95 billion, but net income dropped significantly to INR 232.59 million. The company forecasts robust earnings growth of 37.6% annually over the next three years, outpacing the Indian market average. Although insider buying has not been substantial recently, there is no significant selling either, suggesting confidence in future prospects.

- Get an in-depth perspective on Info Edge (India)'s performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Info Edge (India) shares in the market.

One97 Communications (NSEI:PAYTM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: One97 Communications Limited operates in India, offering payment, commerce and cloud, and financial services to consumers and merchants, with a market cap of ₹522.22 billion.

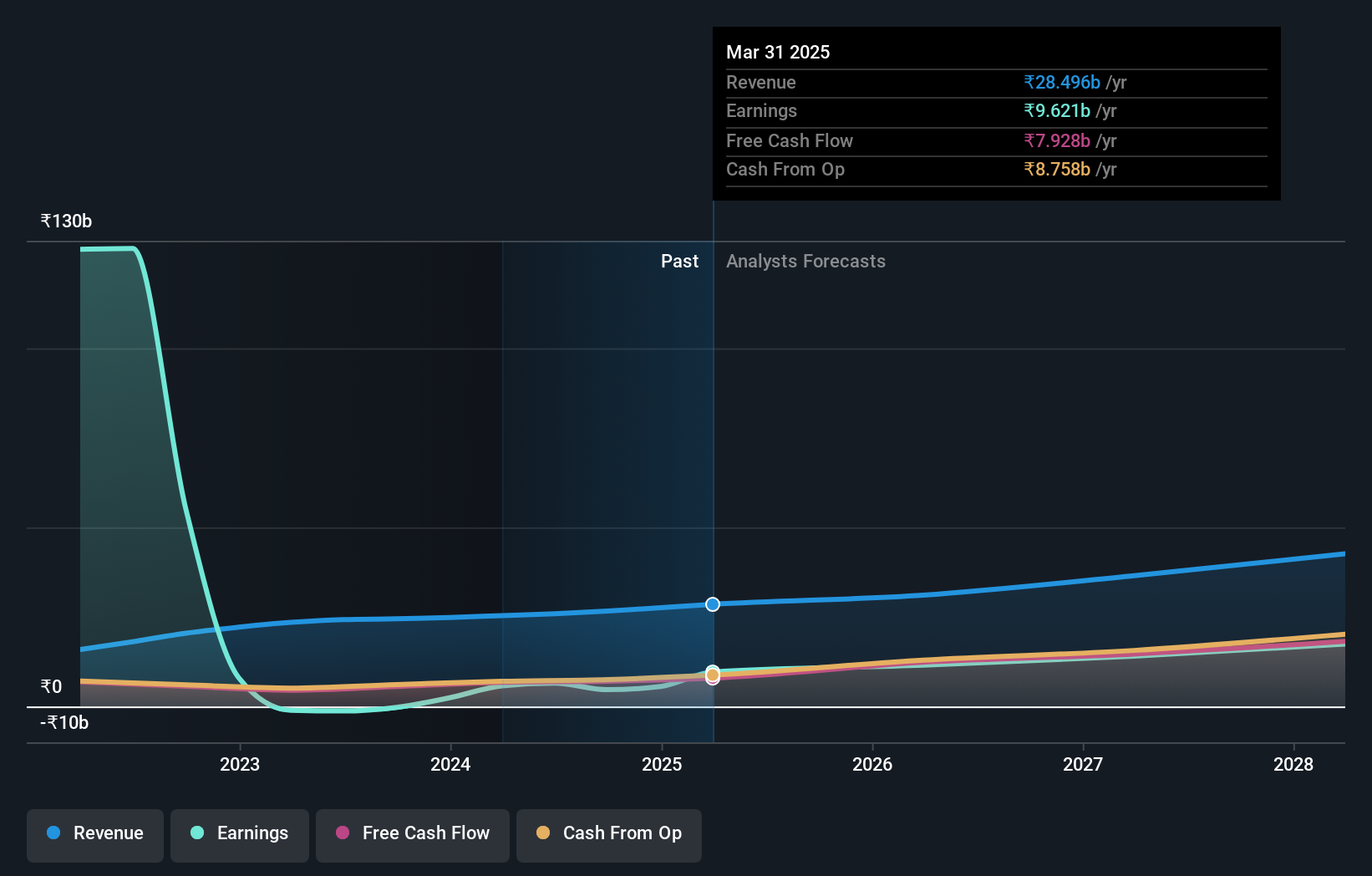

Operations: The company's revenue segments include Data Processing, generating ₹82.79 billion.

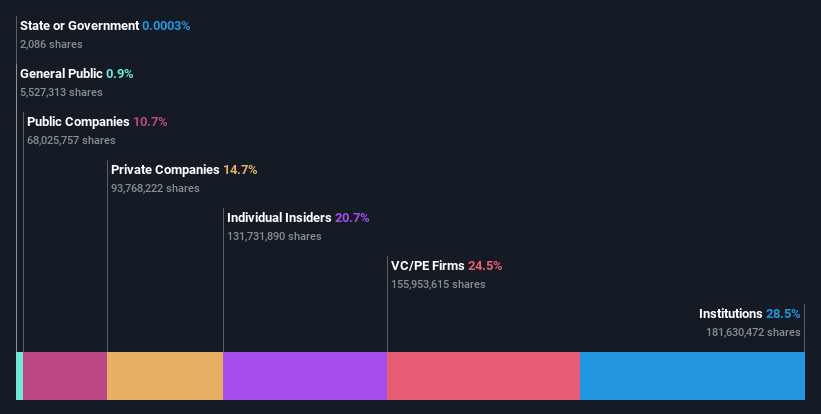

Insider Ownership: 11.6%

One97 Communications, known for its Paytm brand, illustrates growth potential with significant insider ownership. Despite recent revenue declines to INR 18.34 billion in Q2 2024 from INR 26.63 billion a year ago, the company turned a net income of INR 9.28 billion from a previous loss. Expected annual earnings growth of over 74% and strategic leadership changes aim to enhance profitability and market position, while no substantial insider trading suggests stable internal confidence in its future trajectory.

- Click here to discover the nuances of One97 Communications with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that One97 Communications is trading beyond its estimated value.

Jahez International Company for Information Systems Technology (SASE:9526)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jahez International Company for Information Systems Technology operates an online food delivery platform under the Jahez brand name in Saudi Arabia, with a market cap of SAR7.20 billion.

Operations: The company's revenue is primarily derived from its delivery platforms, generating SAR1.93 billion, and logistics activities, contributing SAR405.74 million.

Insider Ownership: 10.5%

Jahez International Company for Information Systems Technology shows promising growth potential, with earnings forecasted to increase by 24.47% annually, surpassing the Saudi Arabian market's average. Despite a volatile share price and declining net income in recent quarters—SAR 30.24 million for Q2 2024 compared to SAR 50.36 million a year ago—the company's revenue growth remains strong at SAR 540.96 million in Q2, indicating resilience amidst challenges and supporting its strategic expansion efforts.

- Click to explore a detailed breakdown of our findings in Jahez International Company for Information Systems Technology's earnings growth report.

- The analysis detailed in our Jahez International Company for Information Systems Technology valuation report hints at an inflated share price compared to its estimated value.

Taking Advantage

- Unlock our comprehensive list of 1524 Fast Growing Companies With High Insider Ownership by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:6017

Jahez International Company for Information Systems Technology

Operates an online food delivery platform under the Jahez brand name in Saudi Arabia.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives