Indian Exchange Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

In the last week, the Indian market has been flat, but it is up 43% over the past year with earnings forecast to grow by 17% annually. In this thriving environment, growth companies with high insider ownership can offer compelling opportunities as they often indicate strong confidence in future performance from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 33.7% |

| Kirloskar Pneumatic (BSE:505283) | 30.4% | 30.1% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 32.5% | 22.2% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 36.6% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.4% |

| PTC Industries (BSE:539006) | 26.3% | 65.3% |

| Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 32.3% |

| Aether Industries (NSEI:AETHER) | 31.1% | 45.9% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 24% |

Let's review some notable picks from our screened stocks.

AU Small Finance Bank (NSEI:AUBANK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AU Small Finance Bank Limited provides a range of banking and financial services in India with a market cap of ₹511.29 billion.

Operations: The company's revenue segments include Treasury at ₹18.63 billion, Retail Banking at ₹103.26 billion, Wholesale Banking at ₹12.74 billion, and Other Banking Operations at ₹3.78 billion.

Insider Ownership: 24.3%

Earnings Growth Forecast: 24.2% p.a.

AU Small Finance Bank's earnings are projected to grow 24.16% annually, outpacing the Indian market's 16.9%. Despite recent shareholder dilution, its Price-to-Earnings ratio of 31x remains below the market average of 34.3x, indicating good value. Recent events include a penalty related to GST issues and plans to raise up to ₹50 billion through equity and debt instruments. The bank also reported strong Q1 earnings with net income rising from ₹3.87 billion to ₹5.03 billion year-over-year.

- Get an in-depth perspective on AU Small Finance Bank's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that AU Small Finance Bank is trading beyond its estimated value.

One97 Communications (NSEI:PAYTM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: One97 Communications Limited operates in India, offering payment, commerce and cloud, and financial services to consumers and merchants with a market cap of ₹390.68 billion.

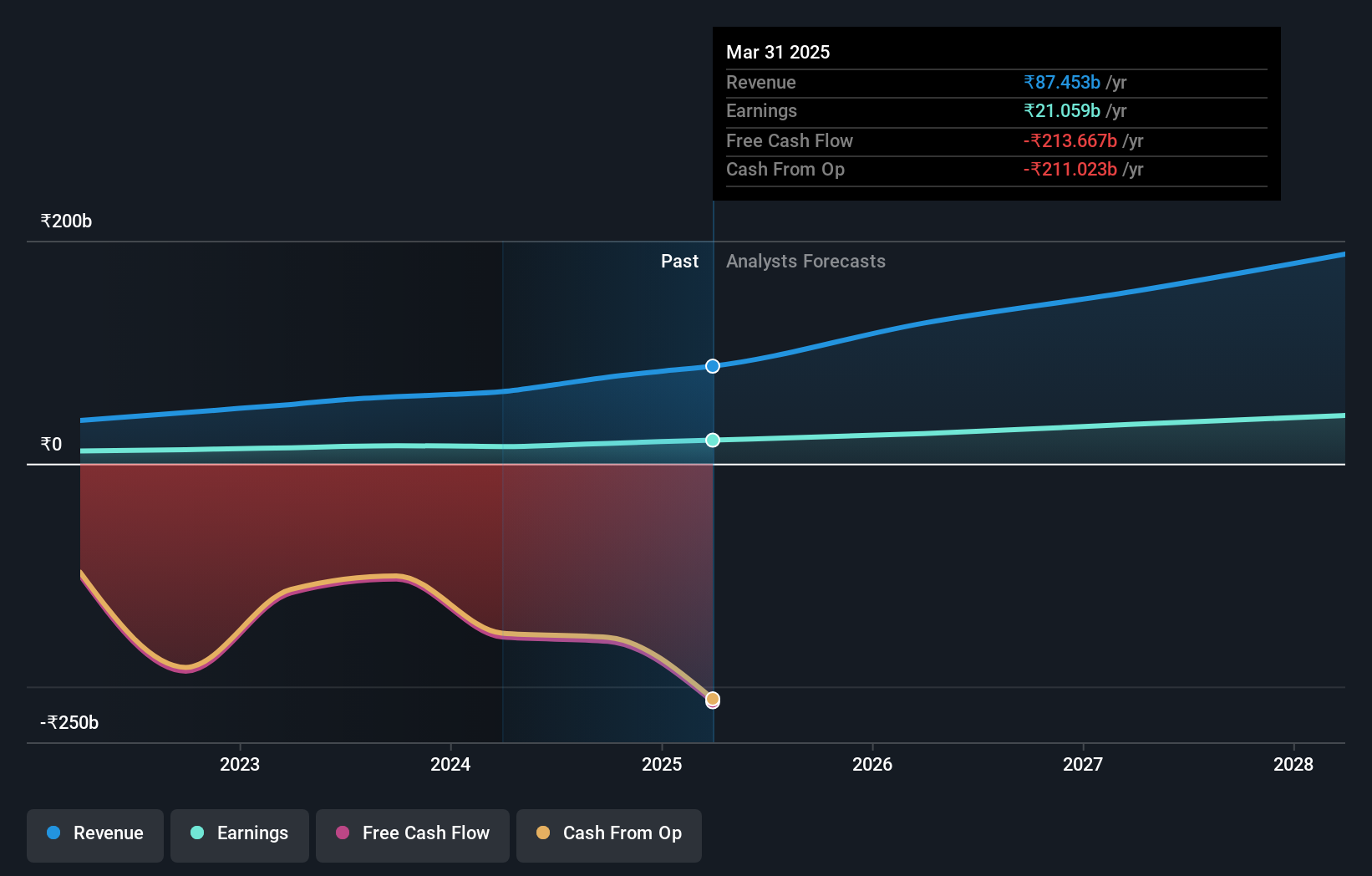

Operations: The company's revenue segments include Data Processing, which generated ₹91.38 billion.

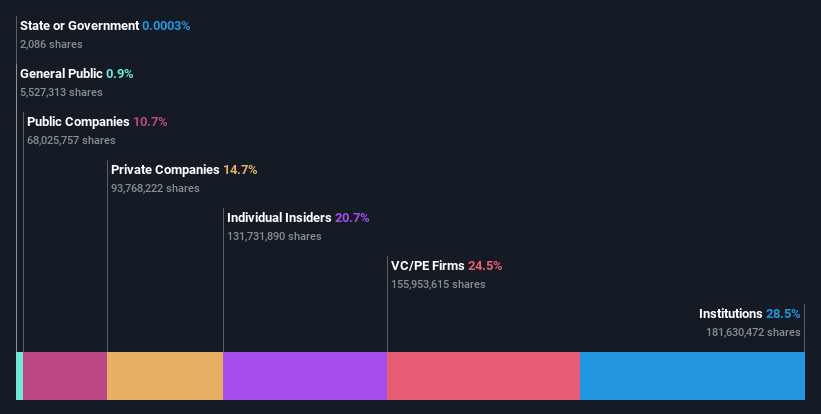

Insider Ownership: 20.7%

Earnings Growth Forecast: 63.5% p.a.

One97 Communications, the parent company of Paytm, is forecast to grow revenue at 11.1% annually and become profitable within three years. Despite a recent penalty for stamp duty non-payment, the company remains focused on its core payments and financial services. Notably, it plans to sell its entertainment ticketing business to Zomato for ₹20.48 billion, enhancing its balance sheet. A strategic partnership with FlixBus aims to expand Paytm's travel offerings significantly.

- Click to explore a detailed breakdown of our findings in One97 Communications' earnings growth report.

- Our comprehensive valuation report raises the possibility that One97 Communications is priced higher than what may be justified by its financials.

Persistent Systems (NSEI:PERSISTENT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Persistent Systems Limited offers software products, services, and technology solutions across India, North America, and internationally with a market cap of ₹771.19 billion.

Operations: The company's revenue segments include Healthcare & Life Sciences (₹23.88 billion), Software, Hi-Tech and Emerging Industries (₹46.41 billion), and Banking, Financial Services and Insurance (BFSI) (₹32.08 billion).

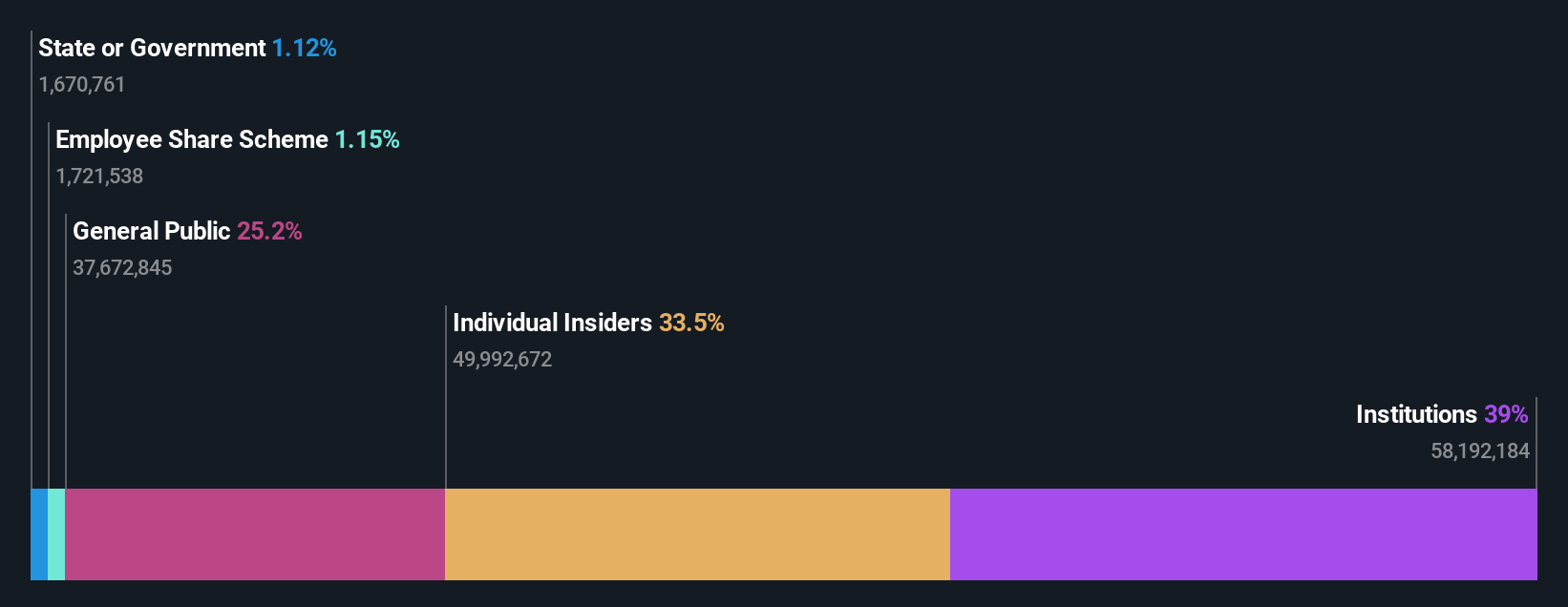

Insider Ownership: 34.3%

Earnings Growth Forecast: 19.2% p.a.

Persistent Systems is forecast to grow revenue at 13.6% annually, outpacing the Indian market's 10%. Earnings are expected to rise by 19.22% per year, also above the market average. Despite some executive changes and a reliable but low dividend of 0.5%, recent partnerships like the one with Mage Data™ enhance its data security services portfolio. The launch of GenAI Hub indicates a strong focus on innovative AI solutions, positioning Persistent for continued growth in digital transformation services.

- Take a closer look at Persistent Systems' potential here in our earnings growth report.

- Our valuation report unveils the possibility Persistent Systems' shares may be trading at a premium.

Key Takeaways

- Access the full spectrum of 95 Fast Growing Indian Companies With High Insider Ownership by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:AUBANK

AU Small Finance Bank

Engages in the provision of various banking and financial services in India.

High growth potential with excellent balance sheet.