- India

- /

- Diversified Financial

- /

- NSEI:NPST

Revenues Tell The Story For Network People Services Technologies Limited (NSE:NPST) As Its Stock Soars 26%

Network People Services Technologies Limited (NSE:NPST) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 27% over that time.

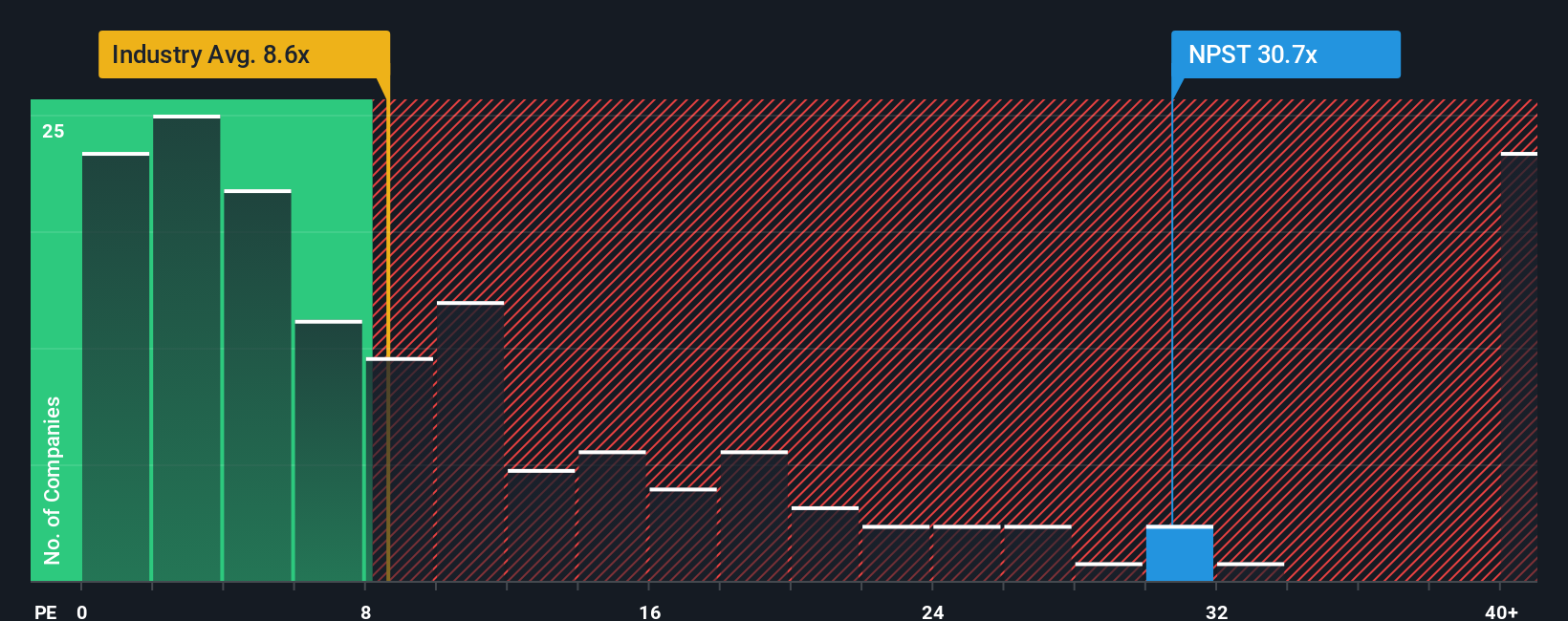

After such a large jump in price, Network People Services Technologies may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 30.7x, when you consider almost half of the companies in the Diversified Financial industry in India have P/S ratios under 8.6x and even P/S lower than 3x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Network People Services Technologies

What Does Network People Services Technologies' P/S Mean For Shareholders?

For example, consider that Network People Services Technologies' financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Network People Services Technologies will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Network People Services Technologies?

The only time you'd be truly comfortable seeing a P/S as steep as Network People Services Technologies' is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 8.6%. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

When compared to the industry's one-year growth forecast of 11%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's understandable that Network People Services Technologies' P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What Does Network People Services Technologies' P/S Mean For Investors?

The strong share price surge has lead to Network People Services Technologies' P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Network People Services Technologies maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Network People Services Technologies with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Network People Services Technologies, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Network People Services Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NPST

Network People Services Technologies

Develops payments infrastructure for banks, payment aggregators, and merchants in India.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives