- India

- /

- Capital Markets

- /

- NSEI:NBIFIN

How Much Did N.B.I. Industrial Finance's(NSE:NBIFIN) Shareholders Earn From Share Price Movements Over The Last Three Years?

As an investor its worth striving to ensure your overall portfolio beats the market average. But if you try your hand at stock picking, your risk returning less than the market. We regret to report that long term N.B.I. Industrial Finance Company Limited (NSE:NBIFIN) shareholders have had that experience, with the share price dropping 15% in three years, versus a market return of about 12%. Even worse, it's down 11% in about a month, which isn't fun at all.

See our latest analysis for N.B.I. Industrial Finance

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

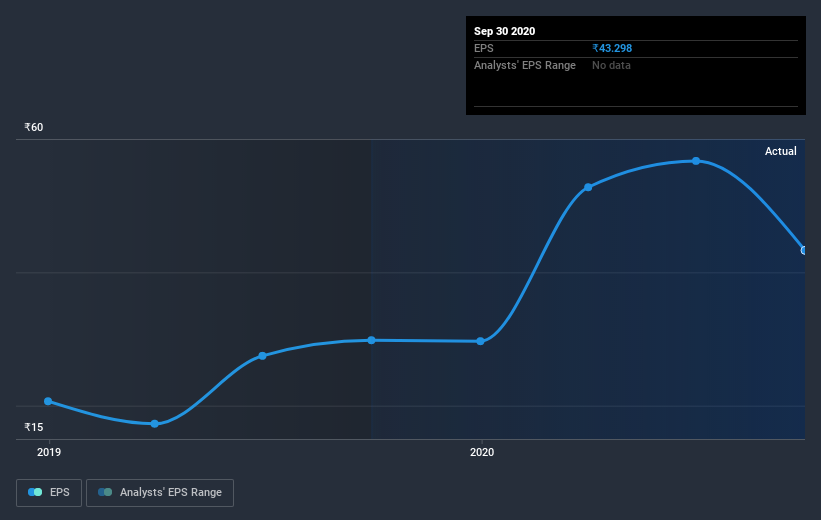

During the three years that the share price fell, N.B.I. Industrial Finance's earnings per share (EPS) dropped by 49% each year. This fall in the EPS is worse than the 5% compound annual share price fall. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

N.B.I. Industrial Finance shareholders are down 0.6% for the year, but the broader market is up 18%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. However, the loss over the last year isn't as bad as the 5% per annum loss investors have suffered over the last three years. We'd need clear signs of growth in the underlying business before we could muster much enthusiasm for this one. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with N.B.I. Industrial Finance (at least 1 which is potentially serious) , and understanding them should be part of your investment process.

We will like N.B.I. Industrial Finance better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you’re looking to trade N.B.I. Industrial Finance, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if N.B.I. Industrial Finance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:NBIFIN

N.B.I. Industrial Finance

A non-banking financial company, engages in the investing in shares and securities, and financial activities in India.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives