- India

- /

- Capital Markets

- /

- NSEI:MOTILALOFS

Why We Think The CEO Of Motilal Oswal Financial Services Limited (NSE:MOTILALOFS) May Soon See A Pay Rise

Key Insights

- Motilal Oswal Financial Services will host its Annual General Meeting on 14th of August

- Total pay for CEO Motilal Oswal includes ₹24.0m salary

- The overall pay is 61% below the industry average

- Motilal Oswal Financial Services' total shareholder return over the past three years was 216% while its EPS grew by 28% over the past three years

The solid performance at Motilal Oswal Financial Services Limited (NSE:MOTILALOFS) has been impressive and shareholders will probably be pleased to know that CEO Motilal Oswal has delivered. This would be kept in mind at the upcoming AGM on 14th of August which will be a chance for them to hear the board review the financial results, discuss future company strategy and vote on resolutions such as executive remuneration and other matters. Let's take a look at why we think the CEO has done a good job and we'll present the case for a bump in pay.

See our latest analysis for Motilal Oswal Financial Services

Comparing Motilal Oswal Financial Services Limited's CEO Compensation With The Industry

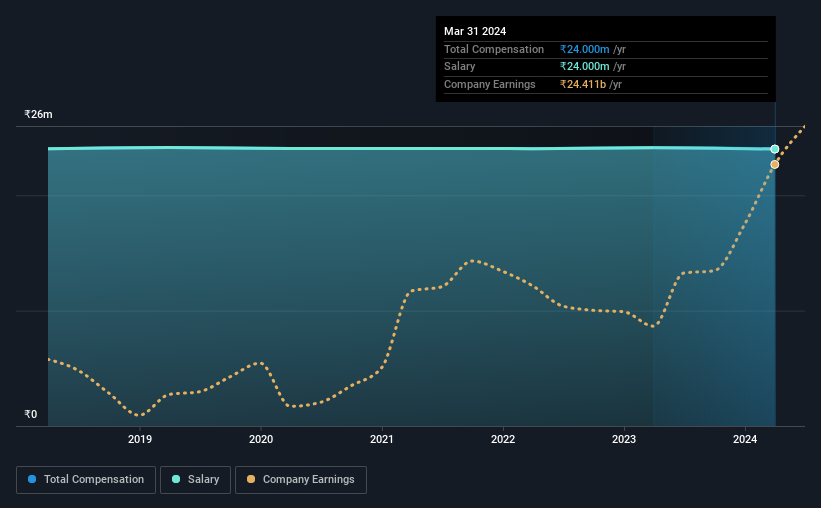

At the time of writing, our data shows that Motilal Oswal Financial Services Limited has a market capitalization of ₹364b, and reported total annual CEO compensation of ₹24m for the year to March 2024. That is, the compensation was roughly the same as last year. It is worth noting that the CEO compensation consists entirely of the salary, worth ₹24m.

On comparing similar companies from the Indian Capital Markets industry with market caps ranging from ₹168b to ₹537b, we found that the median CEO total compensation was ₹61m. In other words, Motilal Oswal Financial Services pays its CEO lower than the industry median. What's more, Motilal Oswal holds ₹119b worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | ₹24m | ₹24m | 100% |

| Other | - | ₹10k | - |

| Total Compensation | ₹24m | ₹24m | 100% |

Speaking on an industry level, all of total compensation represents salary, while non-salary remuneration is completely ignored. On a company level, Motilal Oswal Financial Services prefers to reward its CEO through a salary, opting not to pay Motilal Oswal through non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Motilal Oswal Financial Services Limited's Growth

Motilal Oswal Financial Services Limited has seen its earnings per share (EPS) increase by 28% a year over the past three years. In the last year, its revenue is up 61%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Motilal Oswal Financial Services Limited Been A Good Investment?

Most shareholders would probably be pleased with Motilal Oswal Financial Services Limited for providing a total return of 216% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Motilal Oswal Financial Services pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 2 warning signs for Motilal Oswal Financial Services (of which 1 is potentially serious!) that you should know about in order to have a holistic understanding of the stock.

Important note: Motilal Oswal Financial Services is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:MOTILALOFS

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.