- India

- /

- Capital Markets

- /

- NSEI:MOTILALOFS

Should You Be Adding Motilal Oswal Financial Services (NSE:MOTILALOFS) To Your Watchlist Today?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like Motilal Oswal Financial Services (NSE:MOTILALOFS). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Motilal Oswal Financial Services

Motilal Oswal Financial Services's Improving Profits

In the last three years Motilal Oswal Financial Services's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, Motilal Oswal Financial Services's EPS shot from ₹36.84 to ₹98.10, over the last year. You don't see 166% year-on-year growth like that, very often. That could be a sign that the business has reached a true inflection point.

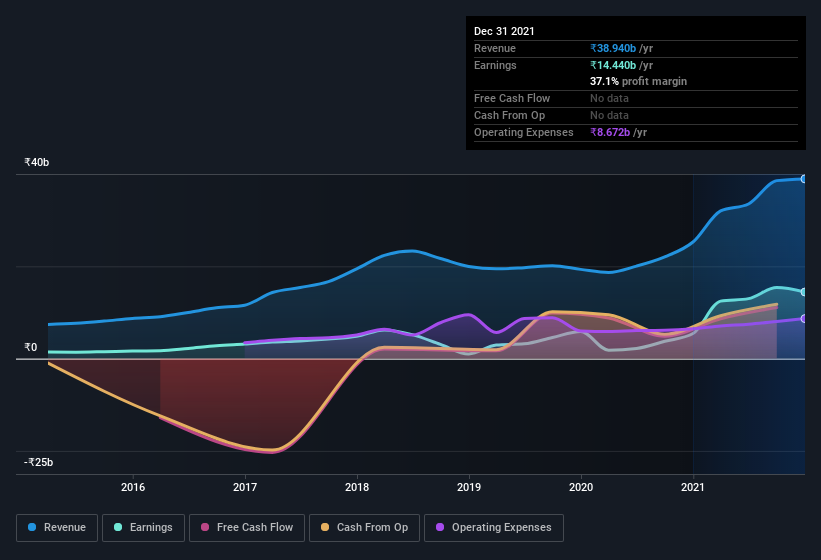

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that Motilal Oswal Financial Services's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Motilal Oswal Financial Services maintained stable EBIT margins over the last year, all while growing revenue 54% to ₹39b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Motilal Oswal Financial Services's balance sheet strength, before getting too excited.

Are Motilal Oswal Financial Services Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We do note that, in the last year, insiders sold -₹85m worth of shares. But that's far less than the ₹189m insiders spend purchasing stock. I find this encouraging because it suggests they are optimistic about the Motilal Oswal Financial Services's future. We also note that it was the Co-Founder, Motilal Oswal, who made the biggest single acquisition, paying ₹64m for shares at about ₹611 each.

The good news, alongside the insider buying, for Motilal Oswal Financial Services bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they have a glittering mountain of wealth invested in it, currently valued at ₹26b. Coming in at 19% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. Very encouraging.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Motilal Oswal, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like Motilal Oswal Financial Services with market caps between ₹75b and ₹239b is about ₹35m.

The Motilal Oswal Financial Services CEO received ₹24m in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Is Motilal Oswal Financial Services Worth Keeping An Eye On?

Motilal Oswal Financial Services's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Motilal Oswal Financial Services deserves timely attention. Before you take the next step you should know about the 3 warning signs for Motilal Oswal Financial Services (1 is potentially serious!) that we have uncovered.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Motilal Oswal Financial Services, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MOTILALOFS

Proven track record with adequate balance sheet and pays a dividend.