- India

- /

- Capital Markets

- /

- NSEI:JSWHL

Undiscovered Gems in India to Watch This September 2024

Reviewed by Simply Wall St

The Indian market has climbed 1.3% in the last 7 days, led by the Financials sector with a gain of 2.1%, while the Information Technology sector is down 3.1%. With the market up 45% over the last 12 months and earnings forecast to grow by 17% annually, identifying undiscovered gems can offer significant opportunities for investors looking to capitalize on strong sectors and emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| All E Technologies | NA | 40.78% | 31.63% | ★★★★★★ |

| Goldiam International | 0.74% | 10.81% | 15.85% | ★★★★★★ |

| Le Travenues Technology | 10.32% | 26.39% | 67.32% | ★★★★★★ |

| Bharat Rasayan | 8.15% | 0.10% | -7.93% | ★★★★★★ |

| Indo Amines | 82.32% | 17.15% | 19.98% | ★★★★★☆ |

| Om Infra | 13.99% | 43.36% | 27.66% | ★★★★★☆ |

| S J Logistics (India) | 11.71% | 90.19% | 60.29% | ★★★★★☆ |

| Ingersoll-Rand (India) | 1.05% | 14.88% | 27.54% | ★★★★★☆ |

| Monarch Networth Capital | 32.66% | 31.02% | 50.24% | ★★★★☆☆ |

| Sanstar | 50.30% | -8.41% | 48.59% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Godawari Power & Ispat (NSEI:GPIL)

Simply Wall St Value Rating: ★★★★★★

Overview: Godawari Power & Ispat Limited, along with its subsidiaries, operates in the mining of iron ores in India and has a market cap of ₹134.62 billion.

Operations: GPIL generates revenue primarily from the mining of iron ores. The company has a net profit margin of 14.50% and incurs significant costs associated with its operations, impacting overall profitability.

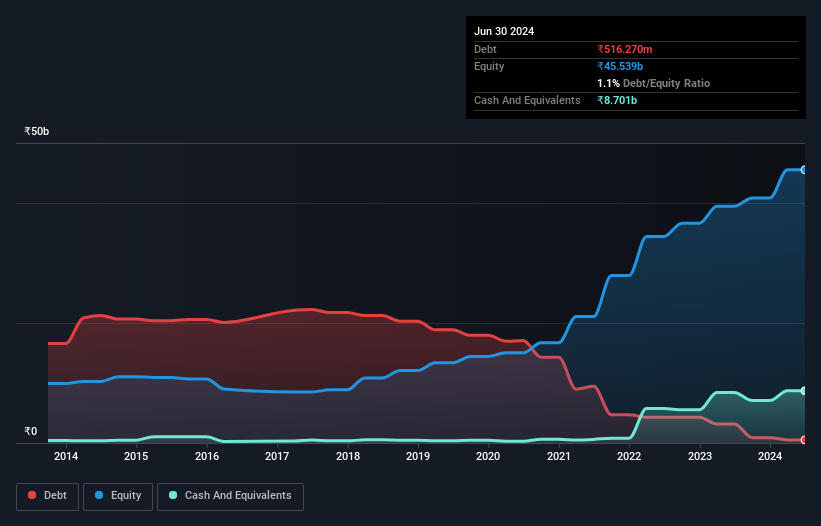

Godawari Power & Ispat (GPIL) shows impressive performance with a 42.1% earnings growth over the past year, surpassing the Metals and Mining industry's 17.8%. The company’s debt to equity ratio has reduced significantly from 141.1% to 1.1% over five years, indicating strong financial health. GPIL's price-to-earnings ratio stands at a favorable 13.6x compared to the Indian market average of 34.3x, suggesting good relative value for investors exploring this sector in India.

- Unlock comprehensive insights into our analysis of Godawari Power & Ispat stock in this health report.

Understand Godawari Power & Ispat's track record by examining our Past report.

JSW Holdings (NSEI:JSWHL)

Simply Wall St Value Rating: ★★★★★☆

Overview: JSW Holdings Limited, a non-banking financial company, primarily engages in investing and financing activities in India with a market cap of ₹100.65 billion.

Operations: JSW Holdings generates revenue primarily from investing and financing activities, amounting to ₹1.71 billion.

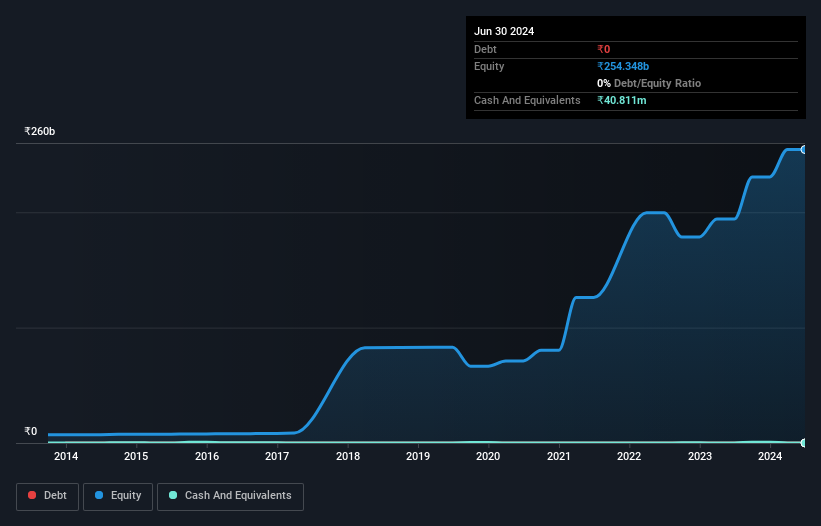

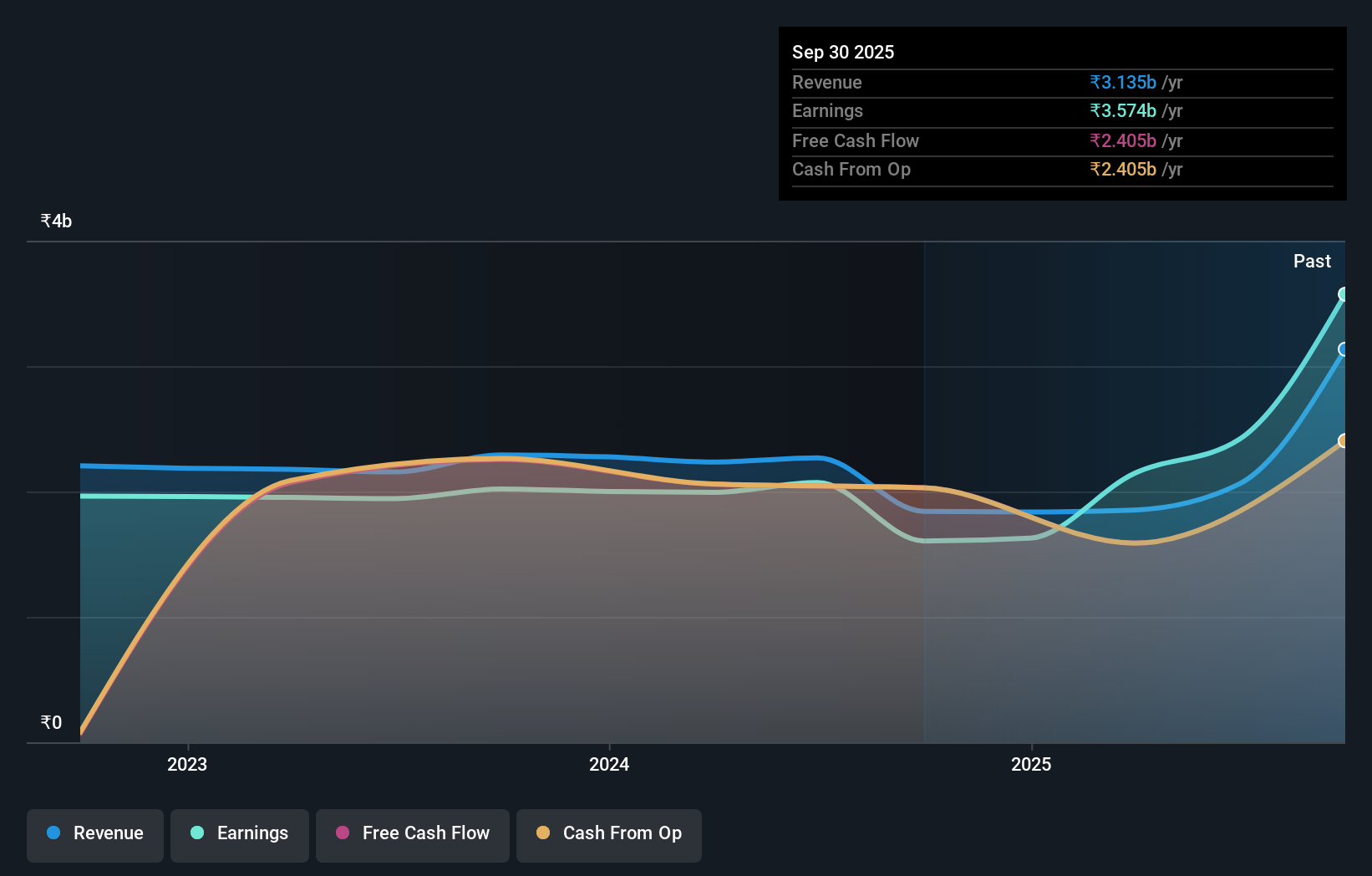

JSW Holdings, a debt-free entity, has seen its earnings drop by 47.5% over the past year, contrasting sharply with the Capital Markets industry average of 63.2%. Despite this, it remains profitable and boasts high-quality earnings. The company reported Q1 2024 revenue of ₹272 million and net income of ₹526 million compared to ₹261 million and ₹244 million respectively in Q1 2023. Recently added to the S&P Global BMI Index, JSW Holdings continues to show strong free cash flow generation at ₹912.92 million as of September 2023.

- Click here and access our complete health analysis report to understand the dynamics of JSW Holdings.

Evaluate JSW Holdings' historical performance by accessing our past performance report.

Maharashtra Scooters (NSEI:MAHSCOOTER)

Simply Wall St Value Rating: ★★★★★☆

Overview: Maharashtra Scooters Ltd. manufactures and sells pressure die casting dies, jigs, fixtures, and die casting components primarily for the two and three-wheeler industry in India with a market cap of ₹141.63 billion.

Operations: Maharashtra Scooters Ltd. generates revenue primarily from investments (₹2.14 billion) and manufacturing activities (₹108.10 million).

Maharashtra Scooters, a small cap with high-quality earnings, has seen its earnings grow 19.3% annually over the past five years. Despite not outperforming the Capital Markets industry last year, it remains debt-free for five years and reported impressive net income of ₹82.6 million in Q1 2024 compared to ₹4.8 million a year ago. The company declared an interim dividend of ₹110 per share and recently appointed Jasmine Chaney as an independent director, enhancing its governance structure.

- Delve into the full analysis health report here for a deeper understanding of Maharashtra Scooters.

Assess Maharashtra Scooters' past performance with our detailed historical performance reports.

Make It Happen

- Click here to access our complete index of 476 Indian Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:JSWHL

JSW Holdings

A non-banking financial company, primarily engages in investing and financing activities in India.

Solid track record with excellent balance sheet.