- India

- /

- Metals and Mining

- /

- NSEI:GPIL

Undiscovered Gems in India to Watch This September 2024

Reviewed by Simply Wall St

In the last week, the Indian market has stayed flat, although it is up 44% over the past year and earnings are expected to grow by 17% per annum over the next few years. In this context, identifying stocks with strong fundamentals and growth potential can be particularly rewarding for investors looking to capitalize on these favorable conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Vidhi Specialty Food Ingredients | 7.27% | 11.00% | 4.02% | ★★★★★★ |

| Yuken India | 27.96% | 12.35% | -44.41% | ★★★★★★ |

| NGL Fine-Chem | 12.95% | 15.22% | 8.68% | ★★★★★★ |

| TCPL Packaging | 95.84% | 15.51% | 31.89% | ★★★★★☆ |

| S J Logistics (India) | 11.71% | 90.19% | 60.29% | ★★★★★☆ |

| Nibe | 39.26% | 80.75% | 84.69% | ★★★★★☆ |

| KP Green Engineering | 13.73% | 47.44% | 61.28% | ★★★★★☆ |

| Kalyani Investment | NA | 20.74% | 6.35% | ★★★★★☆ |

| Sanstar | 50.30% | -8.41% | 48.59% | ★★★★☆☆ |

| SG Mart | 16.77% | 98.09% | 96.54% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Godawari Power & Ispat (NSEI:GPIL)

Simply Wall St Value Rating: ★★★★★★

Overview: Godawari Power & Ispat Limited, along with its subsidiaries, is involved in iron ore mining in India and has a market cap of ₹134.62 billion.

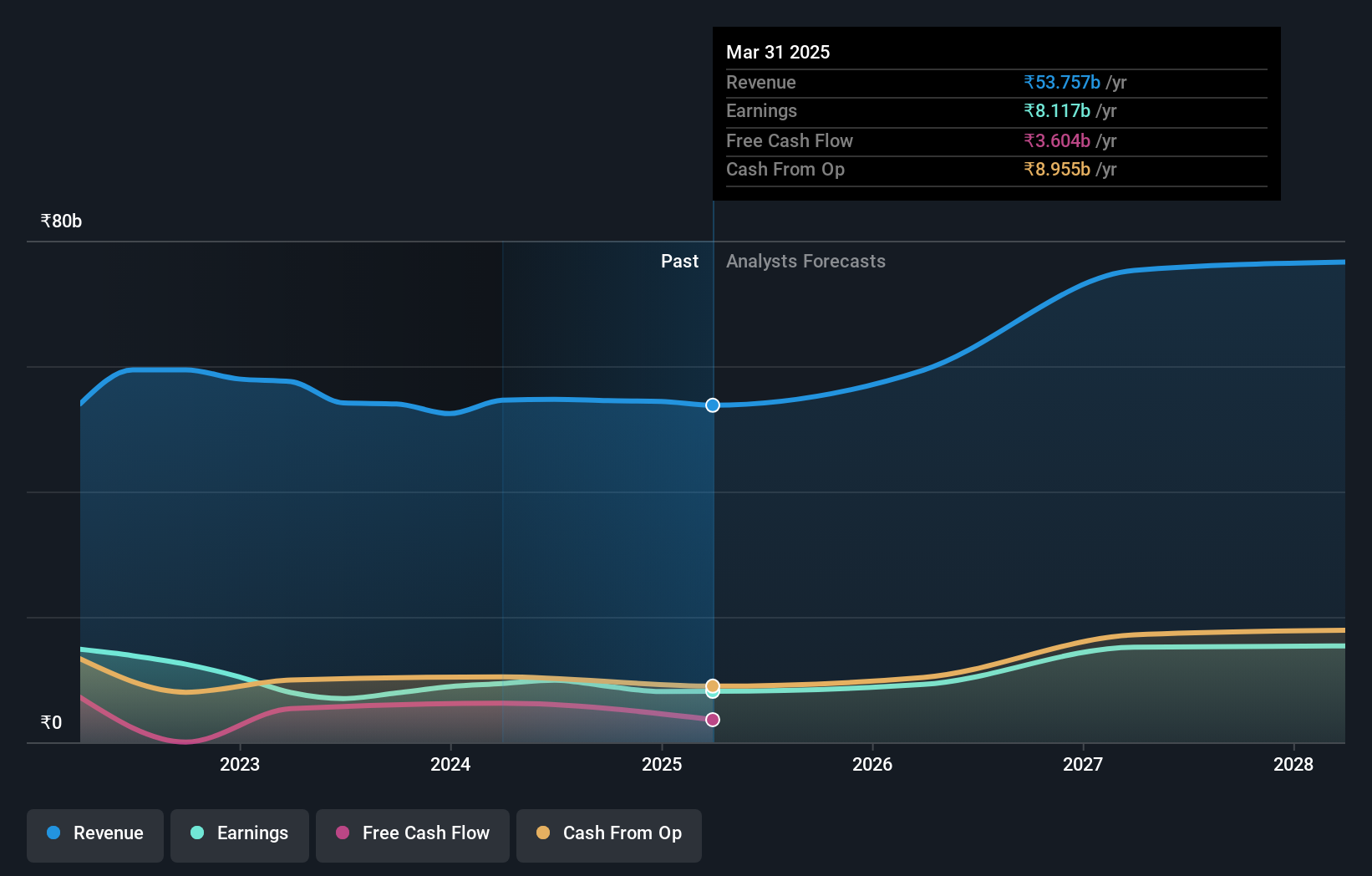

Operations: GPIL generates revenue primarily through iron ore mining activities. The company's net profit margin has shown significant fluctuations, with recent figures at 20.45%.

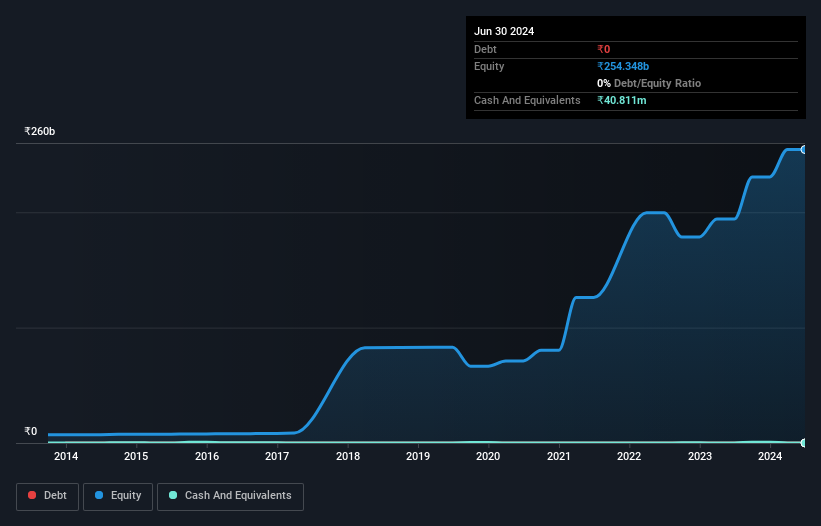

Godawari Power & Ispat (GPIL) has shown impressive financial health, with a debt-to-equity ratio plummeting from 141.1% to 1.1% over five years, and earnings growth of 42.1% in the past year outpacing the industry average of 17.8%. Trading at a P/E ratio of 13.6x, it's undervalued compared to the Indian market's 34.3x. Recent events include a special dividend announcement and approval for expanding its pellet plant capacity by an additional two million tons.

JSW Holdings (NSEI:JSWHL)

Simply Wall St Value Rating: ★★★★★☆

Overview: JSW Holdings Limited, a non-banking financial company, primarily engages in investing and financing activities in India and has a market cap of ₹100.65 billion.

Operations: JSW Holdings generates revenue primarily from its investing and financing activities, amounting to ₹1.71 billion.

JSW Holdings, a debt-free company for the past five years, reported earnings growth of INR 525.81 million in Q1 2024, significantly up from INR 243.57 million last year. Despite experiencing a negative earnings growth of -47.5% over the past year compared to the Capital Markets industry average of 63.2%, it remains profitable with high-quality earnings and positive free cash flow at INR 912.92 million as of September 2023. Recently added to the S&P Global BMI Index, JSW Holdings continues to attract attention in financial circles.

- Get an in-depth perspective on JSW Holdings' performance by reading our health report here.

Gain insights into JSW Holdings' past trends and performance with our Past report.

Maharashtra Scooters (NSEI:MAHSCOOTER)

Simply Wall St Value Rating: ★★★★★☆

Overview: Maharashtra Scooters Ltd. manufactures and sells pressure die casting dies, jigs, fixtures, and die casting components primarily for the two and three-wheeler industry in India with a market cap of ₹141.63 billion.

Operations: Maharashtra Scooters Ltd. generates revenue primarily from investments (₹2.14 billion) and manufacturing activities (₹108.10 million).

Maharashtra Scooters has shown consistent growth with earnings increasing 19.3% annually over the past five years. Despite not outperforming the Capital Markets industry last year, its debt-free status for five years and high-quality earnings highlight its financial stability. The company declared an interim dividend of ₹110 per share, reflecting strong shareholder returns. Recent board changes include the resignation of Anish Amin and new appointments like Jasmine Arish Chaney, indicating a dynamic leadership team.

Taking Advantage

- Gain an insight into the universe of 476 Indian Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:GPIL

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives