- India

- /

- Capital Markets

- /

- NSEI:IITL

The 10% return this week takes Industrial Investment Trust's (NSE:IITL) shareholders five-year gains to 262%

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. For instance, the price of Industrial Investment Trust Limited (NSE:IITL) stock is up an impressive 262% over the last five years. It's also good to see the share price up 20% over the last quarter.

Since it's been a strong week for Industrial Investment Trust shareholders, let's have a look at trend of the longer term fundamentals.

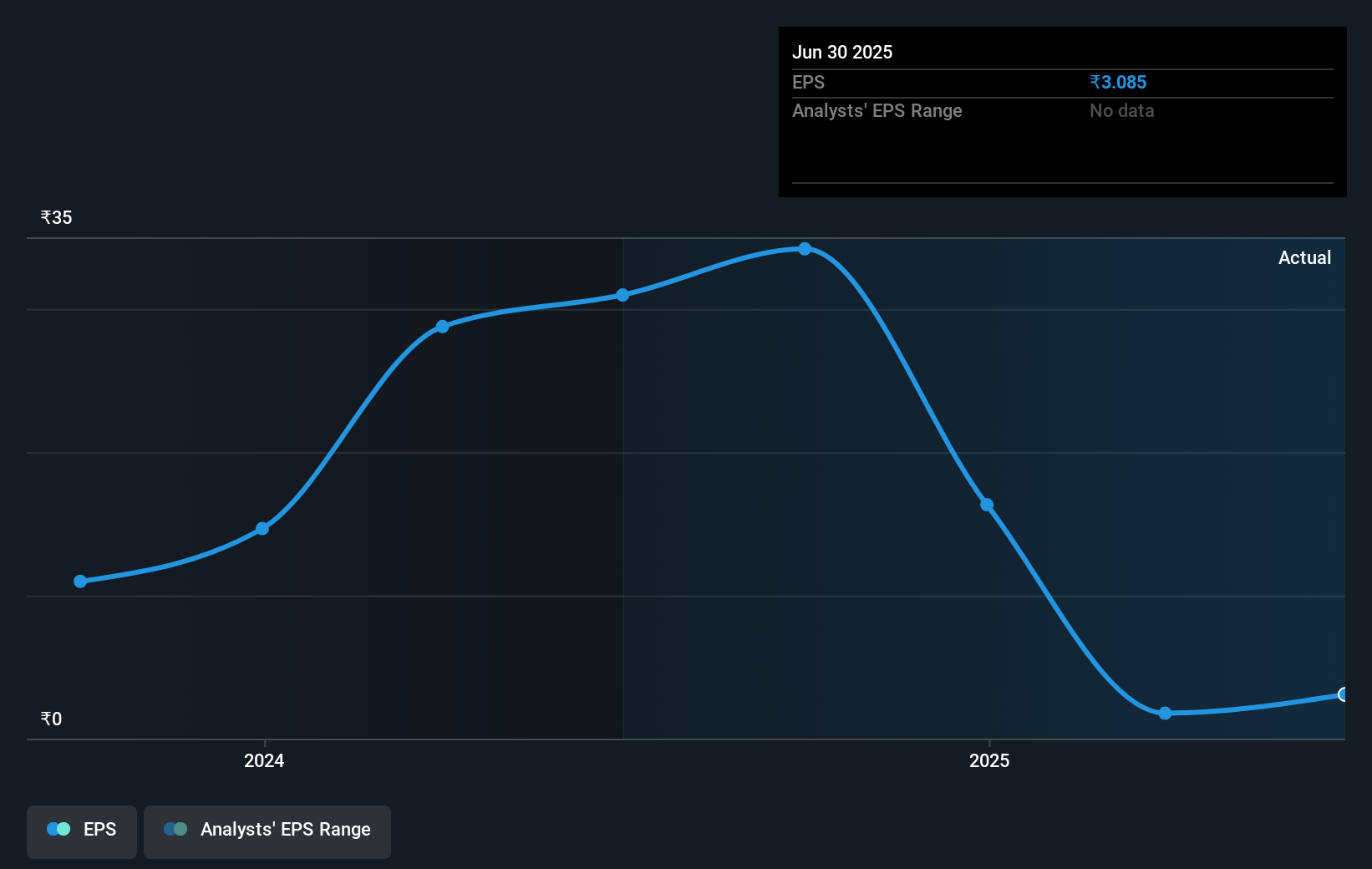

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last half decade, Industrial Investment Trust became profitable. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on Industrial Investment Trust's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

We regret to report that Industrial Investment Trust shareholders are down 34% for the year. Unfortunately, that's worse than the broader market decline of 7.9%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 29% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Industrial Investment Trust better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Industrial Investment Trust you should know about.

Of course Industrial Investment Trust may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:IITL

Industrial Investment Trust

A non-banking financial company, engages in the investment activities in India.

Adequate balance sheet with low risk.

Market Insights

Community Narratives