- India

- /

- Tech Hardware

- /

- NSEI:NETWEB

Undiscovered Gems in India To Watch This August 2024

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has risen 3.4%, driven by gains in every sector, and is up 44% over the last 12 months with earnings forecast to grow by 17% annually. In this thriving environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding for investors looking to capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wealth First Portfolio Managers | NA | -47.95% | 40.47% | ★★★★★★ |

| Vidhi Specialty Food Ingredients | 7.27% | 11.00% | 4.02% | ★★★★★★ |

| Yuken India | 27.96% | 12.35% | -44.41% | ★★★★★★ |

| NGL Fine-Chem | 12.95% | 15.22% | 8.68% | ★★★★★★ |

| AGI Infra | 61.29% | 29.12% | 33.44% | ★★★★★★ |

| Knowledge Marine & Engineering Works | 35.48% | 46.55% | 46.96% | ★★★★★★ |

| Bengal & Assam | 4.48% | 1.54% | 51.11% | ★★★★★☆ |

| Gallantt Ispat | 18.85% | 37.56% | 37.26% | ★★★★★☆ |

| Indo Tech Transformers | 2.30% | 22.04% | 60.31% | ★★★★★☆ |

| Master Trust | 37.05% | 27.57% | 41.99% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

EPACK Durable (NSEI:EPACK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: EPACK Durable Limited manufactures original design room air conditioners in India and has a market cap of approximately ₹24.29 billion.

Operations: EPACK Durable's primary revenue stream is the manufacturing of electronic goods, generating ₹17.57 billion.

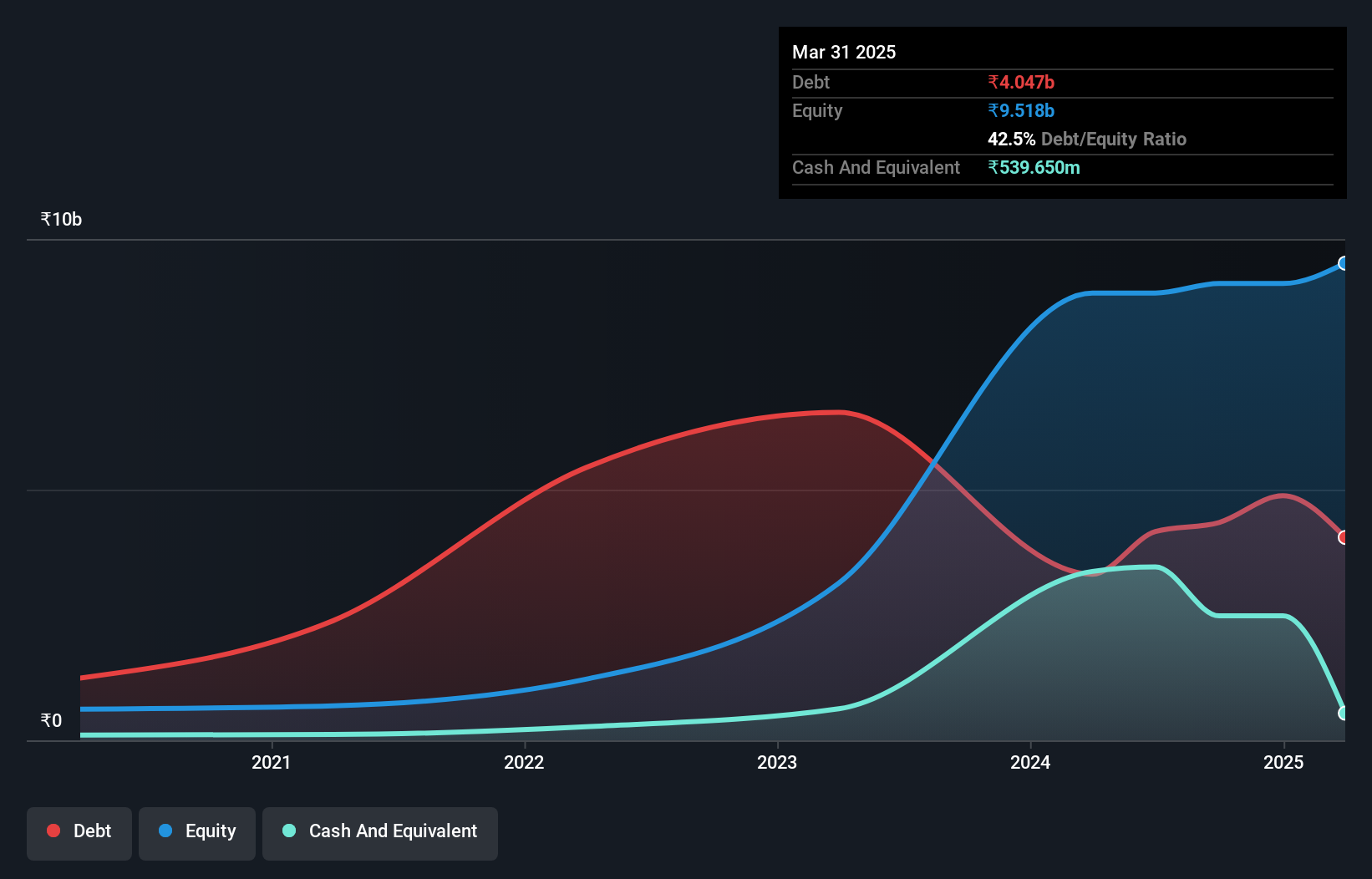

EPACK Durable, a promising player in the consumer durables sector, has shown impressive earnings growth of 43.3% over the past year, outpacing industry averages. With a net debt to equity ratio at 7.9%, its financial health appears satisfactory. The company's recent Q1 results highlight strong performance with sales reaching INR 7.74 billion and net income at INR 234 million compared to last year's INR 87 million. However, interest payments are not well covered by EBIT (2.3x coverage).

- Click here and access our complete health analysis report to understand the dynamics of EPACK Durable.

Explore historical data to track EPACK Durable's performance over time in our Past section.

IIFL Securities (NSEI:IIFLSEC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: IIFL Securities Limited offers a range of capital market services in India's primary and secondary markets with a market cap of ₹80.27 billion.

Operations: IIFL Securities Limited generates revenue primarily from capital market activities (₹20.25 billion), with additional income from facilities and ancillary services (₹375.25 million) and insurance broking and ancillary services (₹2.77 billion).

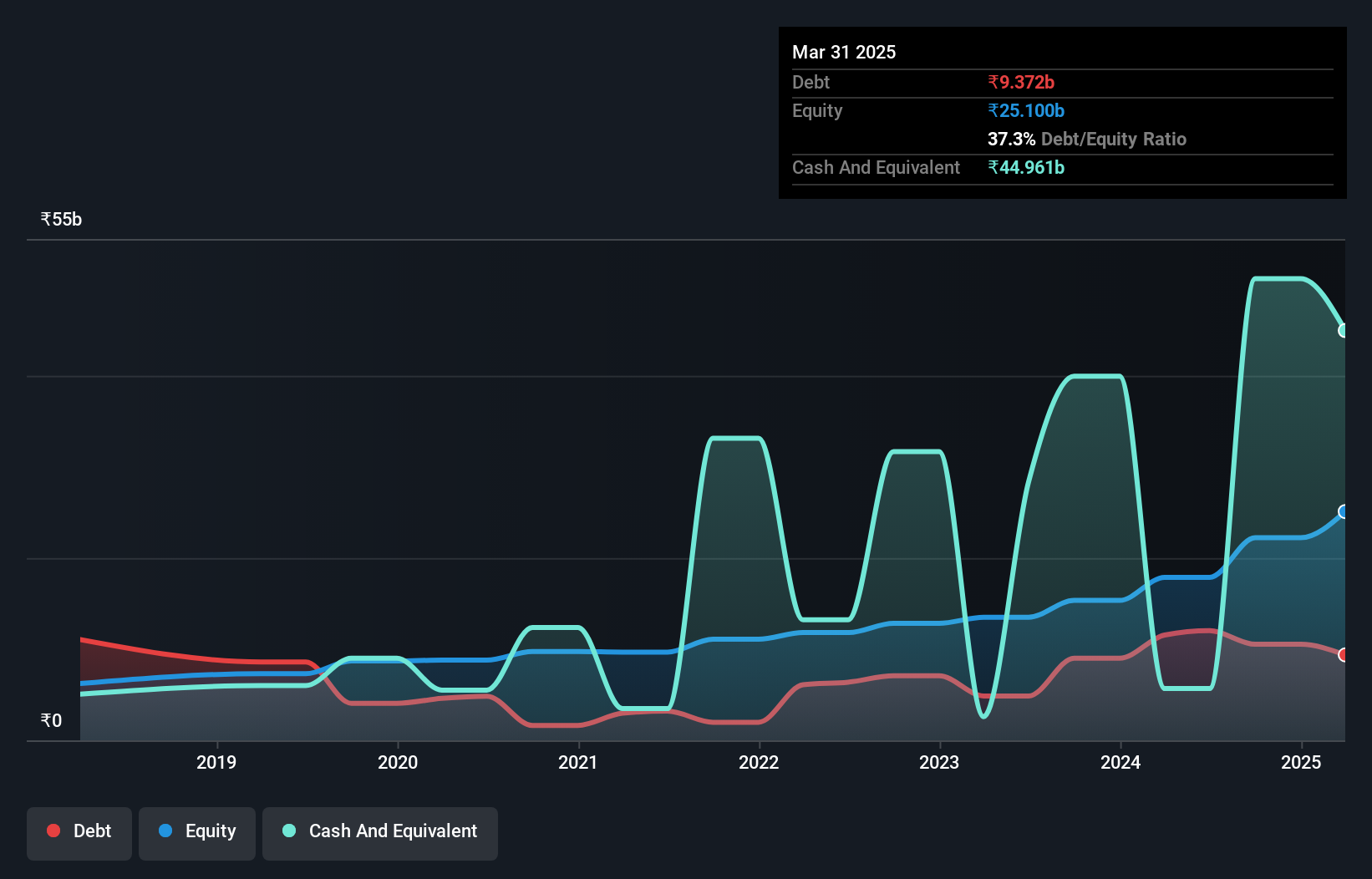

IIFL Securities, a key player in India's financial sector, has seen impressive growth with earnings surging 120.4% over the past year. The firm's price-to-earnings ratio stands at 13x, notably below the Indian market average of 33.7x. Despite a satisfactory net debt to equity ratio of 35.5%, recent regulatory scrutiny resulted in a ₹300K penalty from SEBI for technical errors in client data mapping. Additionally, IIFL's debt to equity ratio improved significantly from 117.6% to 67.2% over five years, reflecting prudent financial management amidst industry challenges and opportunities for further growth under new leadership appointments like CTO Hardik Sanghavi and Joint CEOs Raghav Gupta and Prakash Bulusu.

- Click to explore a detailed breakdown of our findings in IIFL Securities' health report.

Assess IIFL Securities' past performance with our detailed historical performance reports.

Netweb Technologies India (NSEI:NETWEB)

Simply Wall St Value Rating: ★★★★★★

Overview: Netweb Technologies India Limited designs, manufactures, and sells high-end computing solutions (HCS) in India with a market cap of ₹140.21 billion.

Operations: Netweb Technologies India Limited generates revenue primarily from the manufacturing and sale of computer servers, amounting to ₹8.14 billion.

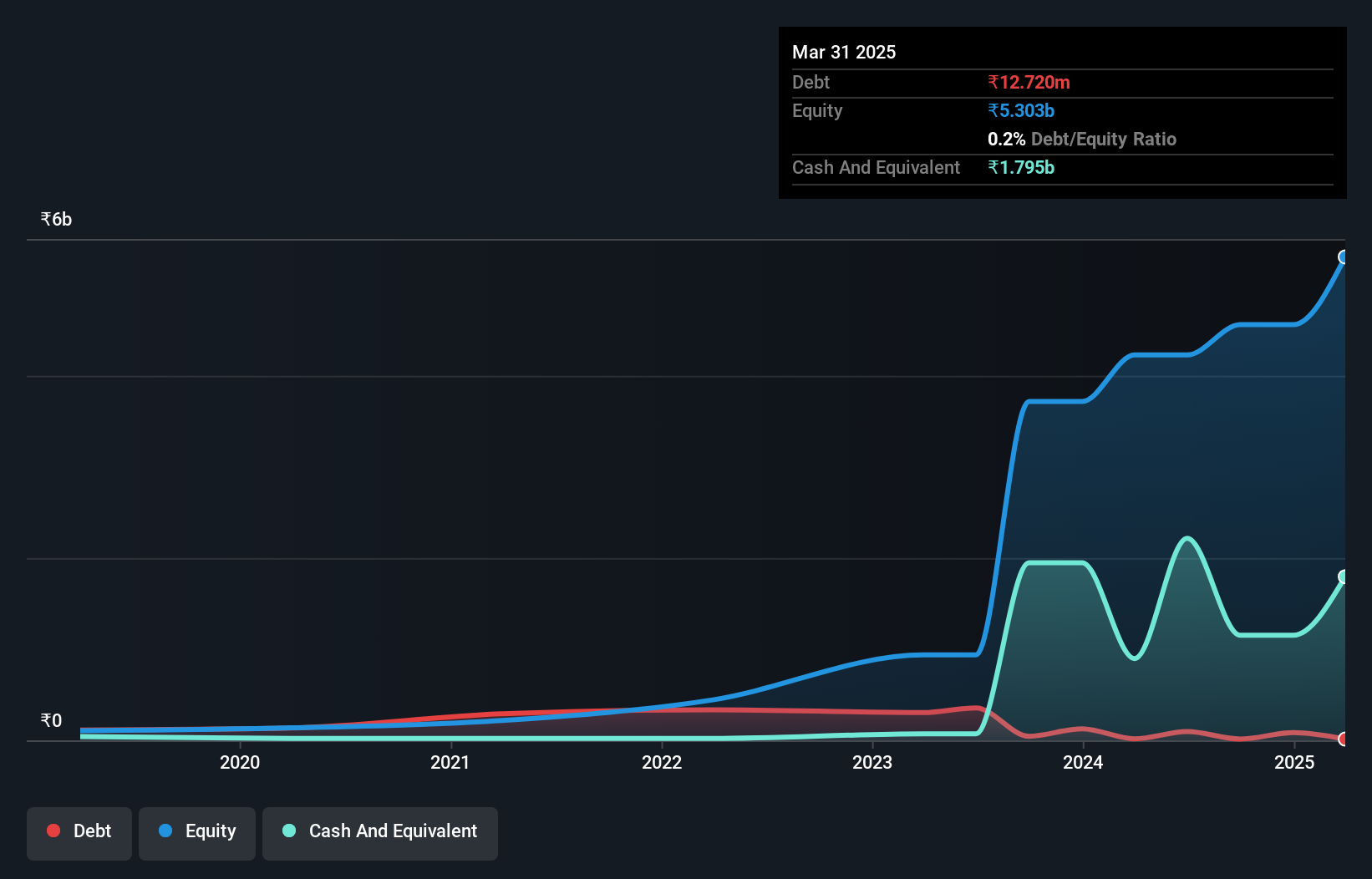

Netweb Technologies India has shown significant progress, with earnings growing 85.8% over the past year, surpassing the Tech industry’s 10.2%. The debt to equity ratio improved dramatically from 108% to 2.3% in five years, indicating strong financial health. Recent Q1 results reported net income of INR 154.44 million compared to INR 50.91 million a year ago, alongside a new server range launch supporting up to 256 cores and aligning with India's Make-in-India initiative.

Make It Happen

- Take a closer look at our Indian Undiscovered Gems With Strong Fundamentals list of 467 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netweb Technologies India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:NETWEB

Netweb Technologies India

Designs, manufactures, and sells high-end computing solutions in India.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives