- India

- /

- Capital Markets

- /

- NSEI:IIFLCAPS

Undiscovered Gems in India to Watch This August 2024

Reviewed by Simply Wall St

The Indian market has shown impressive strength, climbing by 2.6% over the past week and 44% over the last year, with every sector experiencing gains. In such a robust environment where earnings are forecast to grow by 17% annually, identifying undiscovered gems that offer strong growth potential can be particularly rewarding for investors.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NGL Fine-Chem | 12.95% | 15.22% | 8.68% | ★★★★★★ |

| Knowledge Marine & Engineering Works | 35.48% | 46.55% | 46.96% | ★★★★★★ |

| AGI Infra | 61.29% | 29.12% | 33.44% | ★★★★★★ |

| Network People Services Technologies | 0.24% | 81.82% | 86.36% | ★★★★★☆ |

| Genesys International | 12.13% | 15.75% | 36.33% | ★★★★★☆ |

| JSW Holdings | NA | 21.35% | 22.41% | ★★★★★☆ |

| Apollo Micro Systems | 38.51% | 10.59% | 11.93% | ★★★★☆☆ |

| SG Mart | 16.77% | 98.09% | 96.54% | ★★★★☆☆ |

| Vasa Denticity | 0.11% | 38.37% | 48.77% | ★★★★☆☆ |

| Abans Holdings | 91.77% | 13.13% | 18.72% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

IIFL Securities (NSEI:IIFLSEC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: IIFL Securities Limited offers capital market services in India's primary and secondary markets and has a market cap of ₹78.48 billion.

Operations: IIFL Securities generates revenue primarily from capital market activities (₹20.25 billion) and insurance broking and ancillary services (₹2.77 billion). It also earns a smaller portion from facilities and ancillary services (₹375.25 million).

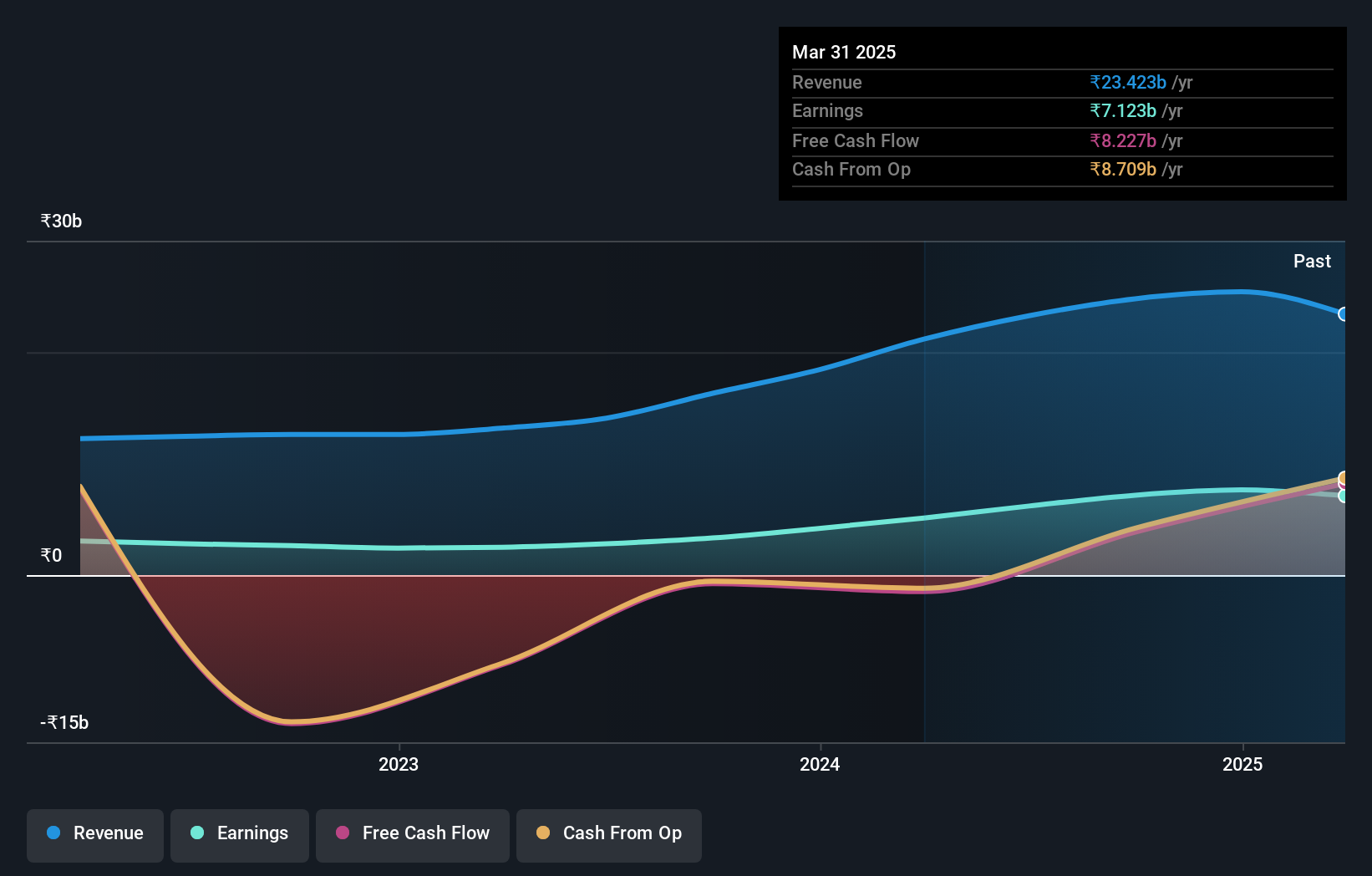

IIFL Securities has shown impressive earnings growth of 120.4% over the past year, outpacing the Capital Markets industry’s 64%. The debt to equity ratio improved significantly from 117.6% to 67.2% in five years, with a satisfactory net debt to equity ratio of 35.5%. Despite high volatility in its share price recently, IIFLSEC offers good value with a P/E ratio of 12.7x compared to the Indian market's 33.1x and reported revenue for Q1 FY2025 at INR 6.44 billion (US$77 million).

- Get an in-depth perspective on IIFL Securities' performance by reading our health report here.

Examine IIFL Securities' past performance report to understand how it has performed in the past.

Netweb Technologies India (NSEI:NETWEB)

Simply Wall St Value Rating: ★★★★★★

Overview: Netweb Technologies India Limited designs, manufactures, and sells high-end computing solutions (HCS) in India with a market cap of ₹141.23 billion.

Operations: The primary revenue stream for Netweb Technologies India Limited comes from the manufacturing and sale of computer servers, generating ₹8.14 billion.

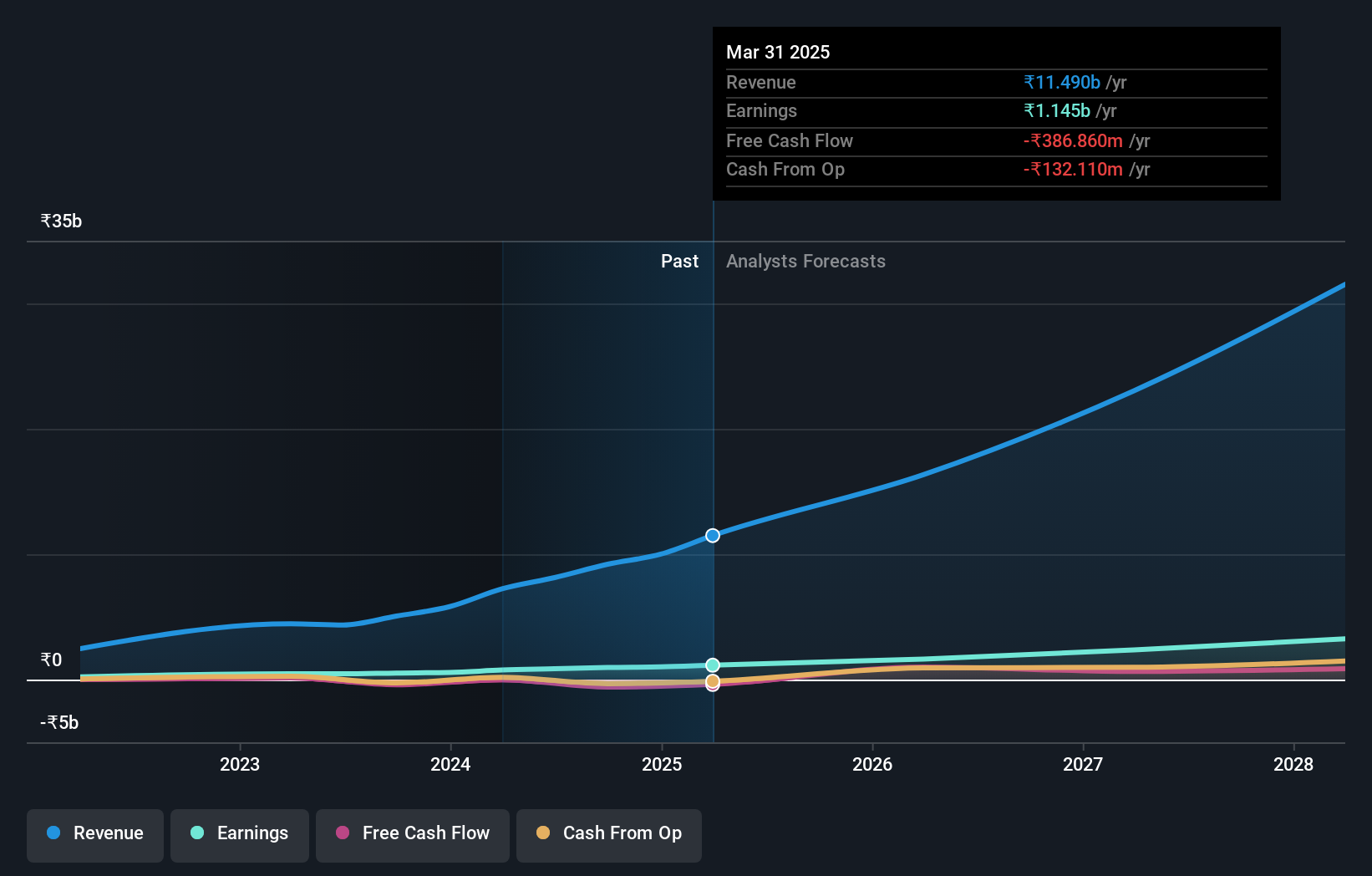

Netweb Technologies India has shown remarkable growth, with earnings increasing by 85.8% over the past year, outpacing the Tech industry’s 10.2%. The company's debt to equity ratio significantly reduced from 108% to 2.3% in five years, indicating a stronger balance sheet. Recent quarterly results reported sales of ₹1.49 billion and net income of ₹154 million compared to last year's ₹598 million and ₹51 million respectively. Their new server range aligns with India's Make-in-India initiative, enhancing their market position in high-performance computing environments.

Platinum Industries (NSEI:PLATIND)

Simply Wall St Value Rating: ★★★★★☆

Overview: Platinum Industries Limited manufactures and sells poly vinyl chloride (PVC) stabilizers, chlorinated polyvinyl chloride (CPVC) additives, and lubricants in India and internationally with a market cap of ₹22.53 billion.

Operations: Platinum Industries generates revenue primarily from its PVC and CPVC additives and related products, amounting to ₹3.06 billion. The company's market cap stands at ₹22.53 billion.

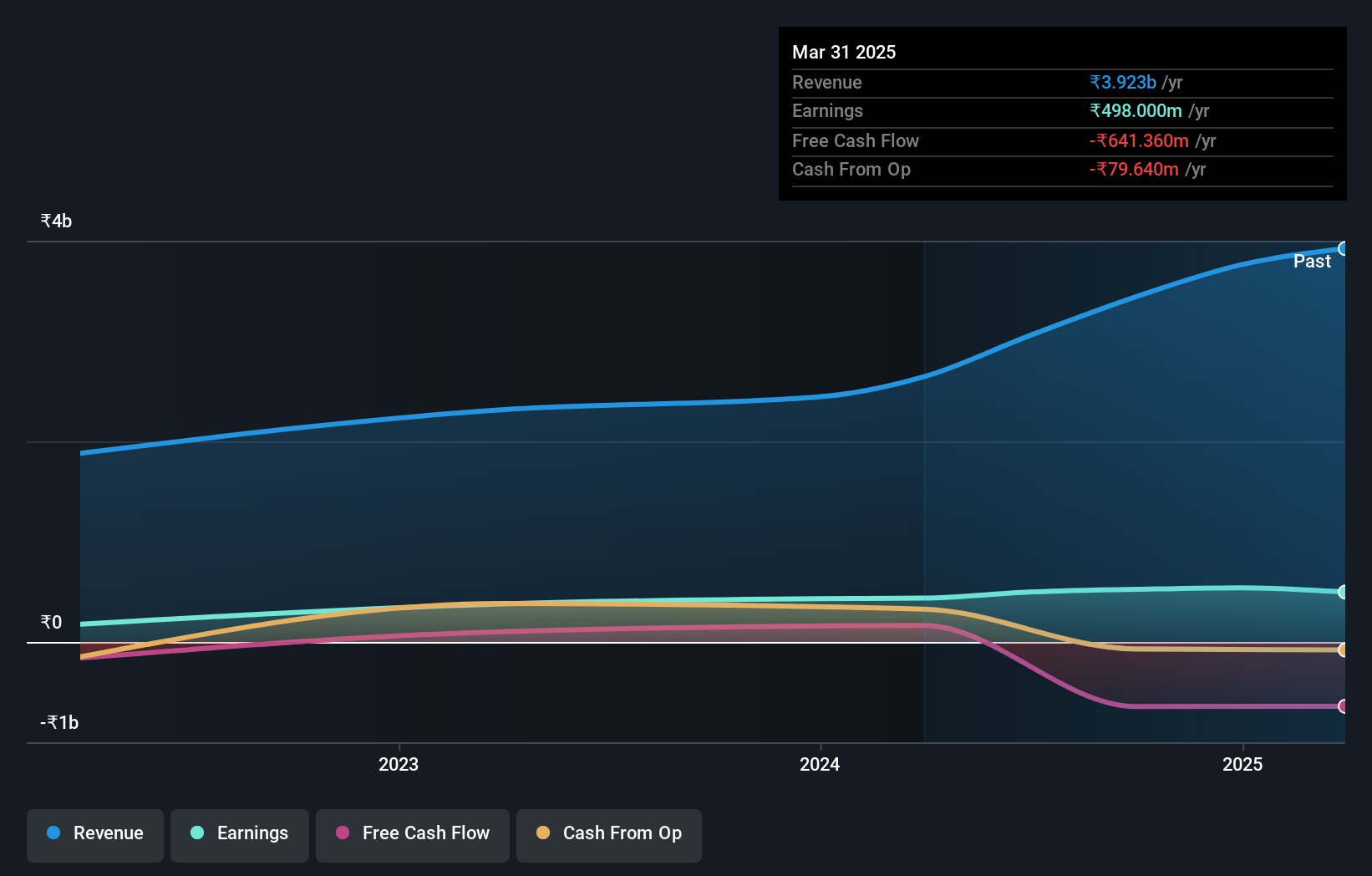

Platinum Industries has shown impressive earnings growth of 25.5% over the past year, outpacing the Chemicals industry average of 10.7%. The company reported a net income of INR 175.17 million for Q1 2024, with basic and diluted earnings per share at INR 3.19 each. Additionally, their EBIT covers interest payments by a substantial margin (26.4x). Despite recent volatility in its share price, Platinum Industries appears to have high-quality earnings and more cash than total debt.

- Click here and access our complete health analysis report to understand the dynamics of Platinum Industries.

Evaluate Platinum Industries' historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Investigate our full lineup of 463 Indian Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:IIFLCAPS

IIFL Capital Services

Provides capital market services in the primary and secondary markets in India.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives