Over the last 7 days, the Indian market has experienced a 3.6% decline, yet it has impressively risen by 40% over the past year with earnings forecasted to grow by 17% annually. In this dynamic environment, identifying stocks that combine strong fundamentals with growth potential could uncover promising opportunities for investors seeking to explore undiscovered gems in India.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Vidhi Specialty Food Ingredients | 7.27% | 11.00% | 4.02% | ★★★★★★ |

| Kokuyo Camlin | 27.11% | 23.20% | 75.70% | ★★★★★★ |

| AGI Infra | 61.29% | 29.16% | 33.44% | ★★★★★★ |

| Focus Lighting and Fixtures | 12.21% | 36.42% | 77.11% | ★★★★★☆ |

| S J Logistics (India) | 11.71% | 90.19% | 60.29% | ★★★★★☆ |

| Piccadily Agro Industries | 50.57% | 13.86% | 42.85% | ★★★★★☆ |

| Kaycee Industries | 17.35% | 19.50% | 34.62% | ★★★★★☆ |

| Nibe | 39.26% | 80.75% | 84.69% | ★★★★★☆ |

| Avantel | 5.92% | 33.98% | 37.33% | ★★★★★☆ |

| Insolation Energy | 88.64% | 163.87% | 419.31% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

IIFL Securities (NSEI:IIFLSEC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: IIFL Securities Limited operates in the primary and secondary capital markets in India, with a market capitalization of ₹122.23 billion.

Operations: IIFL Securities generates revenue primarily from capital market activities, contributing ₹20.25 billion, and also earns from insurance broking and ancillary services at ₹2.77 billion. The company's revenue model is diversified across these segments, with capital market activities being the dominant source of income.

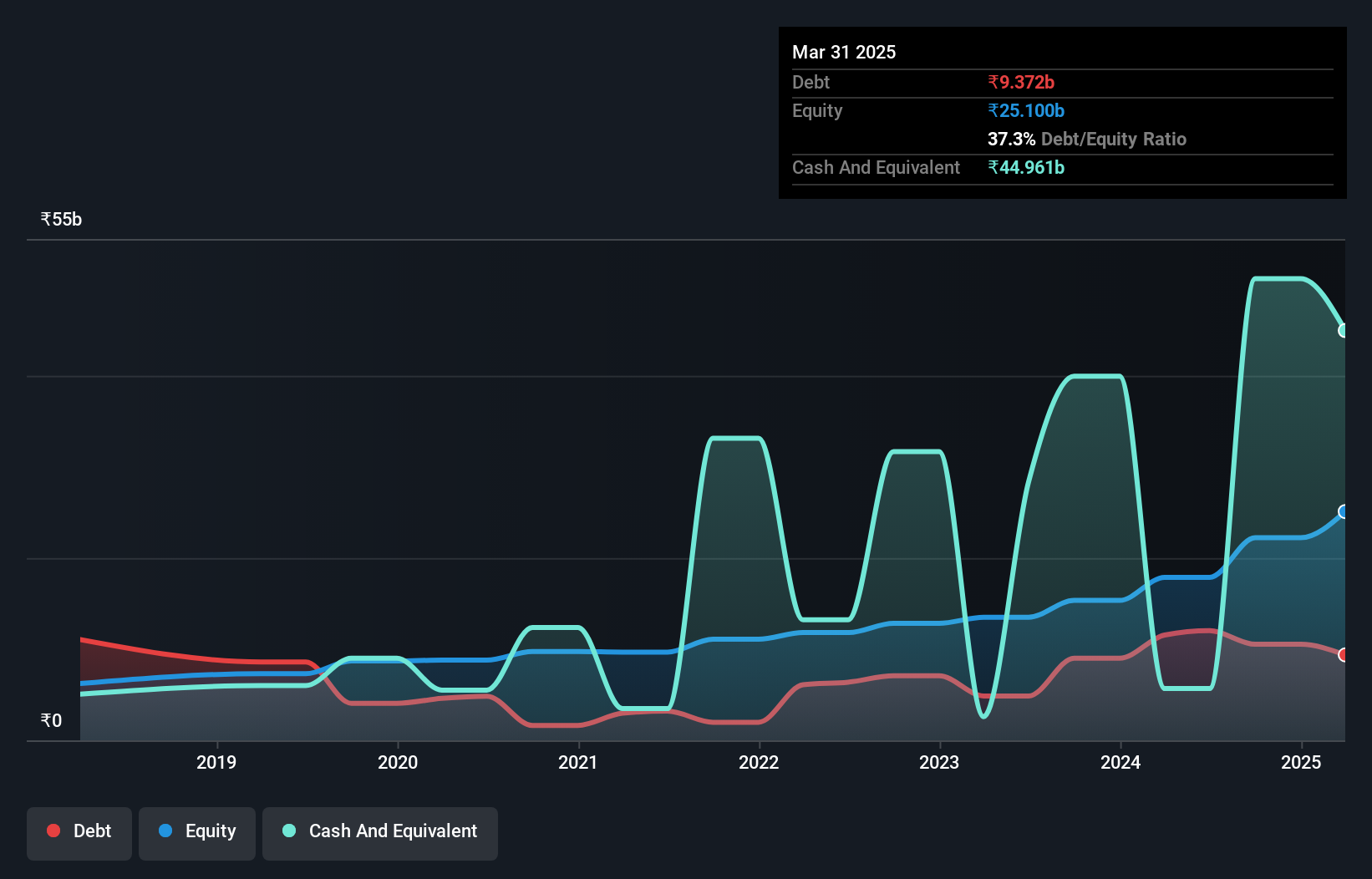

IIFL Securities, a dynamic player in India's financial sector, showcases promising growth with earnings surging by 120% last year, outpacing the industry's 63%. Their net debt to equity ratio stands at a satisfactory 35.5%, down from 117.6% five years ago. Despite recent volatility in share prices and regulatory challenges, the company's price-to-earnings ratio of 19.7x remains attractive compared to the broader Indian market's 33.8x, signaling potential value for investors seeking opportunities in emerging markets.

- Click here to discover the nuances of IIFL Securities with our detailed analytical health report.

Gain insights into IIFL Securities' past trends and performance with our Past report.

KRN Heat Exchanger and Refrigeration (NSEI:KRN)

Simply Wall St Value Rating: ★★★★☆☆

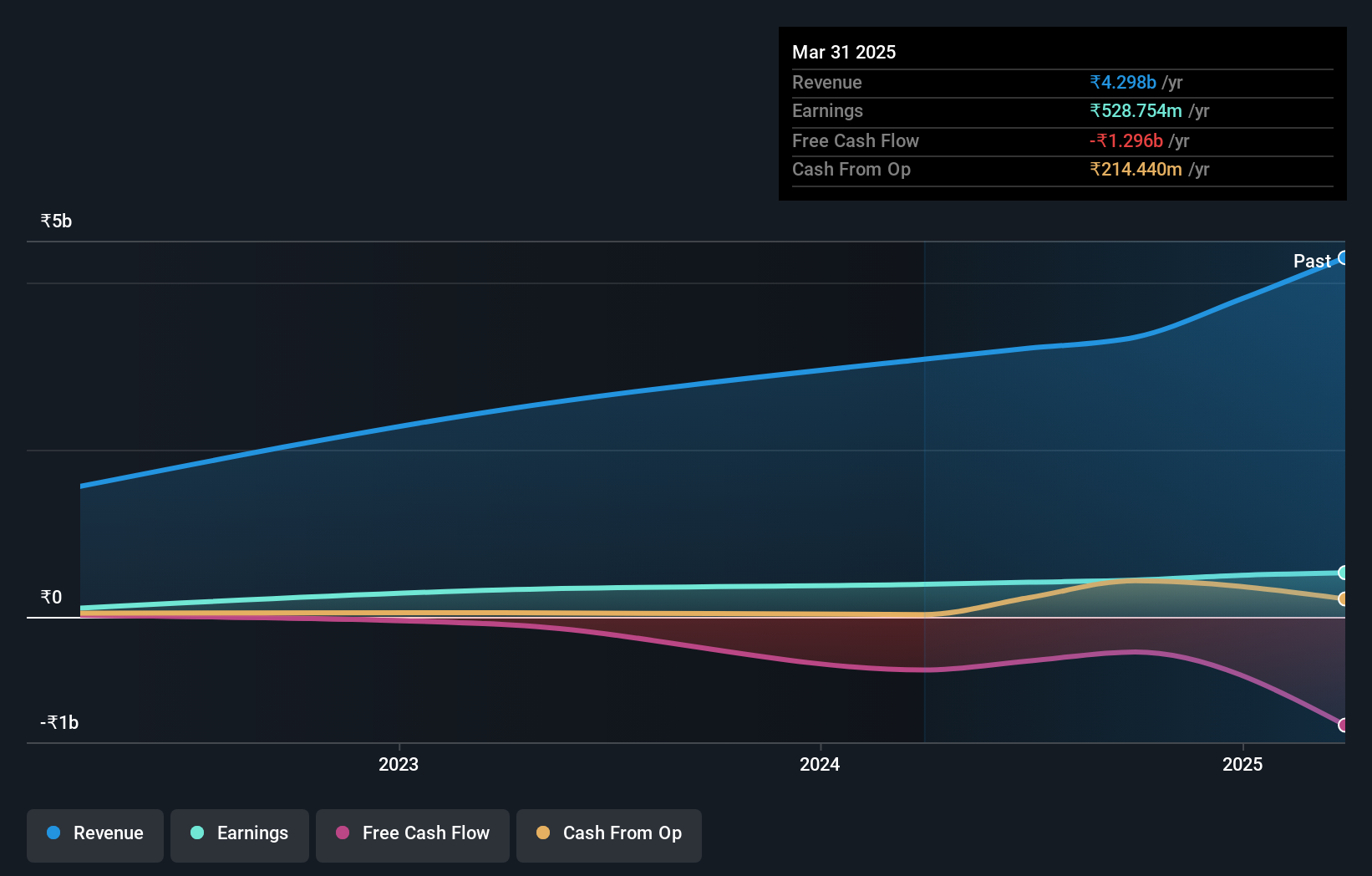

Overview: KRN Heat Exchanger and Refrigeration Limited specializes in the manufacture and sale of aluminium and copper fin and tube-type heat exchangers for the HVACR industry, with a market cap of ₹28.11 billion.

Operations: KRN generates revenue primarily from the manufacture and sale of HVAC parts and accessories, amounting to ₹3.08 billion.

KRN Heat Exchanger and Refrigeration, a small cap player in the HVAC industry, recently completed an IPO raising ₹3.42 billion to fund a new manufacturing facility. The company reported a net income of ₹390.69 million for the year ending March 2024, up from ₹323.14 million previously, with earnings per share rising to ₹8.69 from ₹7.34. KRN's net debt to equity ratio is satisfactory at 37%, while its interest payments are well covered by EBIT at 28 times coverage.

Ujaas Energy (NSEI:UEL)

Simply Wall St Value Rating: ★★★★★☆

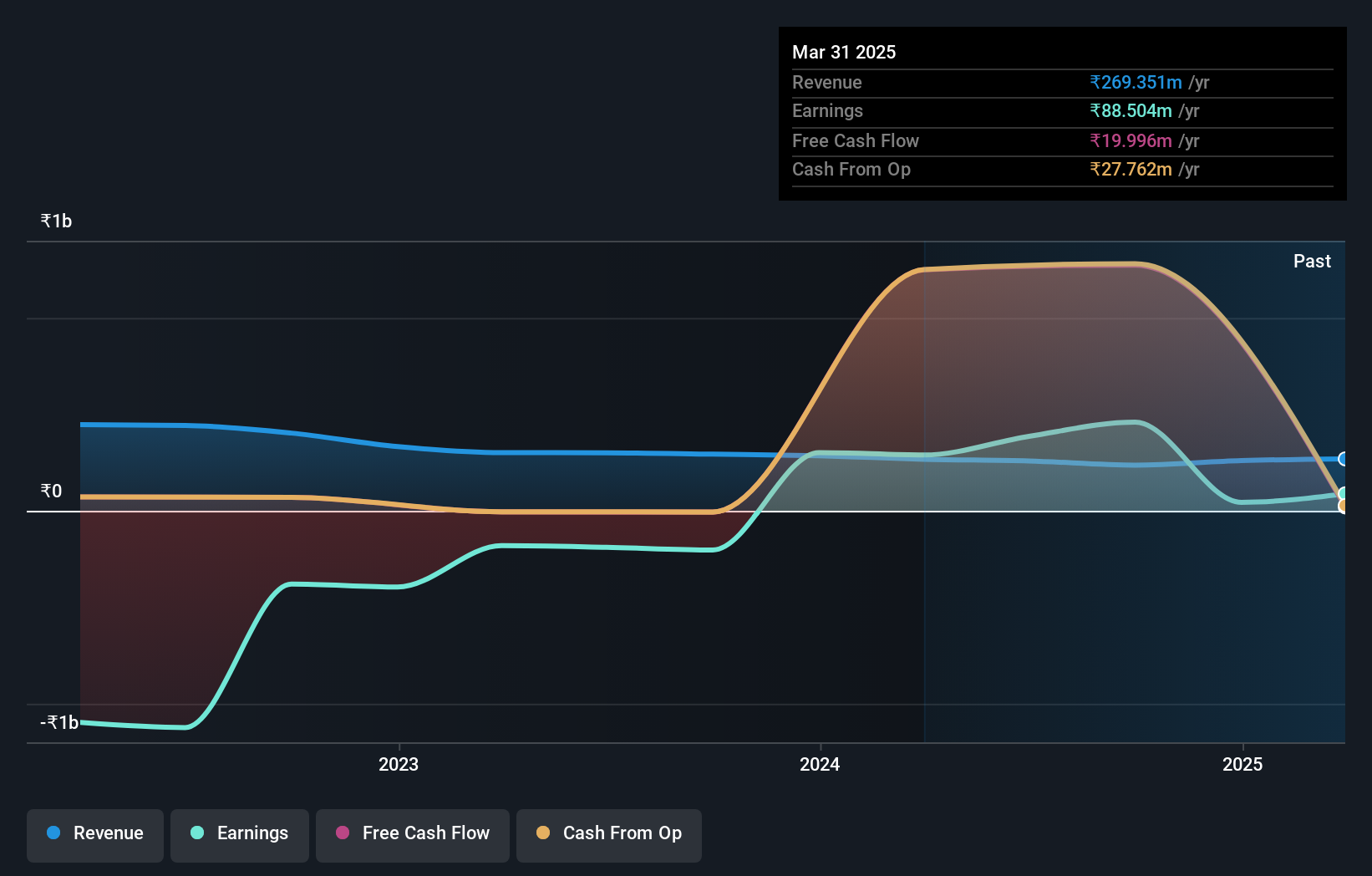

Overview: Ujaas Energy Limited is involved in the generation of solar power in India and has a market capitalization of ₹76.57 billion.

Operations: The primary revenue stream for Ujaas Energy Limited comes from its solar power plant operations, generating ₹307.70 million. The electric vehicle (EV) segment contributes ₹41.00 million to the total revenue.

Ujaas Energy, a player in India's renewable sector, has recently turned profitable with net income reaching ₹38.15 million for the quarter ending June 2024, compared to a loss of ₹58.57 million the previous year. Revenue increased to ₹107.16 million from ₹74.83 million year-on-year, showcasing growth despite sales dipping slightly to ₹62.89 million from ₹71.84 million. The company's debt-to-equity ratio has significantly improved over five years from 59% to 21%, indicating better financial health and management efficiency amidst substantial shareholder dilution last year due to strategic decisions like bonus shares issuance and stock splits planned for September 2024.

Taking Advantage

- Take a closer look at our Indian Undiscovered Gems With Strong Fundamentals list of 468 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KRN Heat Exchanger and Refrigeration might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:KRN

KRN Heat Exchanger and Refrigeration

Manufactures and sells heat exchangers, evaporators, and condensers to original equipment manufacturers in the heat, ventilation, air conditioning, and refrigeration industries.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives