- India

- /

- Capital Markets

- /

- NSEI:IIFLCAPS

IIFL Securities Limited (NSE:IIFLSEC) Stock Rockets 31% But Many Are Still Ignoring The Company

IIFL Securities Limited (NSE:IIFLSEC) shareholders would be excited to see that the share price has had a great month, posting a 31% gain and recovering from prior weakness. The last month tops off a massive increase of 214% in the last year.

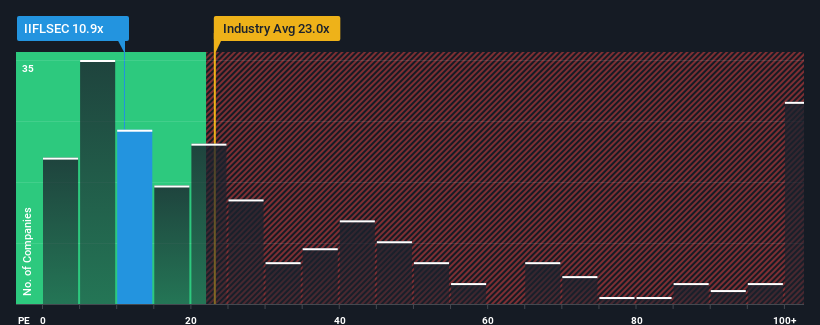

Even after such a large jump in price, IIFL Securities may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 10.9x, since almost half of all companies in India have P/E ratios greater than 32x and even P/E's higher than 62x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

IIFL Securities certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for IIFL Securities

Is There Any Growth For IIFL Securities?

In order to justify its P/E ratio, IIFL Securities would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered an exceptional 104% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 139% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 24% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that IIFL Securities' P/E sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From IIFL Securities' P/E?

Even after such a strong price move, IIFL Securities' P/E still trails the rest of the market significantly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that IIFL Securities currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for IIFL Securities that you should be aware of.

Of course, you might also be able to find a better stock than IIFL Securities. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:IIFLCAPS

IIFL Capital Services

Provides capital market services in the primary and secondary markets in India.

Acceptable track record and slightly overvalued.

Similar Companies

Market Insights

Community Narratives