- India

- /

- Diversified Financial

- /

- NSEI:SAMMAANCAP

Shareholders May Be More Conservative With Indiabulls Housing Finance Limited's (NSE:IBULHSGFIN) CEO Compensation For Now

Key Insights

- Indiabulls Housing Finance to hold its Annual General Meeting on 25th of September

- Salary of ₹105.9m is part of CEO Gagan Banga's total remuneration

- The overall pay is 496% above the industry average

- Indiabulls Housing Finance's total shareholder return over the past three years was 35% while its EPS was down 14% over the past three years

CEO Gagan Banga has done a decent job of delivering relatively good performance at Indiabulls Housing Finance Limited (NSE:IBULHSGFIN) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 25th of September. However, some shareholders may still want to keep CEO compensation within reason.

See our latest analysis for Indiabulls Housing Finance

How Does Total Compensation For Gagan Banga Compare With Other Companies In The Industry?

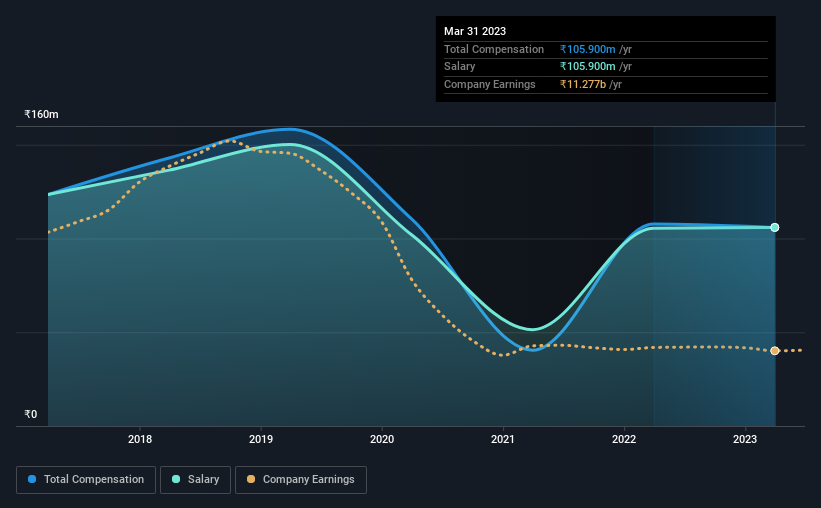

According to our data, Indiabulls Housing Finance Limited has a market capitalization of ₹89b, and paid its CEO total annual compensation worth ₹106m over the year to March 2023. This means that the compensation hasn't changed much from last year. It is worth noting that the CEO compensation consists entirely of the salary, worth ₹106m.

On comparing similar companies from the Indian Diversified Financial industry with market caps ranging from ₹33b to ₹133b, we found that the median CEO total compensation was ₹18m. Accordingly, our analysis reveals that Indiabulls Housing Finance Limited pays Gagan Banga north of the industry median. Furthermore, Gagan Banga directly owns ₹706m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | ₹106m | ₹106m | 100% |

| Other | - | ₹2.2m | - |

| Total Compensation | ₹106m | ₹108m | 100% |

Speaking on an industry level, all of total compensation represents salary, while non-salary remuneration is completely ignored. Speaking on a company level, Indiabulls Housing Finance prefers to tread along a traditional path, disbursing all compensation through a salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Indiabulls Housing Finance Limited's Growth

Indiabulls Housing Finance Limited has reduced its earnings per share by 14% a year over the last three years. It achieved revenue growth of 28% over the last year.

The reduction in EPS, over three years, is arguably concerning. But on the other hand, revenue growth is strong, suggesting a brighter future. It's hard to reach a conclusion about business performance right now. This may be one to watch. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Indiabulls Housing Finance Limited Been A Good Investment?

Most shareholders would probably be pleased with Indiabulls Housing Finance Limited for providing a total return of 35% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Indiabulls Housing Finance rewards its CEO solely through a salary, ignoring non-salary benefits completely. The overall company performance has been commendable, however there are still areas for improvement. Until EPS growth picks back up, we think shareholders may find it hard to justify increasing CEO pay given that they are already paid above industry average.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 4 warning signs for Indiabulls Housing Finance you should be aware of, and 2 of them make us uncomfortable.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SAMMAANCAP

Moderate with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives