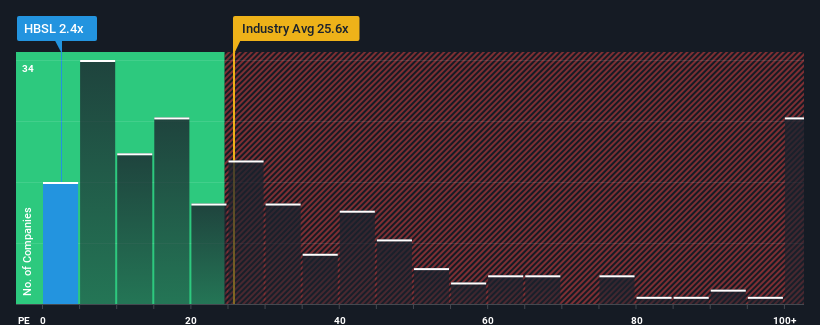

With a price-to-earnings (or "P/E") ratio of 2.4x HB Stockholdings Limited (NSE:HBSL) may be sending very bullish signals at the moment, given that almost half of all companies in India have P/E ratios greater than 32x and even P/E's higher than 59x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With earnings growth that's exceedingly strong of late, HB Stockholdings has been doing very well. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for HB Stockholdings

How Is HB Stockholdings' Growth Trending?

In order to justify its P/E ratio, HB Stockholdings would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered an exceptional 423% gain to the company's bottom line. The latest three year period has also seen an excellent 285% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 25% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that HB Stockholdings' P/E sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From HB Stockholdings' P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that HB Stockholdings currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

Before you settle on your opinion, we've discovered 3 warning signs for HB Stockholdings (2 are significant!) that you should be aware of.

If these risks are making you reconsider your opinion on HB Stockholdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if HB Stockholdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HBSL

HB Stockholdings

A non-banking financial and non-deposit taking company, engages in the activities of investment in securities in India.

Mediocre balance sheet second-rate dividend payer.

Market Insights

Community Narratives