- India

- /

- Metals and Mining

- /

- NSEI:HITECH

Three Indian Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

The Indian market has experienced a flat performance in the past week but has shown impressive growth, rising 40% over the last 12 months, with earnings projected to grow by 17% annually. In this context of robust market expansion, identifying growth companies with high insider ownership can be particularly appealing as it often indicates confidence from those closest to the business and potential alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.4% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 30.8% |

| Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 32.3% |

| Rajratan Global Wire (BSE:517522) | 18.3% | 35.8% |

| KEI Industries (BSE:517569) | 19.2% | 22.5% |

| Aether Industries (NSEI:AETHER) | 31.1% | 44.4% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 24% |

Underneath we present a selection of stocks filtered out by our screen.

Five-Star Business Finance (NSEI:FIVESTAR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Five-Star Business Finance Limited is a non-banking financial company in India with a market cap of ₹254.27 billion.

Operations: The company generates revenue from MSME Loans, Housing Loans, and Property Loans totaling ₹17.79 billion.

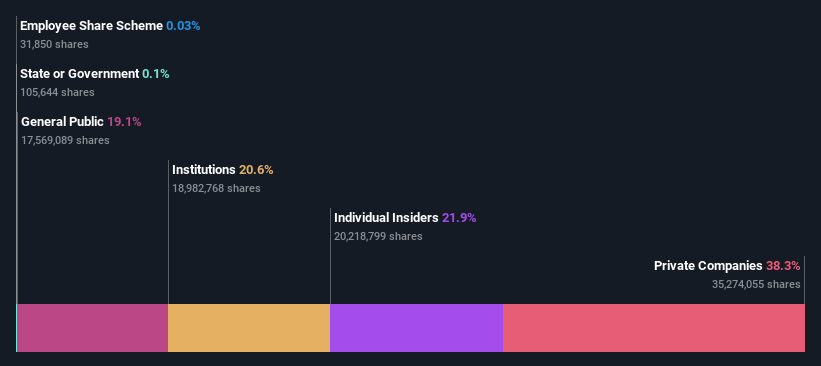

Insider Ownership: 18.7%

Earnings Growth Forecast: 20.5% p.a.

Five-Star Business Finance demonstrates strong growth potential with forecasted revenue and earnings growth exceeding 20% annually, outpacing the Indian market. Insider ownership remains significant, as evidenced by recent private placements involving key executives. However, its debt coverage is a concern due to insufficient operating cash flow. The company’s price-to-earnings ratio of 28.1x offers a more attractive valuation compared to the broader Indian market at 34.1x, though return on equity projections remain modest at 19.4%.

- Dive into the specifics of Five-Star Business Finance here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Five-Star Business Finance is trading beyond its estimated value.

Hi-Tech Pipes (NSEI:HITECH)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hi-Tech Pipes Limited is an Indian company that manufactures and sells steel, with a market capitalization of ₹37.57 billion.

Operations: The company's revenue primarily comes from the manufacturing of steel pipes and CR products, amounting to ₹29.24 billion.

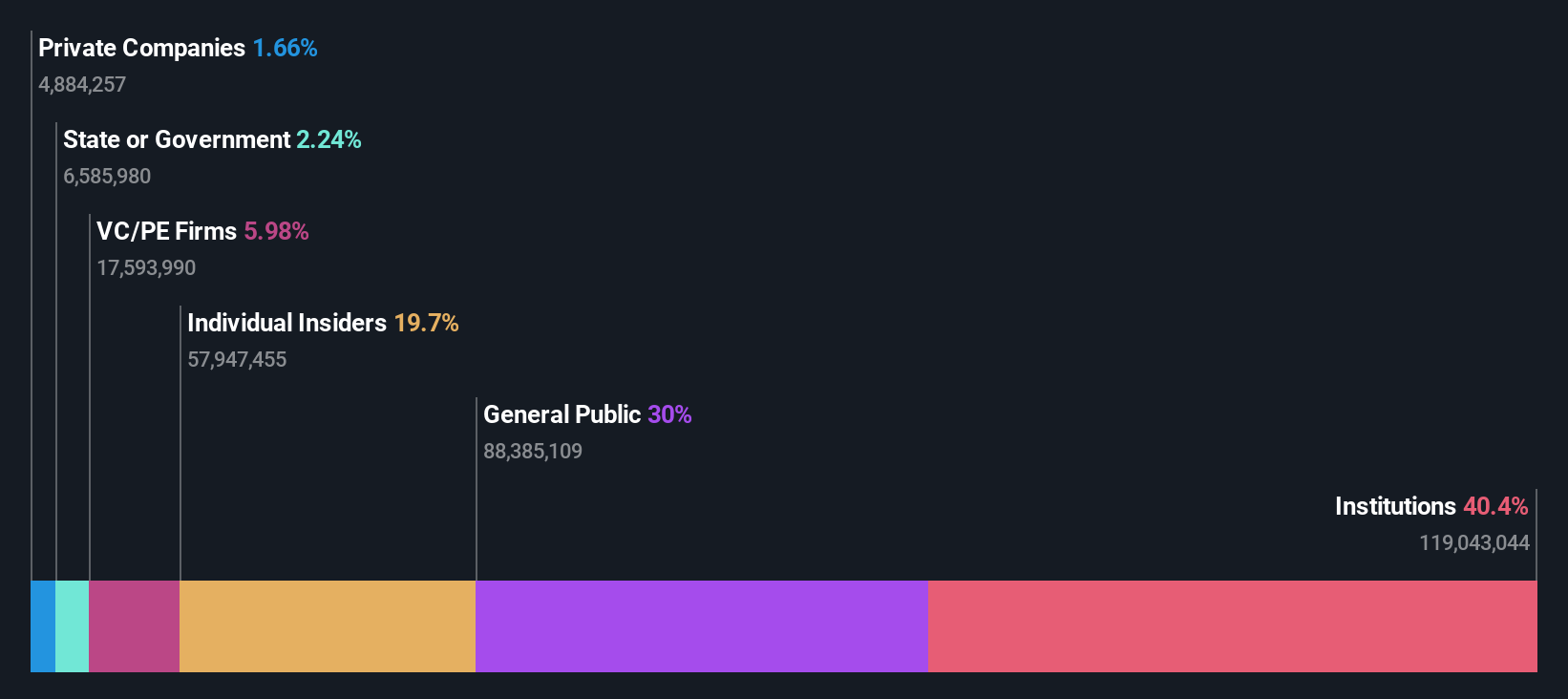

Insider Ownership: 35.1%

Earnings Growth Forecast: 43.8% p.a.

Hi-Tech Pipes is poised for substantial growth, with revenue and earnings projected to increase significantly, surpassing Indian market averages. Recent business expansions include a 5 MW green power initiative, aligning with national sustainability goals. The company has raised INR 5 billion through equity offerings to support growth initiatives. However, the past year's shareholder dilution and low forecasted return on equity of 16.3% are potential concerns despite strong insider ownership supporting strategic decisions.

- Take a closer look at Hi-Tech Pipes' potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Hi-Tech Pipes shares in the market.

Indoco Remedies (NSEI:INDOCO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Indoco Remedies Limited manufactures, markets, and sells formulations and active pharmaceutical ingredients both in India and internationally, with a market cap of ₹30.79 billion.

Operations: The company's revenue is primarily derived from its Pharmaceuticals segment, totaling ₹18.22 billion.

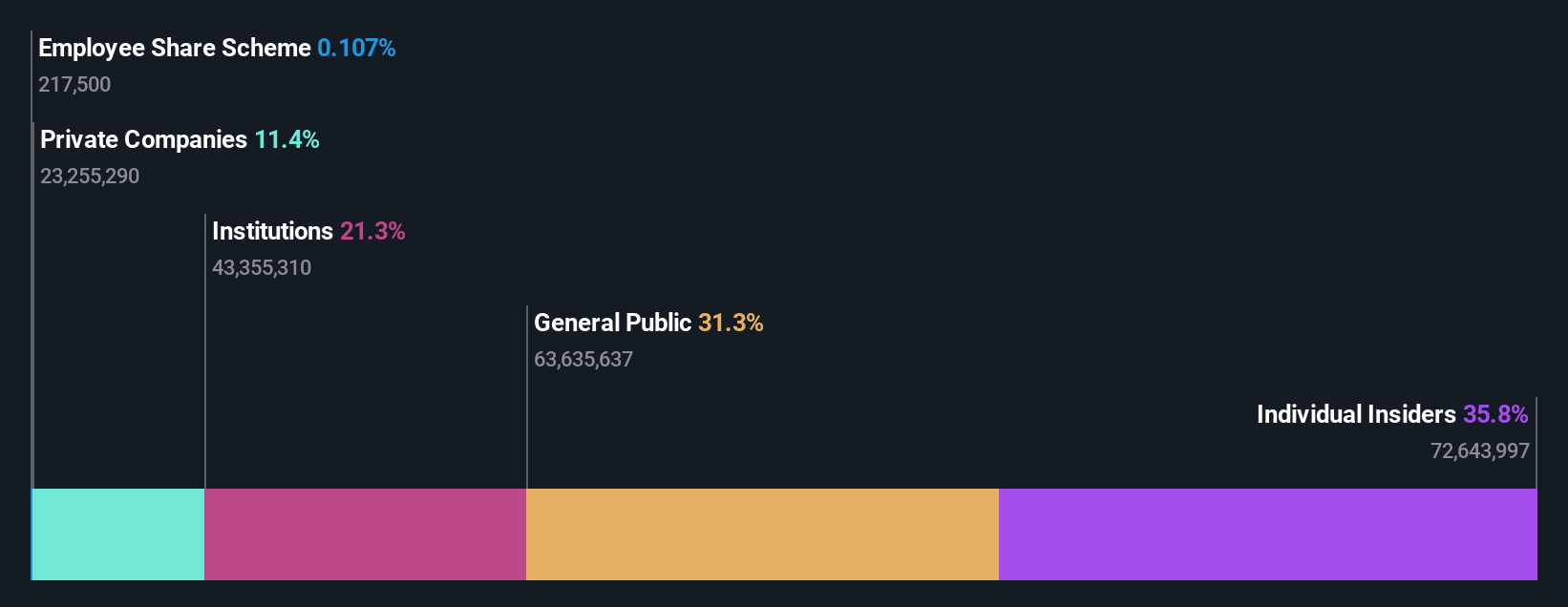

Insider Ownership: 22%

Earnings Growth Forecast: 34.9% p.a.

Indoco Remedies is positioned for significant earnings growth, projected at 34.9% annually, outpacing the Indian market. Despite revenue growth forecasts of 10.4% per year being modest, recent USFDA approval for Cetirizine and Lofexidine tablets could enhance market presence. However, profit margins have declined from last year and interest payments are not well covered by earnings. Insider ownership remains supportive amidst regulatory challenges and a decreased dividend of INR 1.50 per share approved recently.

- Navigate through the intricacies of Indoco Remedies with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Indoco Remedies' current price could be inflated.

Next Steps

- Access the full spectrum of 89 Fast Growing Indian Companies With High Insider Ownership by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hi-Tech Pipes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:HITECH

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives