- India

- /

- Diversified Financial

- /

- NSEI:CSLFINANCE

Here's Why CSL Finance (NSE:CSLFINANCE) Has Caught The Eye Of Investors

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in CSL Finance (NSE:CSLFINANCE). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide CSL Finance with the means to add long-term value to shareholders.

View our latest analysis for CSL Finance

CSL Finance's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. Impressively, CSL Finance has grown EPS by 31% per year, compound, in the last three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

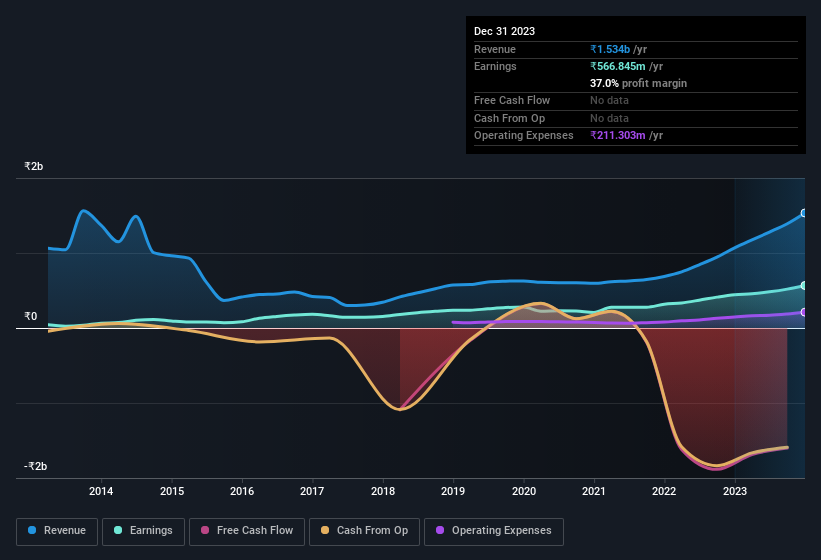

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. It's noted that CSL Finance's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. While we note CSL Finance achieved similar EBIT margins to last year, revenue grew by a solid 44% to ₹1.5b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since CSL Finance is no giant, with a market capitalisation of ₹9.9b, you should definitely check its cash and debt before getting too excited about its prospects.

Are CSL Finance Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

In the last year insider at CSL Finance were both selling and buying shares; but happily, as a group they spent ₹16m more on stock, than they netted from selling it. On balance, that's a good sign. It is also worth noting that it was Chief Operating Officer Amit Ranjan who made the biggest single purchase, worth ₹12m, paying ₹160 per share.

On top of the insider buying, it's good to see that CSL Finance insiders have a valuable investment in the business. As a matter of fact, their holding is valued at ₹3.0b. This considerable investment should help drive long-term value in the business. As a percentage, this totals to 30% of the shares on issue for the business, an appreciable amount considering the market cap.

Is CSL Finance Worth Keeping An Eye On?

For growth investors, CSL Finance's raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant stake in the company and have been buying more shares. These things considered, this is one stock worth watching. You still need to take note of risks, for example - CSL Finance has 3 warning signs (and 1 which is significant) we think you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of CSL Finance, you'll probably love this curated collection of companies in IN that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CSLFINANCE

CSL Finance

A non-banking financial company, provides SME and wholesale loaning businesses in India.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives