- India

- /

- Diversified Financial

- /

- NSEI:CSLFINANCE

CSL Finance Limited (NSE:CSLFINANCE) Could Be Riskier Than It Looks

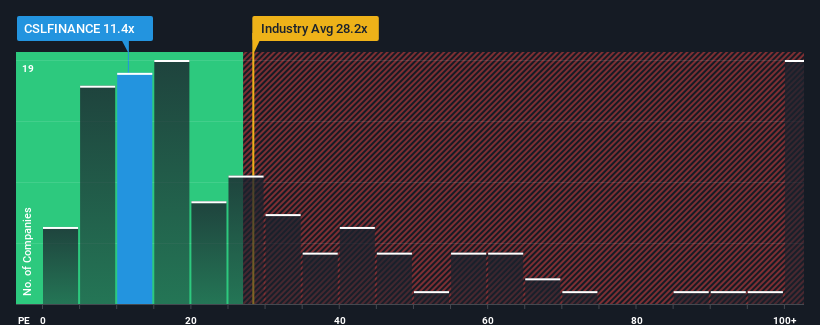

CSL Finance Limited's (NSE:CSLFINANCE) price-to-earnings (or "P/E") ratio of 11.4x might make it look like a strong buy right now compared to the market in India, where around half of the companies have P/E ratios above 34x and even P/E's above 64x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent times have been quite advantageous for CSL Finance as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for CSL Finance

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like CSL Finance's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 30% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 107% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 26% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised earnings results.

With this information, we find it odd that CSL Finance is trading at a P/E lower than the market. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of CSL Finance revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look similar to current market expectations. When we see average earnings with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

Before you take the next step, you should know about the 4 warning signs for CSL Finance (1 is potentially serious!) that we have uncovered.

You might be able to find a better investment than CSL Finance. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CSLFINANCE

CSL Finance

A non-banking financial company, provides SME and wholesale loaning businesses in India.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives