- India

- /

- Capital Markets

- /

- NSEI:CRISIL

Should You Buy CRISIL Limited (NSE:CRISIL) For Its Upcoming Dividend?

It looks like CRISIL Limited (NSE:CRISIL) is about to go ex-dividend in the next 3 days. The ex-dividend date is usually set to be one business day before the record date which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. In other words, investors can purchase CRISIL's shares before the 31st of July in order to be eligible for the dividend, which will be paid on the 12th of August.

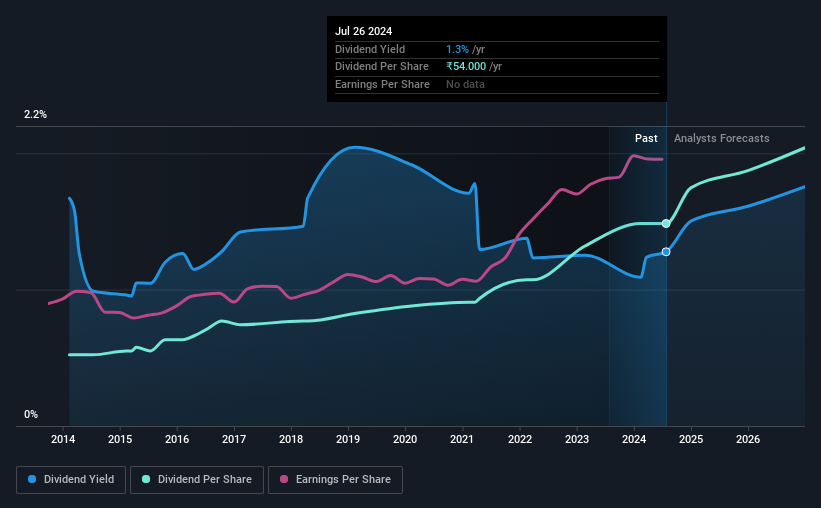

The company's next dividend payment will be ₹8.00 per share, and in the last 12 months, the company paid a total of ₹54.00 per share. Looking at the last 12 months of distributions, CRISIL has a trailing yield of approximately 1.3% on its current stock price of ₹4226.85. If you buy this business for its dividend, you should have an idea of whether CRISIL's dividend is reliable and sustainable. We need to see whether the dividend is covered by earnings and if it's growing.

See our latest analysis for CRISIL

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. CRISIL is paying out an acceptable 61% of its profit, a common payout level among most companies.

Companies that pay out less in dividends than they earn in profits generally have more sustainable dividends. The lower the payout ratio, the more wiggle room the business has before it could be forced to cut the dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Fortunately for readers, CRISIL's earnings per share have been growing at 12% a year for the past five years.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. CRISIL has delivered an average of 11% per year annual increase in its dividend, based on the past 10 years of dividend payments. It's great to see earnings per share growing rapidly over several years, and dividends per share growing right along with it.

The Bottom Line

Should investors buy CRISIL for the upcoming dividend? CRISIL has an acceptable payout ratio and its earnings per share have been improving at a decent rate. We think this is a pretty attractive combination, and would be interested in investigating CRISIL more closely.

Wondering what the future holds for CRISIL? See what the two analysts we track are forecasting, with this visualisation of its historical and future estimated earnings and cash flow

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:CRISIL

CRISIL

An analytical company, provides ratings, research, and risk and policy consulting services in India, Europe, North America, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026