Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like BLB (NSE:BLBLIMITED). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for BLB

BLB's Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's no surprise that some investors are more inclined to invest in profitable businesses. It is therefore awe-striking that BLB's EPS went from ₹0.35 to ₹1.08 in just one year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement.

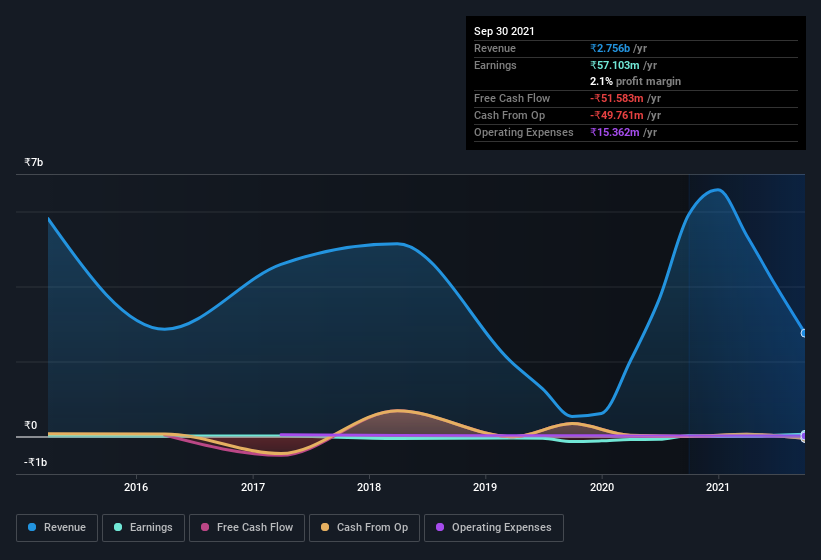

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of BLB's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. While BLB may have maintained EBIT margins over the last year, revenue has fallen. And that does make me a little more cautious of the stock.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since BLB is no giant, with a market capitalization of ₹1.1b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are BLB Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We haven't seen any insiders selling BLB shares, in the last year. With that in mind, it's heartening that Brij Bagri, the Chairman of the Board of the company, paid ₹902k for shares at around ₹6.63 each.

On top of the insider buying, we can also see that BLB insiders own a large chunk of the company. In fact, they own 73% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. Valued at only ₹1.1b BLB is really small for a listed company. So despite a large proportional holding, insiders only have ₹801m worth of stock. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Is BLB Worth Keeping An Eye On?

BLB's earnings have taken off like any random crypto-currency did, back in 2017. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe BLB deserves timely attention. Still, you should learn about the 2 warning signs we've spotted with BLB .

As a growth investor I do like to see insider buying. But BLB isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if BLB might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BLBLIMITED

BLB

Engages in trading and investments in shares, and securities and commodities in India.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives