- India

- /

- Diversified Financial

- /

- NSEI:ASCOM

Ascom Leasing & Investments Limited (NSE:ASCOM) Investors Are Less Pessimistic Than Expected

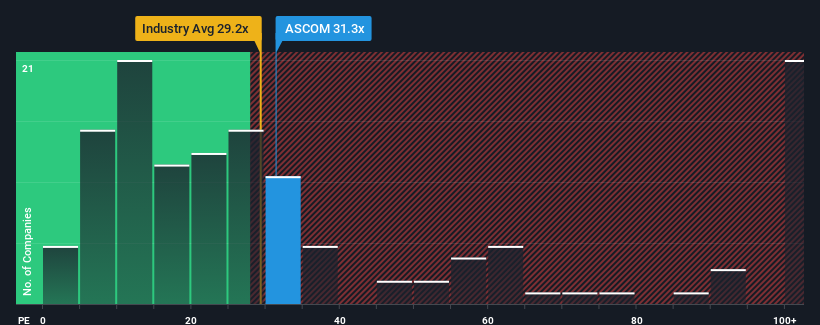

With a median price-to-earnings (or "P/E") ratio of close to 32x in India, you could be forgiven for feeling indifferent about Ascom Leasing & Investments Limited's (NSE:ASCOM) P/E ratio of 31.3x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

We'd have to say that with no tangible growth over the last year, Ascom Leasing & Investments' earnings have been unimpressive. One possibility is that the P/E is moderate because investors think this benign earnings growth rate might not be enough to outperform the broader market in the near future. If not, then existing shareholders may be feeling hopeful about the future direction of the share price.

View our latest analysis for Ascom Leasing & Investments

Is There Some Growth For Ascom Leasing & Investments?

In order to justify its P/E ratio, Ascom Leasing & Investments would need to produce growth that's similar to the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Likewise, not much has changed from three years ago as earnings have been stuck during that whole time. So it seems apparent to us that the company has struggled to grow earnings meaningfully over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 26% shows it's noticeably less attractive on an annualised basis.

With this information, we find it interesting that Ascom Leasing & Investments is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Ascom Leasing & Investments revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Ascom Leasing & Investments (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Ascom Leasing & Investments, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ASCOM

Ascom Leasing & Investments

A non-banking financial company, engages in the lending business in India.

Excellent balance sheet with acceptable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026